USD/JPY Price Forecast: Eyes YTD low as Trump's tariffs trigger global markets meltdown

- USD/JPY comes under intense selling pressure as the global flight to safety boosts the JPY.

- Trump’s tariff triggers a global risk-aversion trade and boosts demand for safe-haven assets.

- The narrowing of the US-Japan rate differential and a USD selloff contributes to the downfall.

The USD/JPY pair plummets to a three-and-half-week low during the early European session on Thursday as investors rushed to take refuge in traditional safe-haven assets in reaction to US President Donald Trump's sweeping trade tariffs. In fact, Trump said that he would slap a baseline 10% duty on all foreign imports into the US and impose greater levies on some of the country's biggest trading partners. The development raises the risk of a widening trade war, which could upset global free trade and impact negatively on the world economy. This sends shockwaves through global financial markets and provides a strong boost to the Japanese Yen (JPY).

Meanwhile, the anti-risk flow saw most global government bond yields tumble. Adding to this, dovish Federal Reserve (Fed) expectations drag the yield on the benchmark 10-year US government bond to a fresh year-to-date low. This contributes to the US Dollar's (USD) intraday slump to its lowest level since October and the heavily offered tone surrounding the USD/JPY pair. In fact, the markets are now pricing in a 70% chance that the Fed will lower borrowing costs in June and deliver a total of three 25-basis-point rate cuts by the end of this year. This marks a big divergence in comparison to bets that the Bank of Japan (BoJ) will continue raising interest rates.

The incoming macro data, including strong consumer inflation figures from Tokyo released last Friday, keeps the door open for further policy tightening by the BoJ. However, worries about the impact of harsher-than-expected US tariffs on Japan's economy forced investors to trim their bets that the central bank would raise policy rate at a faster pace. This, in turn, assists the USD/JPY pair to rebound over 50 pips from the 146.80 region. The aforementioned fundamental backdrop, however, suggests that the path of least resistance for spot prices remains to the downside. Hence, any subsequent recovery might still be seen as a selling opportunity and is likely to remain capped.

Traders now look forward to Thursday's US economic docket – featuring the release of the usual Weekly Initial Jobless Claims and the ISM Services PMI. The data might influence the USD price dynamics and provide some impetus to the USD/JPY pair. The focus, however, will remain glued to trade-related headlines. This will play a key role in driving the broader market risk sentiment and contribute to some meaningful trading opportunities ahead of the closely-watched US Nonfarm Payrolls (NFP) report on Friday.

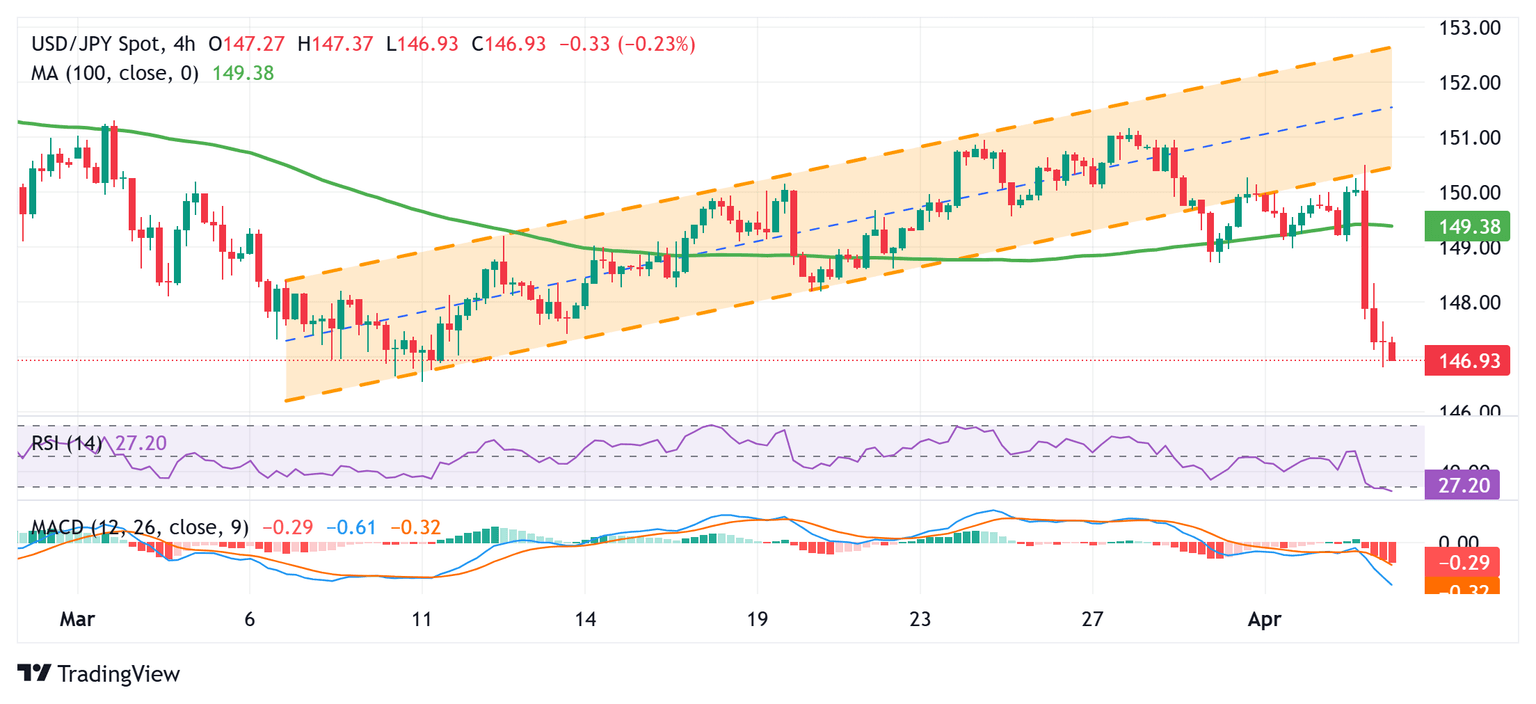

USD/JPY daily chart

Technical Outlook

From a technical perspective, the intraday slump below the 100-period Simple Moving Average (SMA) on the 4-hour chart comes on top of the recent breakdown through a multi-week-old ascending channel and favors bearish traders. This, along with the fact that oscillators on the daily chart are holding deep in negative territory and are still away from being in the oversold zone, supports prospects for a further near-term depreciation for the USD/JPY pair. Acceptance below the 147.00 mark will reaffirm the negative bias and expose a multi-month low, around the 146.55-146.50 region touched in March, below which spot prices could accelerate the fall towards the 146.00 round figure.

On the flip side, any further recovery might confront some resistance near the 148.00 round figure. A sustained strength beyond the said handle could trigger a short-covering rally towards the 148.65-148.70 region. Any subsequent move up, however, is likely to attract fresh sellers near the 149.00 mark and remain capped near the 149.35-149.40 region. The latter represents the 100-period SMA on the 4-hour chart and should act as a key pivotal point, which if cleared decisively might negate the negative outlook and pave the way for additional near-term gains.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.