Bank of England’s cautious rate cut fuels GBP/USD upside momentum

BoE cuts rates but retains a cautious tone

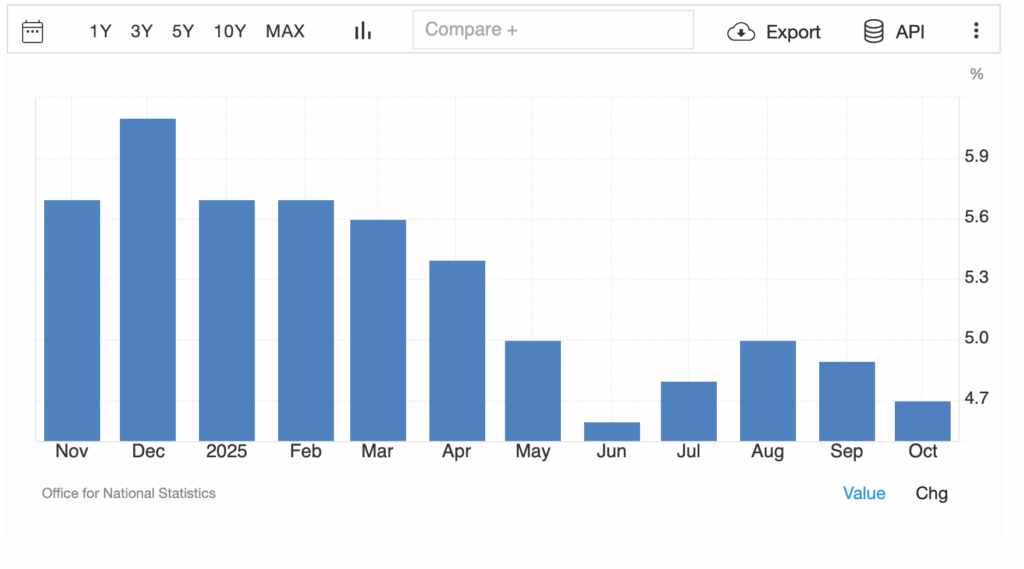

The Bank of England has lowered its benchmark interest rate to 3.75%, a move largely anticipated by markets. However, the tone of the Monetary Policy Committee (MPC) was notably more cautious than investors expected. While officials acknowledged that inflation risks have eased, they also stressed that future rate adjustments would depend heavily on evolving data trends.

This decision reflects a central bank attempting to balance slowing economic growth against lingering inflation pressures. Governor Andrew Bailey and four other members voted for the cut, while four committee members favored holding rates steady, underlining the deep divisions within the BoE.

The central takeaway: despite the rate cut, the Bank signalled that it is approaching a neutral zone, suggesting the pace of easing will remain measured rather than aggressive.

Hawkish undertone keeps GBP supported

Market reaction to the announcement was mixed. Initially, traders interpreted the move as a dovish signal, but the Bank’s statement quickly changed sentiment. By emphasising that inflationary risks, though softer, remain on the radar, the BoE effectively reduced expectations for rapid rate cuts in early 2026.

This “hawkish cut” helped support sterling against the U.S. dollar. The tone of the meeting minutes and comments from policymakers implied that while two more cuts are possible in 2026, they would come only if inflation remains close to the 2% target by midyear.

As a result, GBP/USD found buying interest on dips, with traders reassessing short positions as market rates adjusted higher.

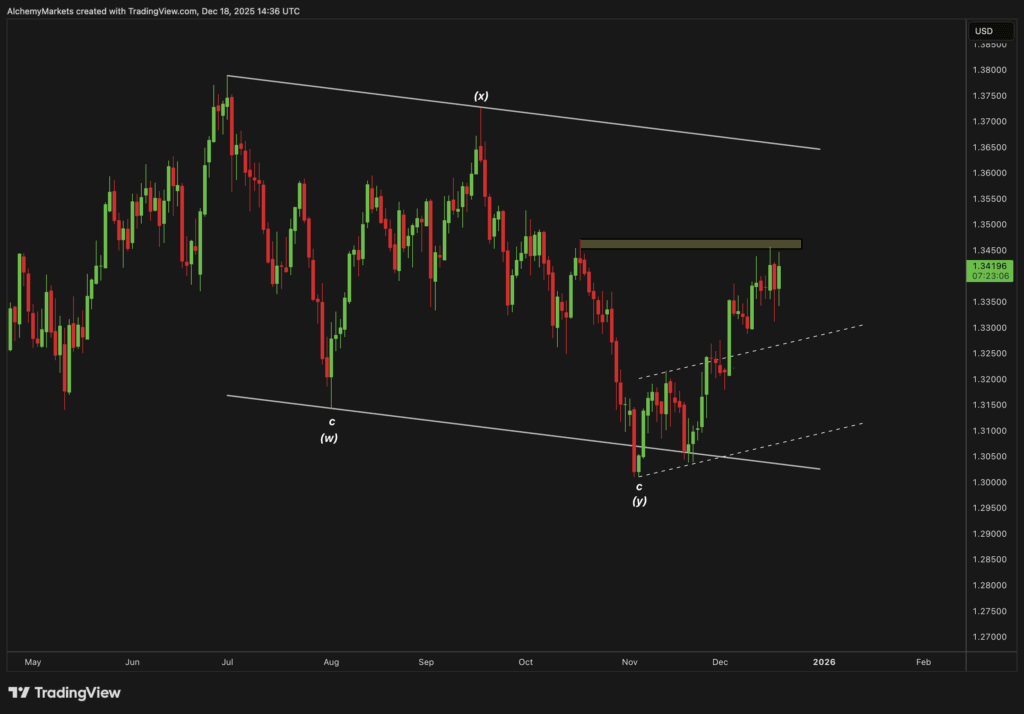

Technical analysis: GBP/USD eyes break above 1.3450 resistance

From a technical standpoint, GBP/USD has staged an impressive rebound from the late-2025 lows near 1.29, climbing steadily within a rising channel. The pair now faces a critical resistance zone around 1.3450, highlighted in your chart.

This area marks both the upper boundary of recent consolidation and a key horizontal resistance tested multiple times since early December. A decisive close above 1.3450 could open the path toward the upper trendline of the broader descending channel, as drawn from the 2023 highs.

Momentum indicators support the bullish outlook:

- The higher lows pattern indicates building upside pressure.

- The channel structure suggests gradual accumulation, with buying interest increasing near 1.31–1.32.

- A confirmed breakout above 1.3450 would likely target 1.3650–1.3700, aligning with the upper channel resistance visible on the chart.

In contrast, failure to break this level could lead to short-term consolidation between 1.3300–1.3450, before renewed attempts higher.

Macro outlook: Two more cuts expected in 2026

Economists widely expect the BoE to deliver two more rate cuts during the first half of 2026, depending on inflation and wage data. The central bank itself noted that decisions will become a “closer call” going forward, a phrase suggesting increasing uncertainty within the committee.

Nevertheless, inflation is projected to approach 2% by May 2026, giving policymakers some flexibility. Once inflation stabilizes, the Bank may shift focus toward stimulating growth, which could cap sterling’s upside later in the year.

For now, however, the relative hawkish tone combined with resilient U.K. data has positioned GBP/USD favourably in the short to medium term.

Market reaction and outlook

The reaction in sterling has been one of cautious optimism. Traders were expecting a more dovish statement, but the Bank’s emphasis on vigilance around inflation led to moderate bullish positioning in GBP/USD.

As of the latest session, GBP/USD is trading near 1.3423, holding firm ahead of the 1.3450 resistance. A sustained push through this barrier could signal a trend reversal from the multi-month downtrend, potentially confirming the start of a new bullish cycle heading into 2026.

Conclusion

The Bank of England’s rate cut to 3.75%, while aligning with forecasts, carried a more cautious message that lent near-term support to sterling. For GBP/USD, the focus now shifts to the technical threshold at 1.3450 — a level that, if broken, could open the door toward the upper boundary of the descending channel around 1.37.

Given the current setup, short-term momentum favours the bulls, with any dips likely to find buyers above 1.33.

FAQs

1. Why did the Bank of England cut rates to 3.75%?

The BoE reduced rates to support the slowing economy while acknowledging that inflation pressures have eased but not disappeared.

2. Is the Bank of England done cutting rates?

Not yet. Analysts anticipate two more rate cuts in the first half of 2026, depending on how inflation and wage data evolve.

3. How did GBP/USD react to the rate cut?

Sterling strengthened slightly after the announcement, as the BoE’s message was less dovish than expected.

4. What key technical levels should traders watch for GBP/USD?

Resistance at 1.3450 is crucial. A breakout could open a move toward 1.37, while support lies near 1.33.

5. What could trigger a GBP/USD rally?

A clear daily close above 1.3450 would confirm bullish momentum, potentially extending gains toward the upper trendline of the descending channel.

6. Could the pair face headwinds later in 2026?

Yes. If inflation stabilises and growth slows, the BoE may accelerate rate cuts, which could weigh on sterling in the second half of 2026.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.