USD tries to bounce higher

GBP/USD bounces back

The pound clawed back some losses after January’s retail sales beat expectations. A fall below 1.1970 has invalidated the rebound and put buyers under renewed pressure. As the cable tests the demand zone above this year’s low of 1.1850, the RSI’s double dip into the oversold area attracted some bargain hunters near 1.1920. 1.2070 is the immediate resistance and stiff selling could be expected around 1.2200-1.2260 as sentiment remains downbeat. A return to the critical level of 1.1850 could trigger a deeper correction.

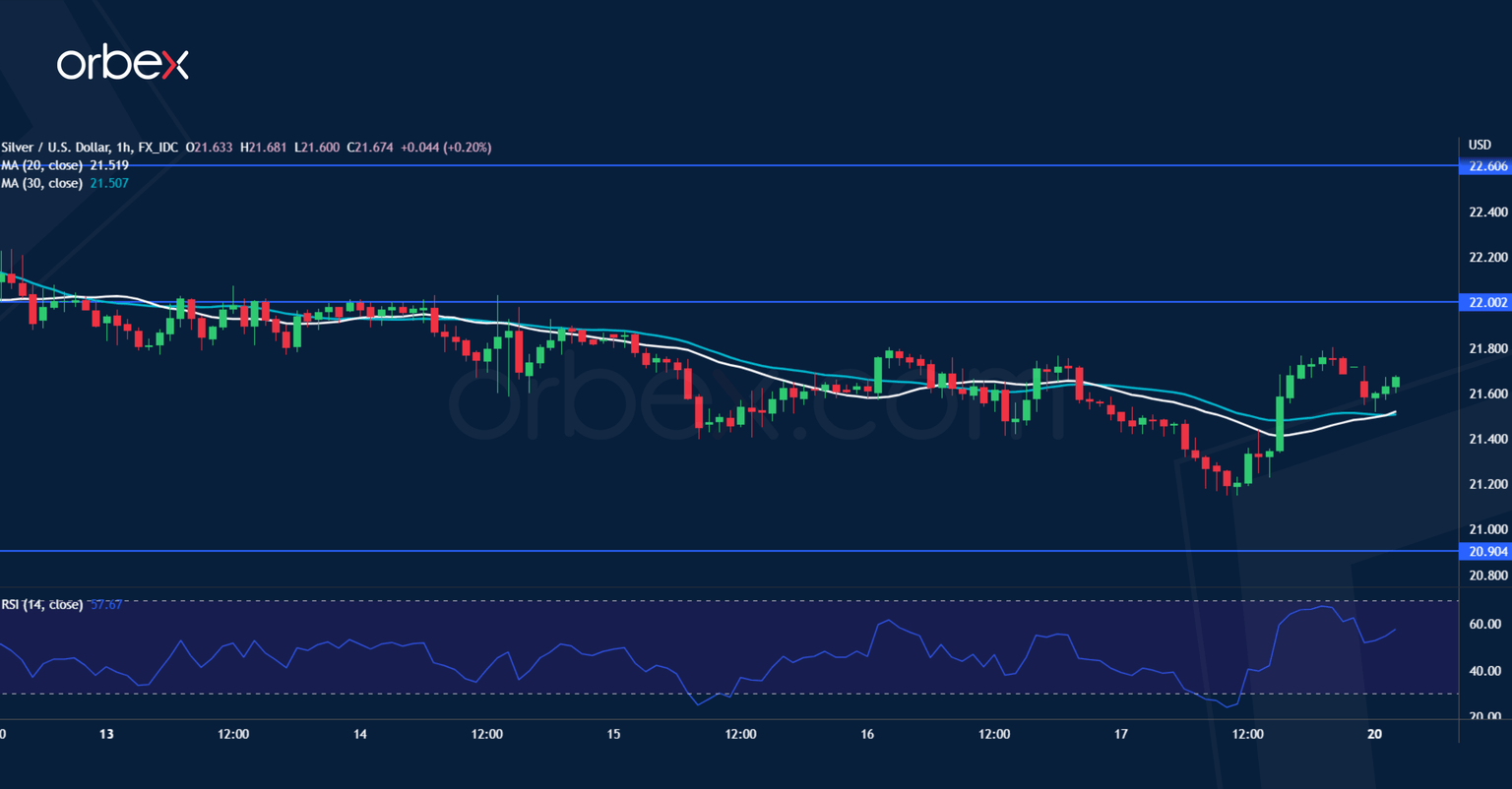

XAG/USD tests major support

Silver struggles as the US dollar nears a six-week peak. The price is drifting to last November’s low of 20.90, a daily support at the origin of a bullish breakout. Buying interest or a lack of in this important zone would dictate the metal’s outlook in the weeks to come. Intraday-wise, the RSI’s oversold condition has triggered a ‘buy-the-dips’ behaviour. A combination of profit-taking and fresh buying may drive the short-term price up. 22.00 is the closest resistance and the bulls will need to lift 22.60 before a recovery could happen.

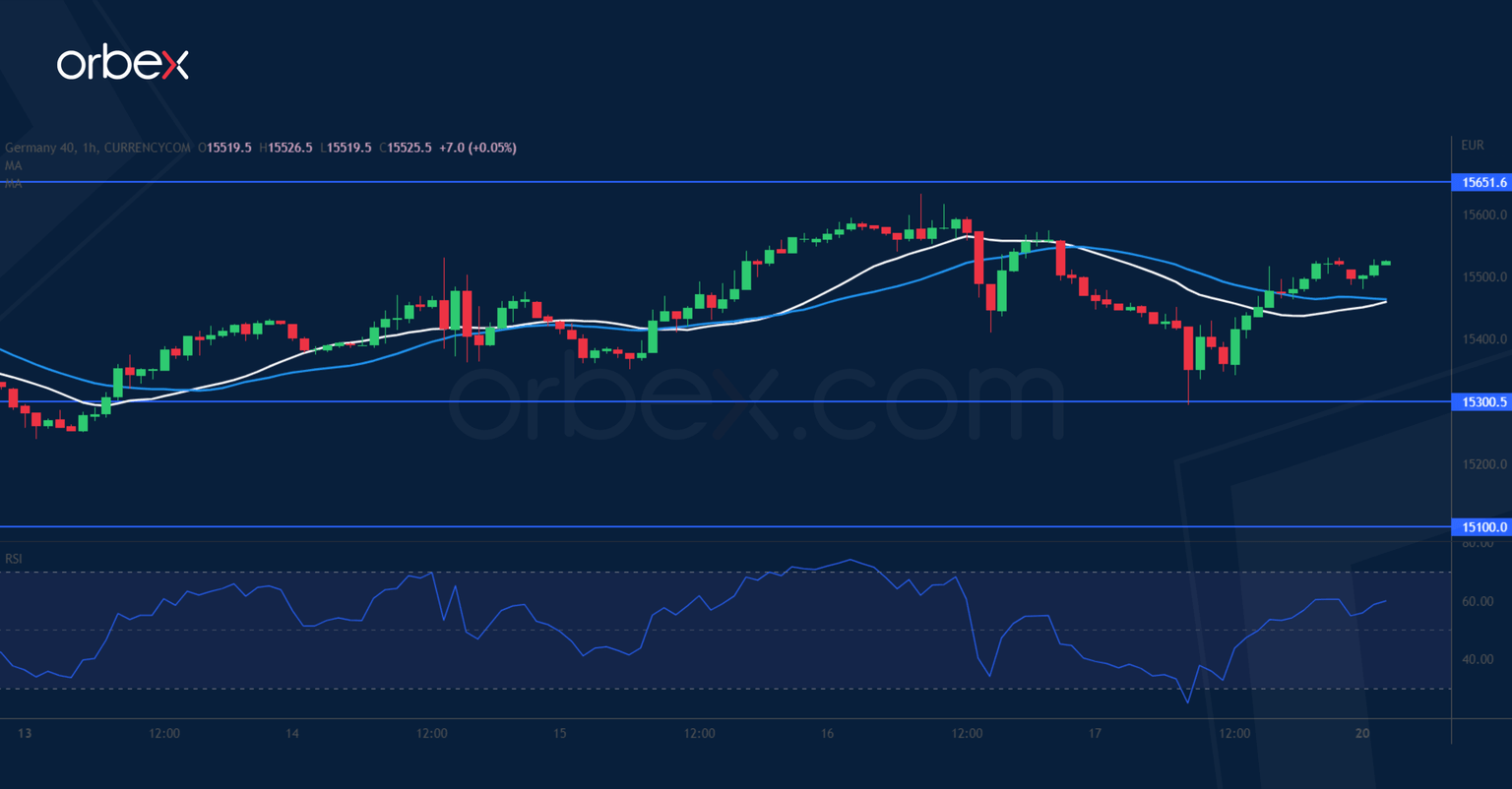

Dax 40 finds support

The Dax 40 whipsaws on concerns about more interest rate hikes. The price action previously failed to clear the high of 15650, forming a double top as it pulls below 15380. A bounce off 15300 right above the swing low of 15250 on the 30-day SMA, suggests a strong enough follow-through to keep the short-term bullish momentum intact. A close back above 15650 would nip the selling in the bud and resume the uptrend while a bearish breakout would cause a correction to the previous consolidation range above 15000.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.