USD/JPY looks for a rebound

-

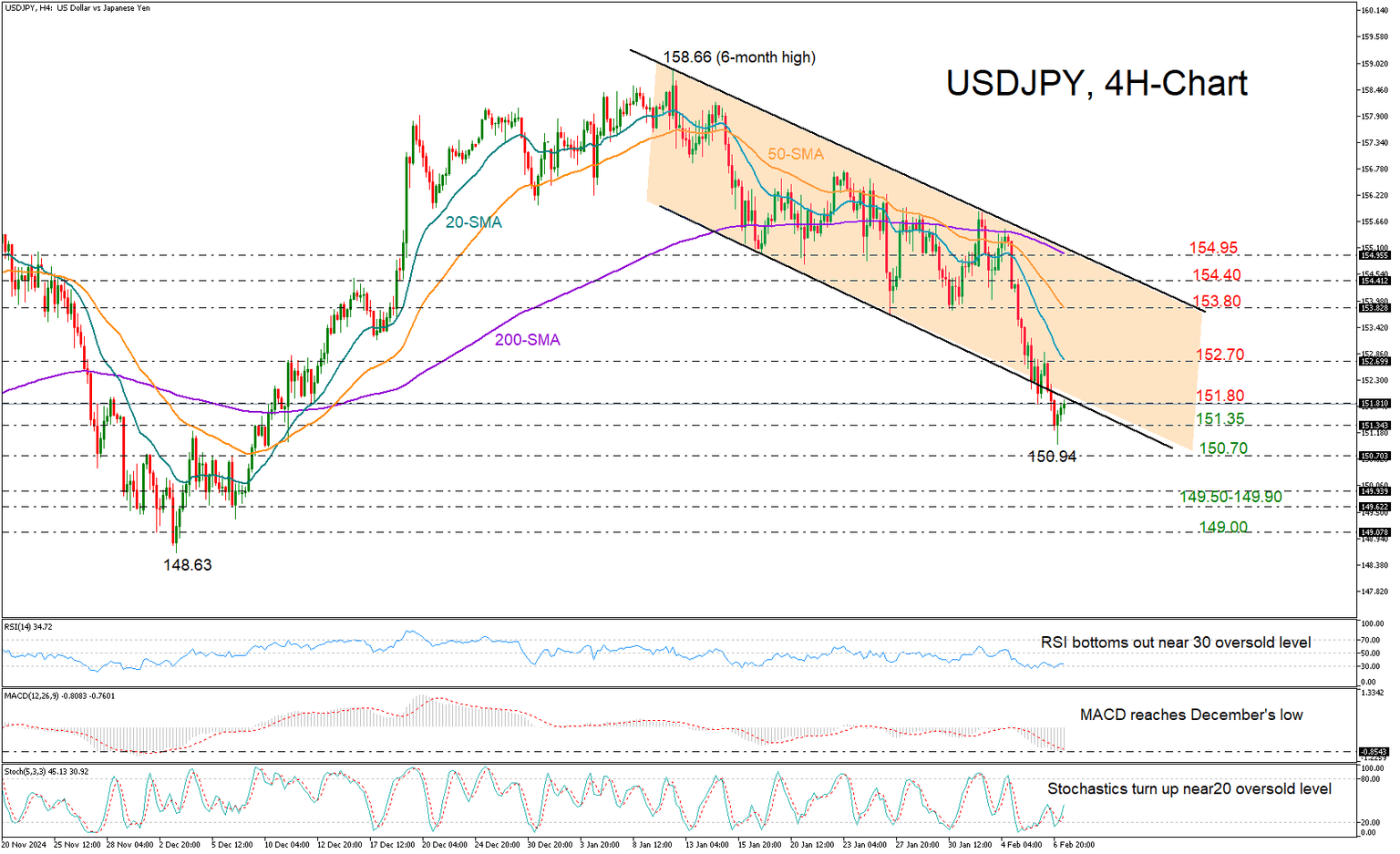

USD/JPY bulls show some signs of life near a two-month low.

-

Oversold signals present; key resistance at 151.80.

USDJPY is showing tentative signs of life after its recent freefall took a halt at 150.94 – the lowest since December – though upside pressures remain subdued, with the price currently struggling to cross above 151.80.

The falling exponential moving averages (EMAs) are endorsing the negative trajectory in the market, but oversold signals coming from the RSI and the stochastic oscillator suggest the decline has gone too far and a recovery or a consolidation phase could be underway.

If the bulls claim the 151.80 region, where the lower band of the broken bearish channel is placed, they could set their sights on the 20-period EMA at 152.70. A move higher could pave the way towards the 50-day EMA near 153.80, while the 154.40 region could be another obstacle before the channel’s upper band and the 200-period EMA at 154.95 come under examination.

In the bearish scenario that the pair closes below the 151.35 floor, the 150.70 barrier taken from December could provide some relief. If selling interest intensifies, traders might watch for a sharp drop to 149.50-149.90 and then down to 149.00.

Summing up, USDJPY is maintaining a bearish short-term outlook but oversold conditions hint that a rebound could be in play if 151.80 is conquered.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.