USD/JPY next upside target at 107.70; short-term bias bullish [Video]

![USD/JPY next upside target at 107.70; short-term bias bullish [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/japanese-10000-yen-and-100-dollar-bills-14367199_XtraLarge.jpg)

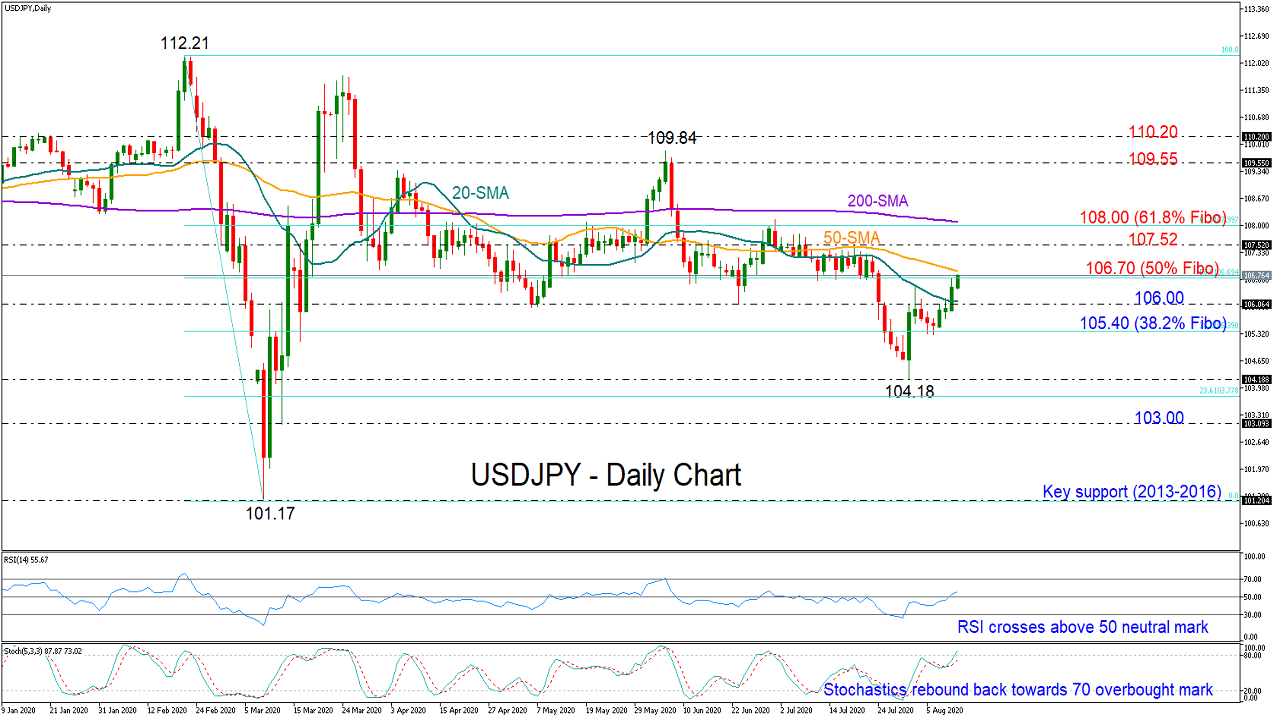

USDJPY gained stronger positive traction this week, gearing above the 20-day simple moving average (SMA) on Tuesday to close successfully above the 106.00 level, which was a struggle last week.

The price is currently facing the 50% Fibonacci of the 112.21-101.17 downleg at 106.70 and the 50-day SMA, a break of which is required to boost momentum towards the 107.52- 108.00 resistance zone. The positive slope in the RSI, which has crossed above its 50-neutral mark, and the rebound in the stochastics are backing this scenario, though the price needs to clear its nearby obstacles to extend higher.

Should the pair run above the 108.00, claiming the 61.8% Fibonacci and the 200-day SMA at the same time, the door would open for the 109.55-110.20 restrictive region.

In the event of a downside reversal, the 20-day SMA at 106.00 could block the way towards the 38.2% Fibonacci of 105.40. Beneath the latter, the spotlight will shift to the 104.18 bottom, and if this fails to hold too, the bears could head for the 103.00 mark, adding a new lower low in the two-month timeframe.

Meanwhile, in the bigger picture, the pair maintains a neutral profile within the 112.21 and 101.17 borders.

Summarizing, USDJPY is holding a bullish short-term bias, but it has to remove the 107.70 barrier first to confirm additional upside corrections.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.