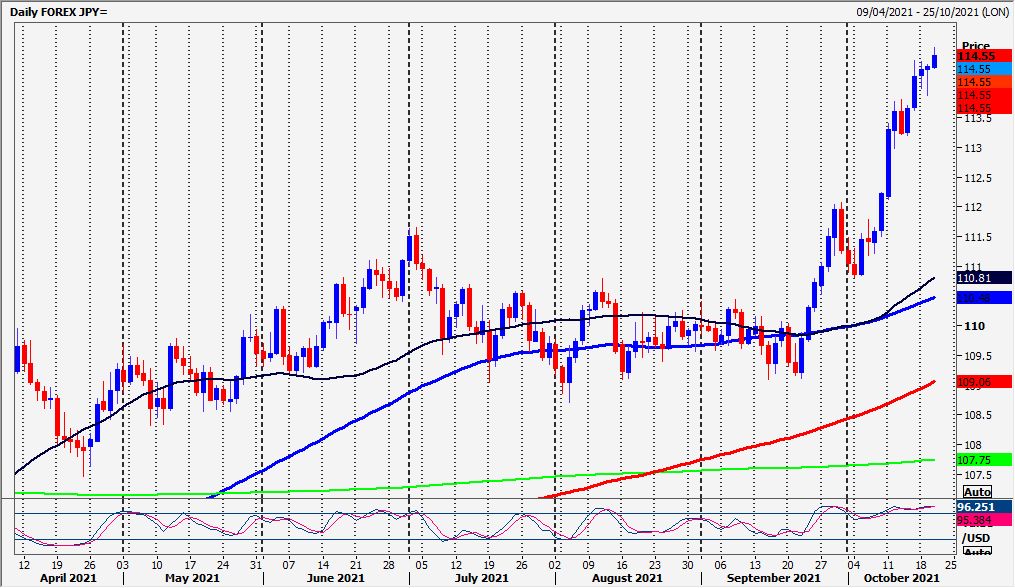

USD/JPY longs at first support at 113.90/70

USD/JPY, EUR/JPY, CAD/JPY

USDJPY longs at first support at 113.90/70 worked (although we saw a low for the day at 113.89).

EURJPY longs are doing very well in the strong bull trend after we beat minor resistance at 132.65/75 targeting 133.10/15 & 133.50/70... we are expected the hit this target today.

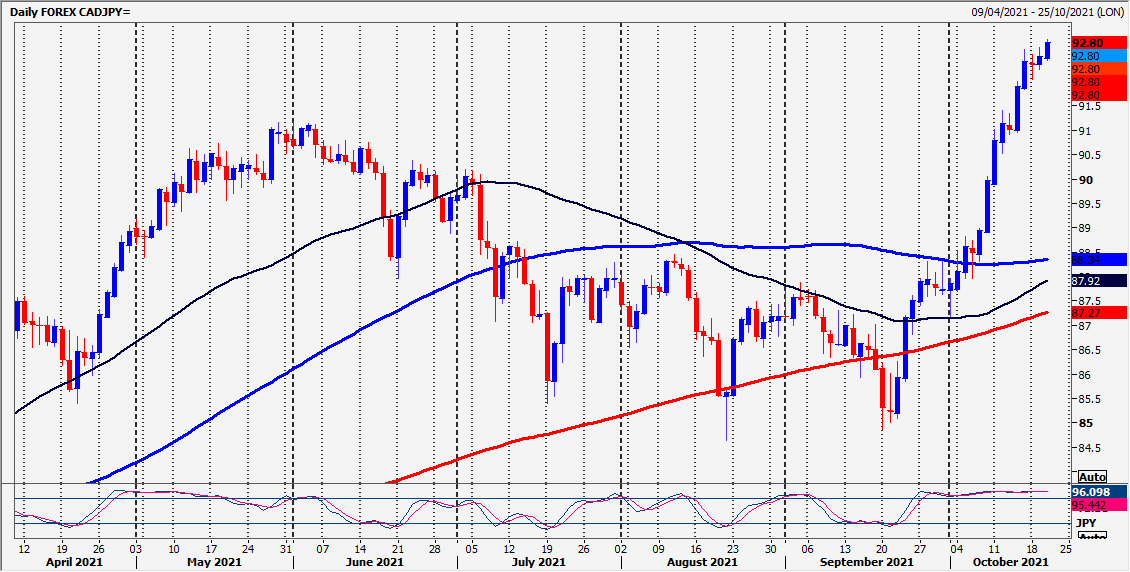

CADJPY beat strong resistance at 9140/75 for the next buy signal targeting 9270/90 (hit this morning) & 9320/30. Longs at first support at 9230/20 this trade worked perfectly yesterday offering a 50 pip profit this morning.

Daily analysis

USDJPY longs at 113.90/70 target 114.45/55, 114.70, 114.95 & 115.20 after our buy signal.

The downside is expected to be limited with first support at 113.90/70. A break below 113.60 however meets a buying opportunity at 113.30/20. Stop below 113.05.

EURJPY is expected to target 133.10/15 & 133.50/70 before the 2021 high at 134.10/12.

Minor support at 132.80/60. Stop below 132.50.

CADJPY through 9140/75 for the next buy signal targeting 9270/90 & 9320/30 before reaching 9266. Further gains are expected with a break above 9280 targeting 9310/20. A break above 9330 is the next buy signal targeting 9370/90.

The downside is expected to be limited with bulls in control. First support at 131.80/60. Longs need stops below 131.40.

CADJPY through 9140/75 for the next buy signal targeting 9270/90 (hit this morning) & now 9320/30.

The downside is expected to be limited with first support again at 9230/20. Best support at 9160/40. Longs need stops below 9120.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk