USD/JPY Forecast: Market rushes into the dollar

USD/JPY Current price: 107.68

- The market’s sentiment turned sour with coronavirus-related headlines.

- Japan’s Leading Economic Indicator unexpectedly improved in May.

- USD/JPY turned positive, although risk aversion will likely keep the upside limited.

The market’s sentiment took a U-turn, and so did the greenback, up against all of its major rivals included the Japanese yen. Optimism was overshadowed by coronavirus-related headlines, as the number of cases in the US continued to rise, while Australia announced a six-week lockdown in Melbourne, amid a new outbreak of the virus. Equities trade in the red, with European indexes trimming Monday gains.

In the data front, Japan released the preliminary estimate of the May Leading Economic Indicator, which unexpectedly improved to 79.3 from 77.7, better than the 73.2 expected. The Coincident Index, for the same period, however, contracted to 74.6 from 80.1. The country also published Overall Household Spending, down by 16.2% in the year to May. The US will have quite a light macroeconomic calendar, as it will publish the IBD/TIPP Economic Optimism for July and the May JOLTS Job Openings.

USD/JPY short-term technical outlook

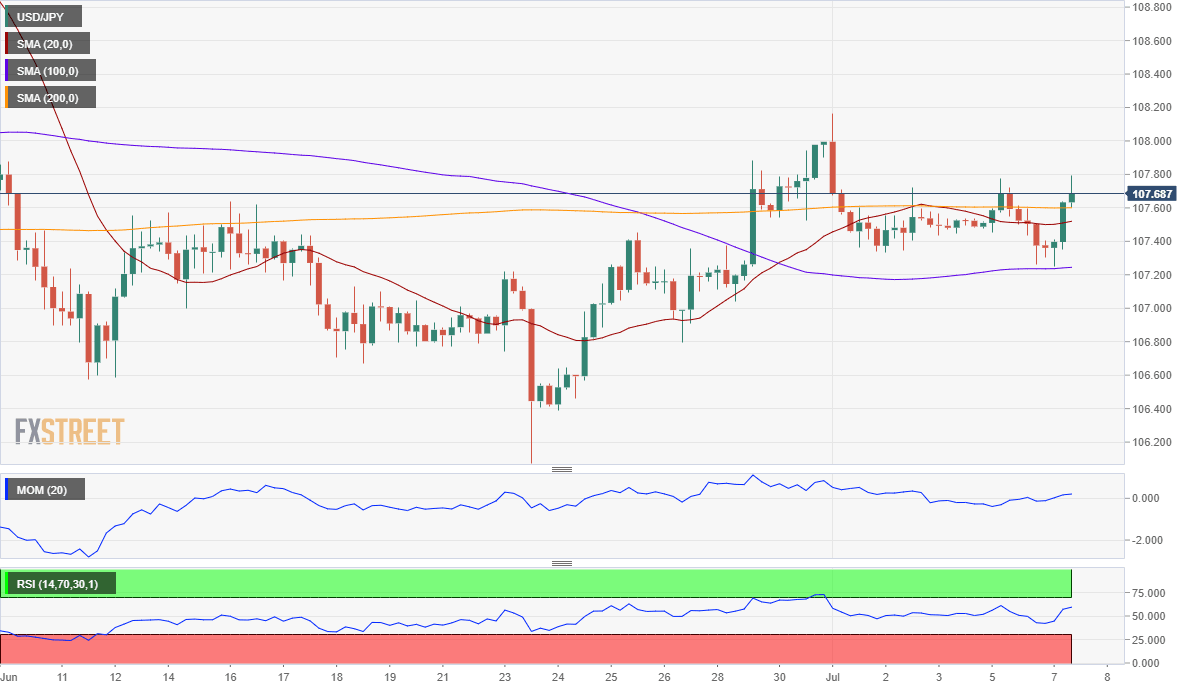

The USD/JPY pair is trading near a daily high of 107.78, neutral in the short-term, although with the risk skewing to the upside. However, in a risk-averse environment, the chances of a bullish run are limited. In the 4-hour chart, the pair is trading above all of its moving averages, which remain flat, as technical indicators are directionless just above their midlines. The pair has an immediate Fibonacci resistance at 107.95, the level to surpass to see it gather additional bullish momentum.

Support levels: 107.20 106.95 106.60

Resistance levels: 107.95 108.30 108.65

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.