USD/JPY Weekly Forecast: The Fed’s next step is balance sheet reduction

- USD/JPY weakens to one-month low ahead of Fed meeting.

- BOJ keeps overnight call rate static at -0.1%, raises inflation forecast slightly.

- No change in rates or taper expected from FOMC on Thursday.

- Credit market is wary that Fed balance sheet reduction could begin in March.

- FXStreet Forecast Poll predicts USD/JPY recovery.

The USD/JPY moved further from its four-year high at 116.10 on January 4, dipping below 114.00 on Thursday and trading to a one-month low on Friday. Dollar weakness proliferated in spite of the diverging monetary policies of the Federal Reserve and the Bank of Japan (BOJ).

Tuesday's BOJ meeting produced no surprises with the Japanese overnight call rate unchanged at -0.1%, where it has been for five years.

BOJ Overnight Call Rate

FXStreet

Governor Haruhiko Kuroda scotched media reports that BOJ policymakers were discussing how soon they might begin to signal an eventual rate increase. Mr. Kuroda called a rate hike “absolutely impossible.” “We would discuss policy normalization if we see our inflation target achieved, but we are not in such a situation,” said Mr. Kuroda.The bank did raise its inflation forecasts for the first time since 2014. For this year, the Consumer Price Index (CPI) prediction moved to 1.1% from 0.9% and in 2023 it edged to 1.1% from 1.0%.

In its assessment of the economy, the BOJ said the “recovery was becoming clearer” , a marginally more positive view than the 'picking up as a trend’ judgement in October, which seems to indicate the latest viral surge is not creating major dislocations. Japan’s economy shrank at a 3.6% annualized rate in the third quarter.

Treasury yields in the US touched a two-year high with the 10-year reaching 1.902% on Wednesday but closed at 1.827% and then 1.79% on Thursday. The 2-year traded to 1.059% on Tuesday finishing at 1.038% and 1.016% on Thursday

The Japanese Government Bond (JGB) 10-year return slipped from 0.165% on Monday to 0.129% on Friday.

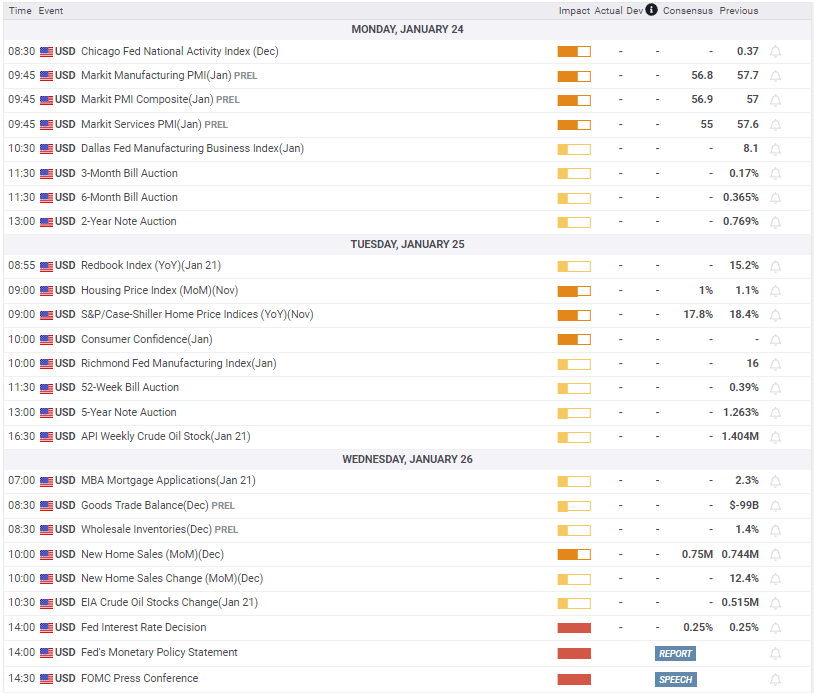

Markets have priced in the Fed’s first hike in March and are expecting details on the rate course for the remainder of the year and the prospective balance sheet reduction at the Wednesday Federal Open Market Committee (FOMC) meeting.

Fed funds futures show a 93.4% probability for a 0.25% hike at the March 16 FOMC, a 90.3% chance for three hikes by the December 14 meeting and 67.1% odds for four increases by the last meeting of the year. Increases in the fed funds rate after March are probably not priced into the USD/JPY.

CBOE

Japanese exports increased in December for the tenth straight month of annual growth and imports were higher for the eleventh month. Industrial Production for November was a bit weaker than forecast at 7% for the month and 5.1% for the year. Consumer prices partially justified the BOJ’s upgrade with December’s annual rate rising to 0.8% from 0.6% but the core rate dipped to -0.7% (YoY) from -0.6%.

The US home construction sector continued to perform in December with Housing Starts rising 1.4% to a nine-month high with work backlogs jumping to a record as supply strains and labor shortages restricted projects. Building Permits rose 9.1%, the largest gain since January. Existing Home Sales, 90% of the US market, fell 4.6% in December as availability decreased 14.2% from a year earlier. The median selling price was 15.8% higher than in December 2020. Initial Jobless Claims were 286,000 for the January 14 week, far more than the 231,000 prior and the third increase in a row. Jobless filings have climbed from 200,000 on December 24. Though they are low by historical standards, the increases may indicate that the Omicron wave of the virus has forced layoffs.

USD/JPY outlook

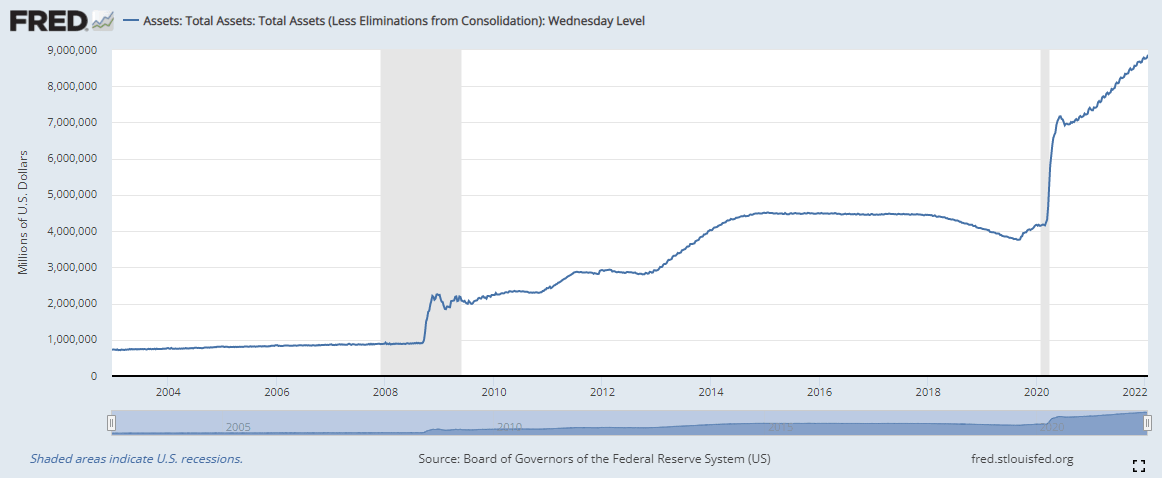

The Fed has been quite emphatic in its switch to a tightening bias. This has had the effect of front-loading most dollar gains which are now being whittled away in the Fed’s traditional comment blackout before a meeting. Having doubled the taper to $30 billion a month in December no further adjustment is expected at the January 26 meeting. Speculation is centered on the balance sheet reduction which could begin in March.

Fed Chair Jerome Powell will no doubt be asked about this and his answers will set the market reaction. The sooner the reduction begins and the faster it proceeds, the better for the dollar.

The most probable course for the Fed is a so-called natural runoff, meaning the bank will not reinvest the capital of maturing bonds, a process which is expected to reduce the bank’s holding about $2 trillion in two years of its $8.9 trillion in assets. If Mr. Powell says the Fed is considering or has decided to sell some of its bonds, it would be a major surprise and Treasury yields and the dollar will respond forcefully higher.

Pertinent pending Japanese data is limited to Tokyo CPI for November which will not move trading.

In the US, Durable Goods Orders for December, a subset of Retail Sales, should confirm December’s weakness.

Fourth quarter annualized US Gross Domestic Product (GDP) on Thursday is expected to be 5.8%, up from 2.3% prior. Variation from the forecast, up or down, and by degree, will directly impact the USD/JPY and Treasury yields. The Personal Consumption Expenditure (PCE) Price Index on Friday, the Fed's well-known elected measure, will confirm accelerating inflation without providing any new insight on duration or extent.

The bias for the USD/JPY is lower to neutral until the FOMC meeting. Unless the Fed asserts an unexpected penchant for portfolio reduction on Wednesday the lower bias will continue for the balance of the week. Technical support is relatively robust down to 112.75, but then weak for the three-quarters of a figure to 112.00.

Japan statistics January17–January 21

FXStreet

US statistics January 17–January 21

FXStreet

Japan statistics January 24–January 28

FXStreet

US statistics January 24–January 28

FXStreet

USD/JPY technical outlook

Negative bias in the MACD (Moving Average Convergence Divergence) and Relative Strength Index (RSI) have increased slightly from last week. Failure at 114.00 despite substantial support weakened the case for a rebound ahead of the Fed meeting on Wednesday. The spread in the MACD is now at its widest of the decline and the RSI is at its lowest since April 2021. Volatility decreased in the second half of the week and is unlikely to revive before the Fed meeting.

Support is strong at 113.25 where it is augmented by the 100-day moving average (MA) at 113.24 and at 111.50 which is backed by the 200-day MA at 111.47. The range from 112.75 to 112.00 was largely traversed in a single day's trading on October 11 and is consequently free of notable support. If the USD/JPY drops below the three-month low at 112.75, it will likely not rest until 112.00.

Resistance: 114.00, 114.50, 115.00, 115.35, 116.10

Support: 113.50, 113.25, 112.75, 112.00, 111.50

FXStreet Forecast Poll

The FXStreet Forecast Poll has excellent logic with firm technical support seconded by a fundamental rate outlook favoring the USD/JPY.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.