USD/JPY Price Forecast: Attempted recovery is likely to get sold into; US NFP in focus

- USD/JPY rebounds from a two-month low following cautious remarks from the IMF this Friday.

- The narrowing US-Japan rate differential limits JPY losses and caps the recovery for the major.

- Investors also seem reluctant and opt to move to the sidelines ahead of the crucial US NFP report.

The USD/JPY pair stages a goodish intraday recovery from sub-151.00 levels or the lowest since December 10 touched earlier this Friday, and for now, seems to have snapped a four-day losing streak. The Japanese Yen (JPY) weakens across the board in reaction to cautious remarks from the International Monetary Fund (IMF), which, in turn, prompts some short-covering around the currency pair. In fact, warned that Japan should remain alert to potential spillover effects from rising volatility in global markets that could affect liquidity conditions for its financial institutions. The IMF added that Japan needs to be vigilant about monitoring any fallout from the Bank of Japan's rate hikes, such as an increase in the government's debt-servicing costs and a possible jump in corporate bankruptcies.

The momentum lifts the USD/JPY pair back closer to the 152.00 mark, though it lacks follow-through traction in the wake of hawkish Bank of Japan (BoJ) expectations. Kazuhiro Masaki, Director General of the BoJ's monetary affairs department, said on Thursday that the central bank will continue to raise interest rates if underlying inflation accelerates toward its 2% target as projected. This comes on top of the BoJ Summary of Opinions released on Monday, which showed that policymakers discussed the likelihood of raising interest rates further at the January meeting. Adding to this, data released this week showed that Japan’s inflation-adjusted real wages rose 0.6% year-on-year in December – marking the second consecutive monthly gain – and backs the case for further tightening by the BoJ.

This, in turn, pushed the yield on Japan’s 10-year government bond to a 14-year high earlier this week. In contrast, the yield on the benchmark 10-year US government bond fell to its lowest level since December 12 earlier this week amid bets that the Federal Reserve (Fed) will stick to its easing bias in 2025. The resultant narrowing of the US-Japan yield differential helps limit losses for the JPY, which, along with subdued US Dollar (USD) price action, contributes to capping the upside for the USD/JPY pair. Traders also seem reluctant to place aggressive bets and opt to wait for the release of the US monthly employment details, due later during the North American session.

The popularly known Nonfarm Payrolls (NFP) report is expected to show that the world's largest economy added 170K jobs in January compared to 256K in the previous month and the Unemployment rate held steady at 4.1%. Apart from this, Average Weekly Earnings will influence market expectations about the Fed's interest rate outlook. This, in turn, would play a key role in driving the USD demand and determining the near-term trajectory for the USD/JPY pair. Nevertheless, spot prices remain on track to register losses for the fourth successive week. Moreover, the fundamental backdrop suggests that the path of least resistance for the pair remains to the downside.

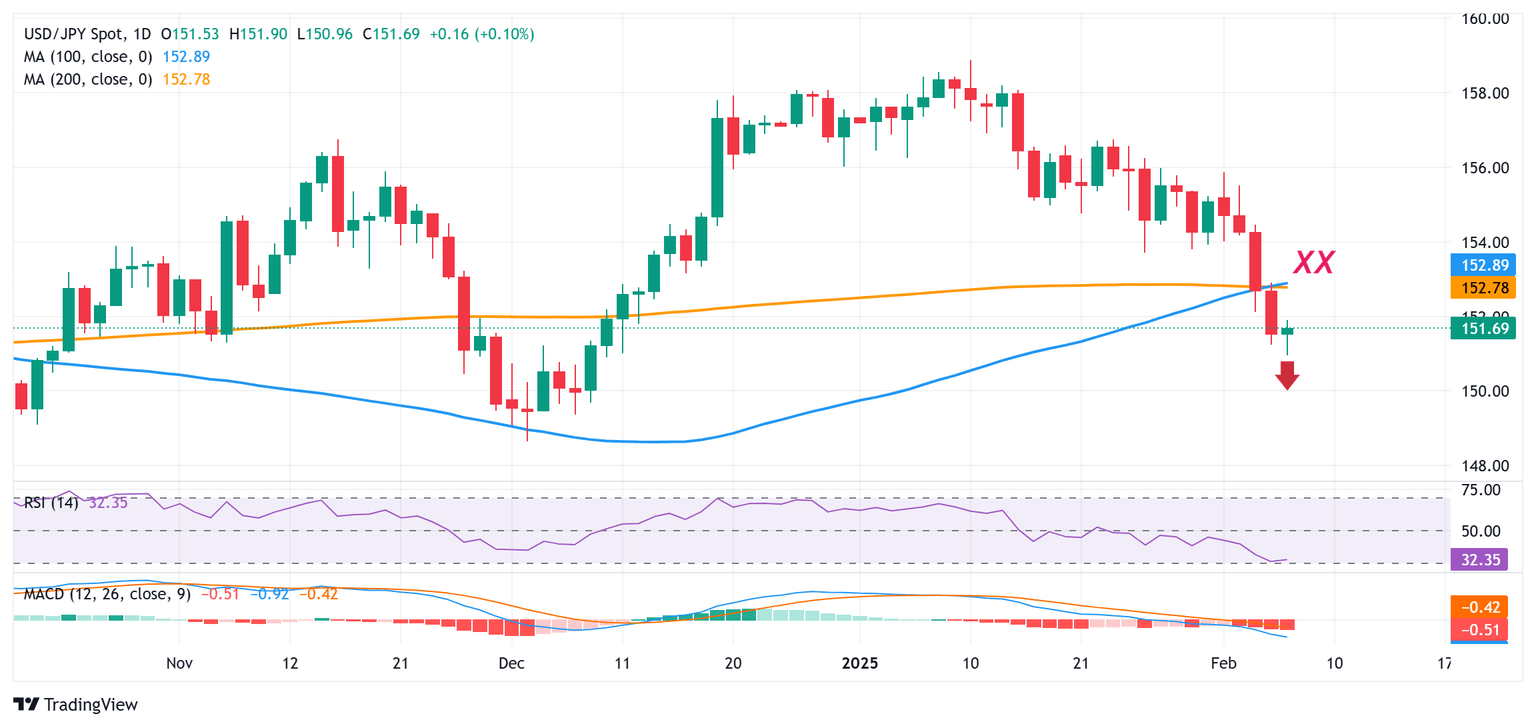

USD/JPY daily chart

Technical Outlook

From a technical perspective, this week's breakdown below the 152.50-152.45 confluence – comprising the 100- and the 200-day Simple Moving Averages (SMAs) was seen as a key trigger for bearish traders. Moreover, oscillators on the daily chart are holding deep in negative territory and are still away from being in the oversold zone. This, in turn, suggests that any subsequent move up beyond the 152.00 mark is likely to remain capped near the aforementioned support breakpoint. Some follow-through buying, however, could allow the USD/JPY pair to reclaim the 153.00 round figure.

On the flip side, the 151.00 mark now seems to have emerged as an immediate support. A sustained break and acceptance below the said handle would make the USD/JPY pair vulnerable to weaken further towards 150.55-150.50 support. The downward trajectory could extend toward the 150.00 psychological mark, below which spot prices could slide to the 149.60 horizontal support before aiming to test the 149.00 mark and the December swing low, around the 148.65 region.

(This story was corrected on February 7 at 13:00 GMT to say Bank of Japan (BoJ), not Bank of Japan (JPY).)

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.