USD/JPY outlook: Bulls hold grip in lower-volume Boxing day trading

USD/JPY

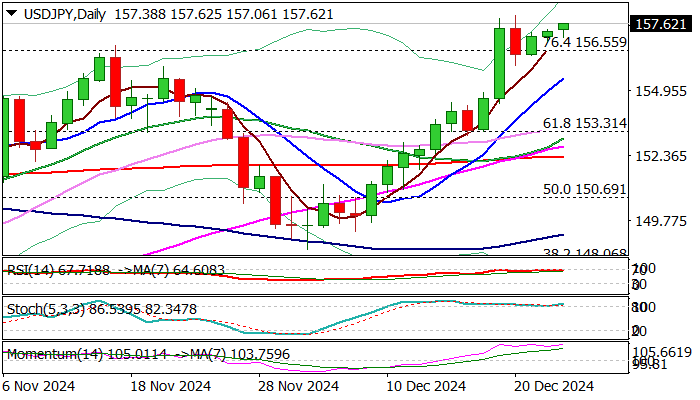

USDJPY keeps firm tone in holiday-thinned trading on Thursday and pressuring last Friday’s peak at 157.92 (the highest since mid-July).

The pair is on track for the fourth consecutive weekly gain and for over 5% monthly advance in December.

Hawkish signals from Fed on expectations that inflation will remain elevated for some time and continue to obstruct plans for rate cuts, as well as wide gap between Fed and BoJ monetary policies, continue to support the pair.

Near term price action has established above broken Fibo barrier at 156.67 (76.4% retracement of 161.98/139.57 correction) which now offers solid support, followed by rising daily Tenkan-sen (155.19) and key supports at 153.62/40 (daily cloud top / daily Kijun-sen / broken Fibo 61.8%).

Strong bullish momentum and multiple golden crosses on daily chart support bullish near-term outlook, with thick rising daily Ichimoku cloud underpinning the action.

However, initial warning from overbought conditions should be considered, while traders continue to closely watch the action from Bank of Japan after they have sent a signal in a shape of verbal intervention, with markets expect that the authorities may act somewhere above 160 mark, similar to intervention in July.

Res: 155.95; 156.95; 157.61; 158.00.

Sup: 157.00; 156.55; 155.88; 155.19.

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.