USD/JPY outlook: Japanese yen surges on signals that BoJ is about to exit its ultra-loose policy

USD/JPY

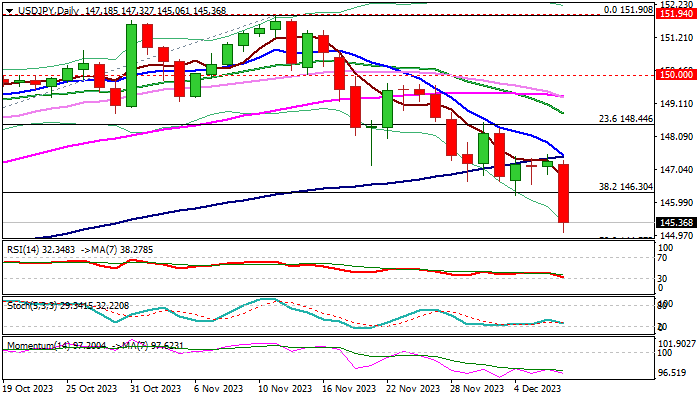

USDJPY accelerated lower (down 1.4% in Asian/early European session) on Thursday, driven by growing market expectations that the Bank of Japan will soon start exiting its long lasting ultra-low monetary policy, which strongly boosts demand for yen.

On the other hand, the US Federal Reserve is likely done with tightening and markets speculate that the US central bank may start cutting rates as early as March 2024.

Fresh weakness broke below pivotal Fibo support at 146.30 (38.2% of 137.23/151.90) which contained attacks earlier this week and kept bears on hold for consolidation.

Technical picture is getting more bearish on daily chart, as MA’s are in bearish configuration and created a number of bear-crosses and 14-d momentum turned south, deeply in the negative territory, validating bearish near-term outlook.

Bears eye next target at 144.57 (50% of 137.23/151.90) and could travel much lower in such environment, with limited corrections expected to provide better selling levels.

Broken Fibo 38.32% (146.30) reverts to resistance which should cap and keep bears intact.

Only return above converged 10/100DMA’s would harm bears and neutralize downside risk.

Res: 146.30; 147.00; 147.45; 148.44.

Sup: 145.00; 144.57; 144.00; 142.84.

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.