Venezuela and Oil: US involvement carves path for more Oil supply

Over the weekend, markets were jolted by reports surrounding the capture of Nicolás Maduro, Venezuela’s long-time president.

The situation now points toward an impending US trial tied to drug trafficking and human rights allegations, but for markets, the bigger implication is renewed US involvement in Venezuela’s oil sector.

Venezuela has the largest proven crude oil reserves globally, estimated at ~303 billion barrels, or roughly 7% of total global reserves. However, in terms of production, it accounts for less than 1%, largely due to sanctions, capital starvation, and decades of infrastructure decay.

That distinction matters. Reserves represent potential supply, not immediate barrels hitting the market.

Technical analysis: WTI Crude Oil (Big picture first)

Before we talk fundamentals, the chart matters more, because oil trades expectations first, reality later.

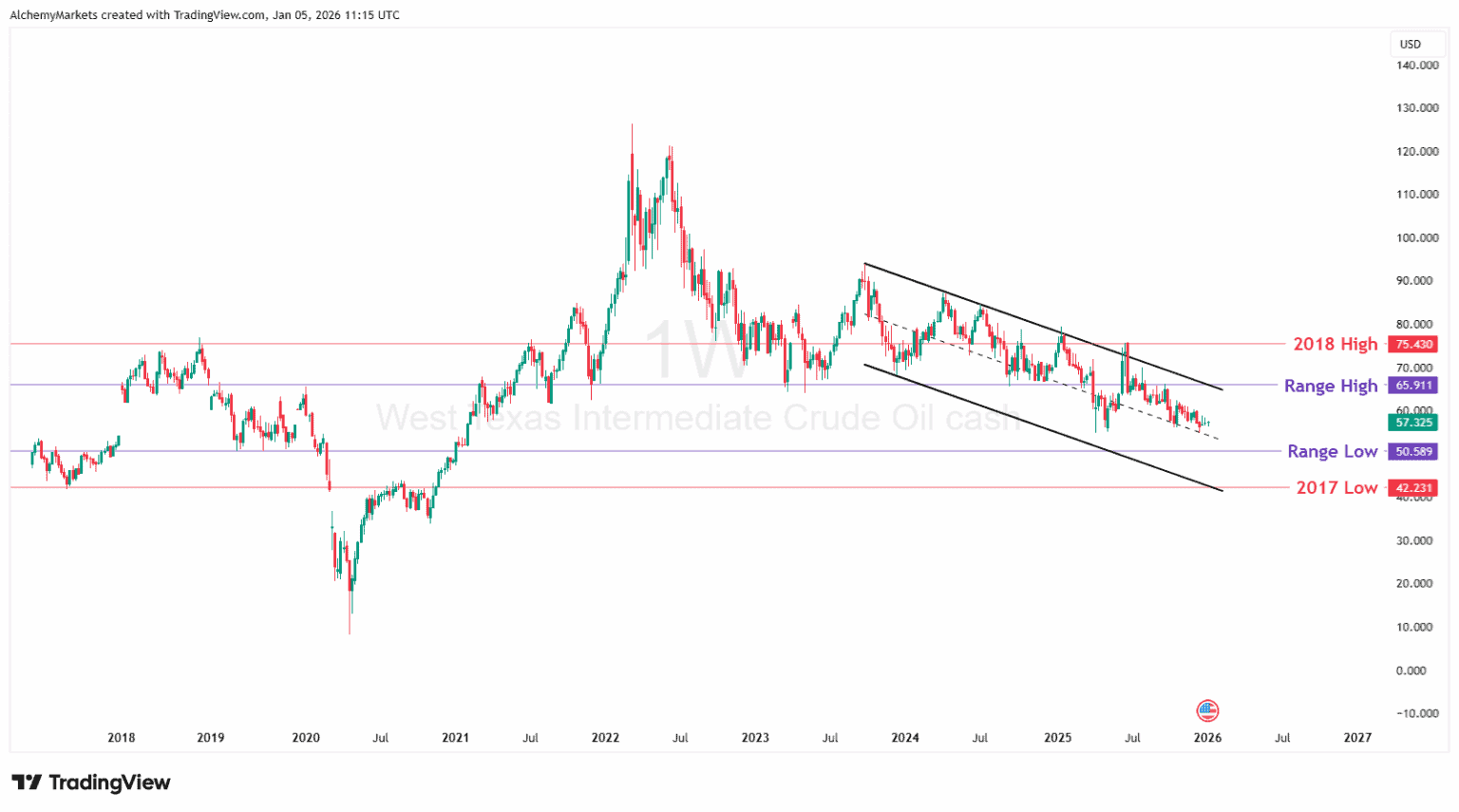

WTI is still locked inside a long-term descending channel, a structure that’s been in place since the 2022 peak. Every rally over the past two years has failed into lower highs, while price continues to compress toward the lower end of the range.

- Watch how WTI Crude reacts at the middle line of the channel.

- Around $50 has been a historical low, and is a psychological level to watch.

- The range high at $65 poses a challenge for oil to break higher, and it aligns with the channel high.

Bottom line:

The market is not pricing a sudden Venezuelan supply surge. It’s pricing uncertainty, with a slight downside bias as expectations of future supply linger. If Venezuela headlines were truly bullish for crude, WTI would not still be grinding lower near range support.

The potential of Venezuelan Oil and the US’s transitional role

Most Venezuelan crude is extra-heavy. It’s thick, sulphur-heavy, and expensive to process. That creates three immediate constraints:

- It requires specialised refining capacity.

- It often needs blending with lighter crude.

- Cannot be scaled quickly without large, sustained capital investment.

This is where the United States comes into the picture.

US Gulf Coast refineries are explicitly built to handle heavy crude, and over the past decade the US has grown structurally more reliant on it.

From a refining perspective, the US is ready. From a production perspective, Venezuela is not.

Years of sanctions, underinvestment, and infrastructure decay mean that even under a transitional US-backed framework, any meaningful increase in Venezuelan output would take years, not months. Pipelines, upgraders, ports, tankers, and refining coordination all need rebuilding.

That’s the disconnect markets are grappling with right now. The headline suggests future supply, but we still need more confirmation that significant infrastructural changes are coming.

This explains the muted reaction in crude prices.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.