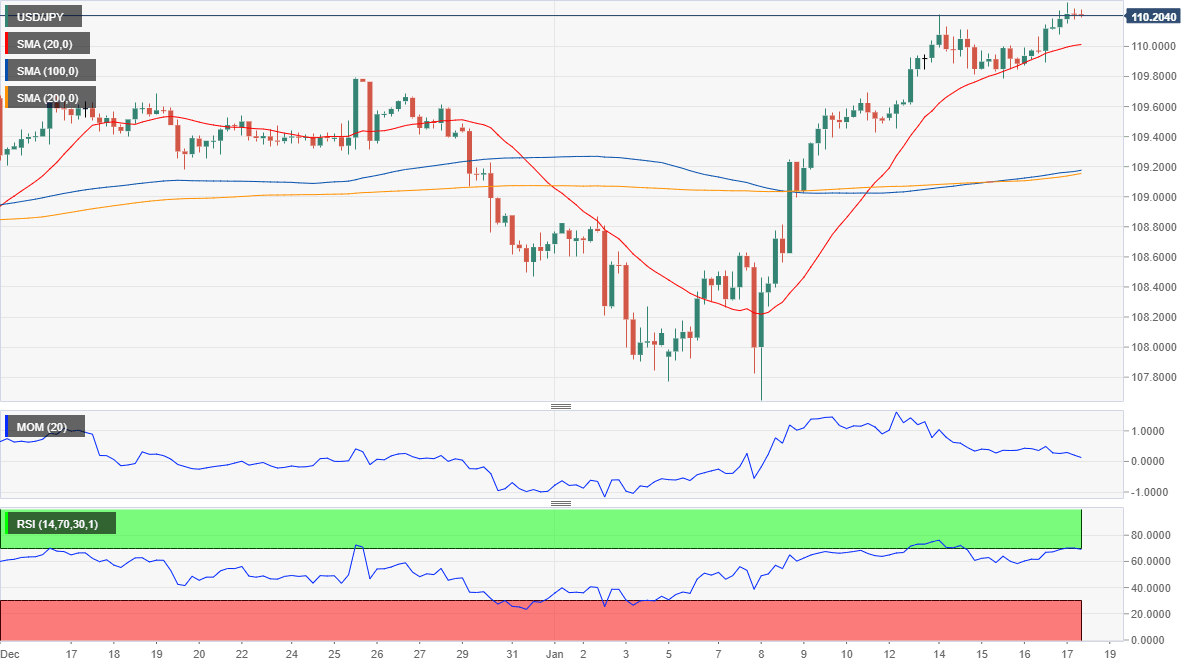

USD/JPY Forecast: Losing bullish momentum but retaining gains

USD/JPY Current price: 110.20

- Chinese encouraging data kept markets in risk-on mode at the beginning of the day.

- The US January Michigan Consumer Sentiment Index is seen at 99.3, matching December figure.

- USD/JPY holding at the upper end of its weekly range could correct lower.

The USD/JPY pair has extended its weekly advance to 110.28 during Asian trading hours, as better-than-expected Chinese data kept the market mood positive, yet not upbeat. The Gross Domestic Product of the world’s second-largest economy met the market’s expectations, increasing by an annualized 6.0% in Q4. Retail Sales and Industrial Production increased by more than anticipated in December, printing at 8.0% and 6.9% respectively.

Japan published the November Tertiary Industry Index, which came in at 1.3%, worse than the 3.9% expected, although better than the previous -5.2%. Later today, the US will publish December Housing Starts and Building Permits. More relevantly, the country will publish the preliminary estimate of the January Michigan Consumer Sentiment Index, foreseen at 99.3, matching December final reading.

USD/JPY short-term technical outlook

The USD/JPY is trading at around 111.20, holding at the upper end of its weekly range. The short-term picture is neutral-to-bullish, as, in the 4-hour chart, technical indicators hold above their midlines, although lacking directional strength. The pair continues developing above its 20 SMA, which has lost its bullish slope and now stands flat at around 110.00, providing immediate support. The pair, however, would need to break below the next support at 109.70, to turn bearish ahead of the weekly close.

Support levels: 110.00 109.70 109.35

Resistance levels: 110.40 110.75 111.05

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.