USD/JPY outlook: Bearish pressure eases but downside is still at risk

USD/JPY

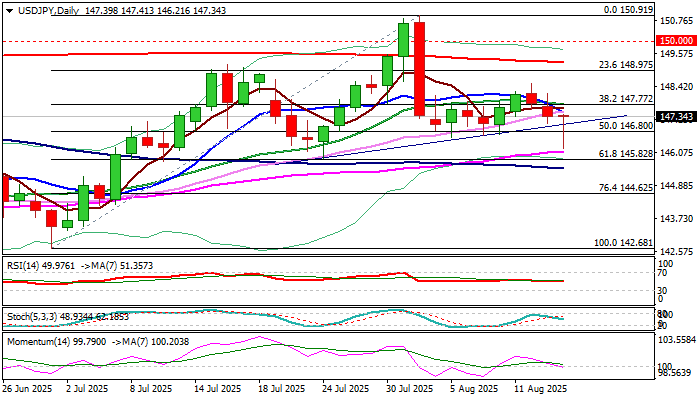

USDJPY trends lower for the third consecutive day and accelerated losses on Thursday, hitting the lowest in three weeks.

Fresh bears spiked through pivotal supports at 146.80/70 (50% retracement of 142.68/150.91 / early Aug higher base) but need close below these levels to confirm bearish signal (also on completion on asymmetric Head & Shoulders pattern on daily chart) and open way for attack at 145.85/82 (July 24 higher low / Fibo 61.8%) and 145.50 (100DMA).

The dollar remains under pressure on growing expectations of Fed rate cut in September and probably another one or two by the end of the year.

However, bears may pause for further consolidation after today’s quick bounce from new low pointed to increased headwinds, as daily studies still lack clear direction signal (MA’s in mixed setup with conflicting 55/100DMA bull cross and 10/20 DMA bear cross, with 14d momentum being currently at the centreline.

Falling 10DMA (147.47) should cap and guard 20DMA (147.78) upper breakpoint.

Stronger signals to be expected from the outcome of Trump – Putin summit, with Monday’s market opening to be closely watched.

Res: 147.47; 147.78; 148.51; 148.97.

Sup: 147.09; 146.80; 146.12; 145.82.

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.