USD struggles for bids

USD/CHF breaks lower

The US dollar tumbled after February’s jobs data showed slower wage growth. A previous fall below 0.9350 was a sign that the buy side had difficulty in holding on to their gains. Coming off the newly formed double top at 0.9440 a break below the swing low of 0.9290 then the daily support of 0.9210 suggests that the bears may have turned the tide. As the RSI bounces back from the oversold area, 0.9120 is the next level to see if any buying interest would emerge and 0.9290 is the first resistance to lift should this happen.

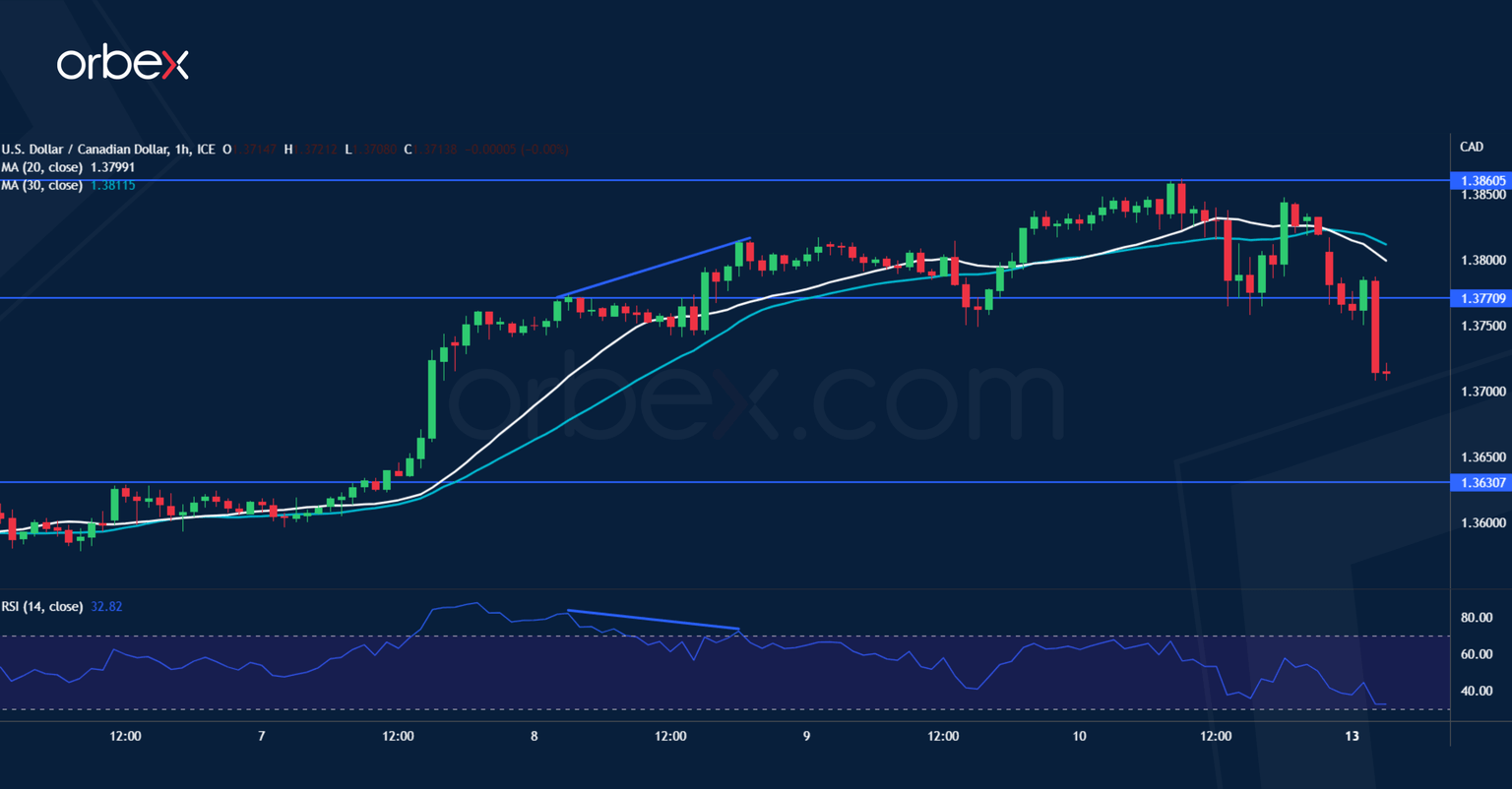

USD/CAD seeks support

The Canadian dollar softened as the BoC may not budge despite a solid labour market. The pair turned south at 1.3860 as the daily RSI’s overbought condition combined with a bearish divergence on the hourly chart suggests that the price action may need some breathing room. 1.3750 saw some bids as trend followers stepped in at a discount but a deeper correction would send the greenback to the 20-day SMA near 1.3630, which coincides with the origin of the bullish breakout. 1.3770 has become a fresh resistance.

Dax 40 tests daily support

The Dax 40 grinds lower as the SVB crisis causes a flight to safety across the globe. This could be a serious test of the bulls’ commitment as the price is striving to hold on despite the latest sell-off. Bargain hunters were eager to buy the dip, prompting a limited bounce off the resistance-turned-support of 15320. 15150 is a critical floor to keep the index afloat and its breach would force buyers to abandon ship and trigger a liquidation towards 14900. 15520 is the first hurdle to go to ease the downward pressure.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.