USD/JPY Outlook: Seems vulnerable amid possibility of further BoJ policy tweak; US CPI awaited

- USD/JPY slides back closer to the weekly low and is pressured by a combination of factors.

- The BoJ review news boosts the JPY and exerts some pressure amid a modest USD downtick.

- Bets for smaller Fed rate hikes continue to weigh on the buck ahead of the key US CPI report.

The USD/JPY pair comes under some renewed selling pressure on Thursday and drops back closer to the weekly low during the Asian session. The Japanese Yen strengthens across the board amid reports that the Bank of Japan (BoJ) will inspect the side effects of ultra-loose monetary policy at its next policy meeting on January 17-18. Further details showed that policymakers may take additional steps to correct distortions in the yield curve. This comes on the back of the BoJ's surprise tweak in December and fuels speculation for an eventual tightening later this year. This, along with a modest US Dollar downtick, acts as a headwind for the major.

The USD continues to be weighed down by growing acceptance that the Federal Reserve will soften its hawkish stance amid signs of easing inflationary pressures. The bets were lifted by last week's US monthly jobs report (NFP), which showed a slowdown in wage growth during December. Adding to this, business activity in the US services sector hit the worst level since 2009 and suggested that the effects of the Fed's large rate hikes in 2022 are being felt in the economy. This reaffirmed market expectations for a less aggressive policy tightening by the Fed and leads to an extension of the recent decline in the US Treasury bond yields.

In fact, the yield in the benchmark 10-year US Treasury note drops to a nearly four-week low and continues to undermine the greenback. That said, a generally positive risk tone, bolstered by the easing of COVID-19 curbs in China, could undermine the safe-haven JPY and limit the downside for the USD/JPY pair. Traders might also prefer to move to the sidelines and wait for the release of the US consumer inflation figures, due later during the early North American session. The crucial US CPI report will influence the Fed's rate-hike path, which, in turn, will drive the USD demand and provide a fresh directional impetus to the major.

Technical Outlook

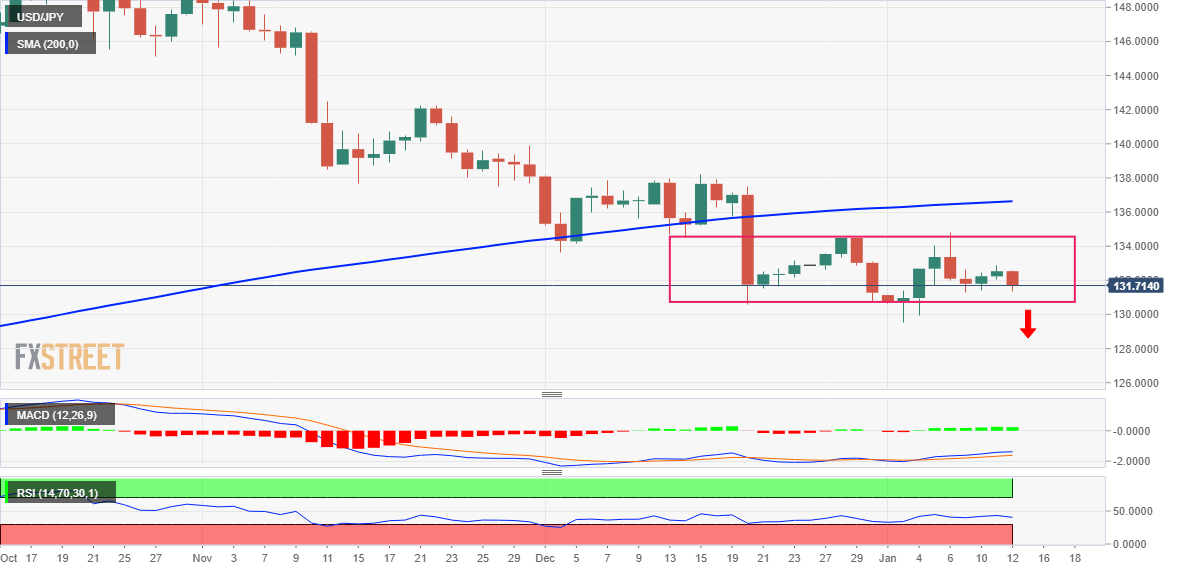

The USD/JPY pair's inability to gain any meaningful traction and the emergence of fresh selling at higher levels comes on the back of the recent breakdown below the very important 200-day SMA. This, in turn, suggests that the recent downfall might still be far from being over and that the path of least resistance for spot prices is to the downside. Some follow-through selling and a convincing break below the 131.00 round figure will reaffirm the negative outlook and drag the pair towards the 130.60 intermediate support. The downward trajectory could get extended towards the 130.00 psychological mark en route to the monthly swing low, around mid-129.00s.

On the flip side, any meaningful recovery back above the 132.00 mark could attract fresh sellers near the 132.65 area. This, in turn, should cap the USD/JPY pair near the weekly high, around the 132.85-132.90 region, which should now act as a pivotal point for short-term traders. A sustained strength beyond might prompt a short-covering rally and lift spot prices beyond the 133.50 hurdle, allowing bulls to reclaim the 134.00 mark. Some follow-through buying will set the stage for a further near-term appreciating move towards testing last week's swing high, around the 134.75-134.80 region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.