USD recovers from Tuesday's declines

Euro Pares Gains As USD Bounces Back

The euro currency is resuming its decline as the USD is making a rebound following the one-day slump on Tuesday. As a result, the euro currency formed a lower high above the 1.2200 level.

With the Stochastics oscillator also signaling a bearish move, further declines are likely.

Following the break down below Monday's lows near 1.2138, the euro currency could post steeper declines. The next main target is seen near the 1.2050 level of support.

To the upside, any rebound is likely to stall near the 1.2179 level. The downside bias changes only if the euro currency can rise above Wednesday's highs of 1.2220.

GBP/USD Pulls Back After Strong Gains

The British pound sterling is posting losses following the solid gains made from earlier in the week.

After briefly rising close to 4 th Jan highs near 1.3702, the cable gave back the gains intraday. This has led to a bearish close.

For the moment, the bias still remains to the upside. Price action could potentially form a reversal near the trendline around the 1.3600 level.

If price crashes through this level then we could see a move back to the 1.3500 handle.

With the Stochastics oscillator also moving out from the overbought levels, the downside is likely to prevail in the near term.

WTI Crude Oil Pulls Back From An Eleven-Month High

Crude oil prices are likely to signal a correction if the price action closes with a Doji.

This comes after a steady patch of gains that pushed the commodity to an 11- month high. Given the strong pace of gains, prices are likely to make a short term correction.

For the moment, the long term trend line continues to offer support. But if price loses this handle, then we expect to see a move lower.

The support level near 49.00 remains within reach. The Stochastics oscillator is also moving out from the overbought levels at the moment, adding to the downside bias.

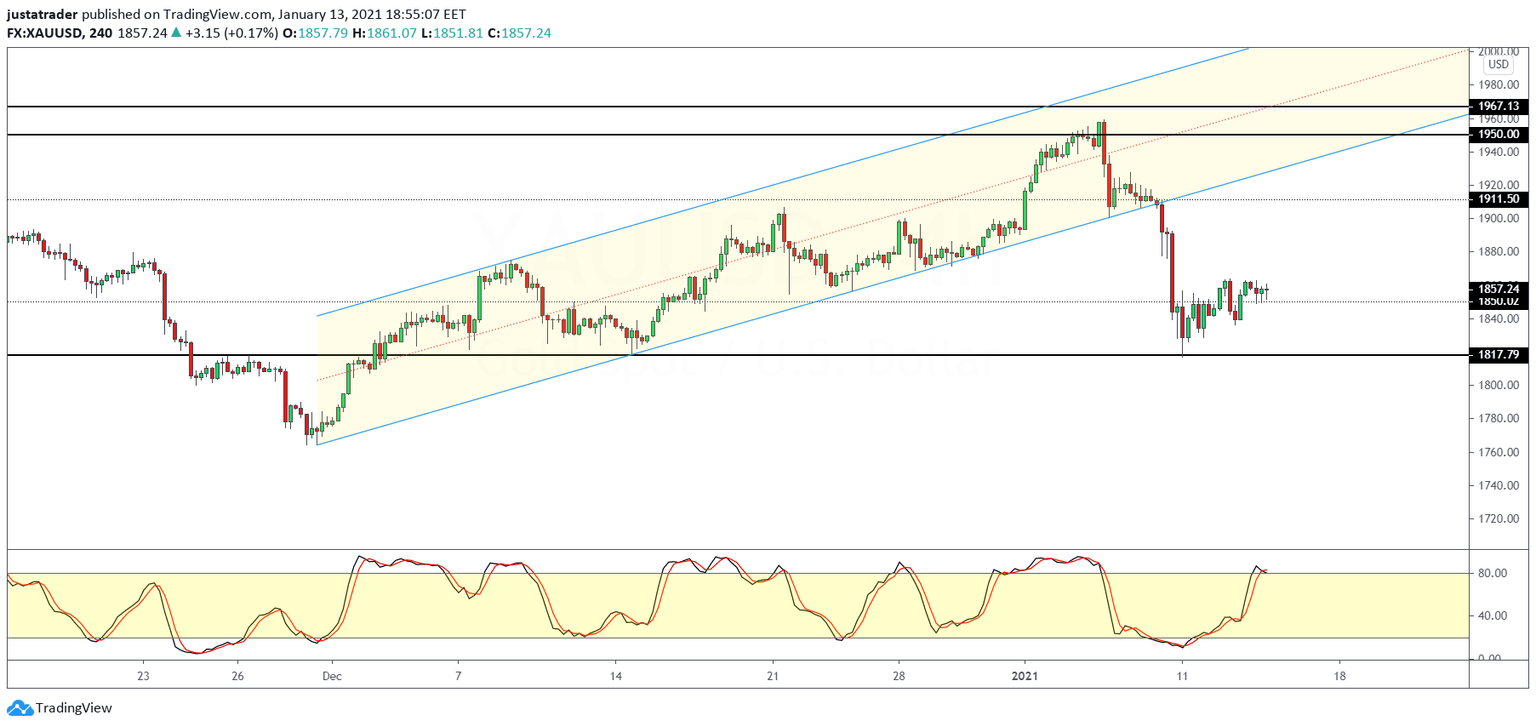

Gold Prices Continue To Consolidate Into A Bearish Pattern

Price action in the precious metal remains mixed. In the medium-term outlook, the current consolidation near the 1850 level is likely to signal a bearish flag pattern.

But price action needs to post a strong close below the 1850 level to validate this pattern.

The Stochastics oscillator remains currently in the overbought level, keeping the bias somewhat mixed.

To the upside, a move from the 1850 level could see prices attempting to retest the 1911.50 level where resistance could once again form.

But if prices break down lower, then we could see a strong correction taking place.

Author

Orbex Team

Orbex