USD/JPY outlook: Bulls may take a breather under 107 zone before resuming

USD/JPY

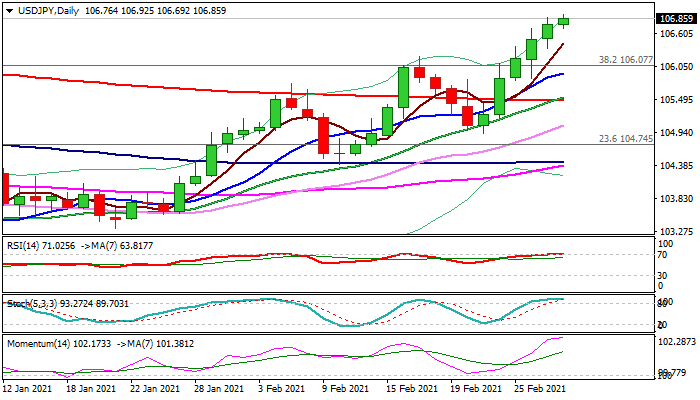

The pair maintains firm bullish tone for the sixth straight day and hit new multi-month high in early Tuesday’s trading, driven by rising demand for the US dollar.

Bulls pressure resistances at 107 zone, consisting of mid-Aug high (106.94), Fibo 50% of 111.71/102.59 (107.15) and 100WMA (107.22), violation of which would open way for 108+ extension.

Daily studies show very strong bullish momentum, with double golden-cross (10/200 and 20/200DMA’s) underpinning the action, but overbought stochastic and RSI warn that bulls may pause here for consolidation.

Dips should be ideally contained above former high at 106.22 (17 Feb), but near-term action is expected to keep bullish bias above rising 10DMA (105.94).

Res: 106.94; 107.22; 107.52; 108.00.

Sup: 106.69; 106.43; 106.22; 105.94.

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.