USD/JPY forecast: Is USD/JPY ready to re-test, or a pullback ahead?

- USD/JPY rebounds strongly from the 154.60 manipulation zone, reclaiming short-term bullish structure ahead of key macro catalysts.

- Rate-cut expectations in the U.S. and BOJ’s delayed hawkish shift continue to create a tug-of-war in the pair.

- 156.18 and 157.89 remain the critical levels that decide whether USD/JPY retests its 52-week high at 158.88 — or rotates into a deeper correction.

USD/JPY attempts a recovery — But is the trend strong enough to break 158 again?

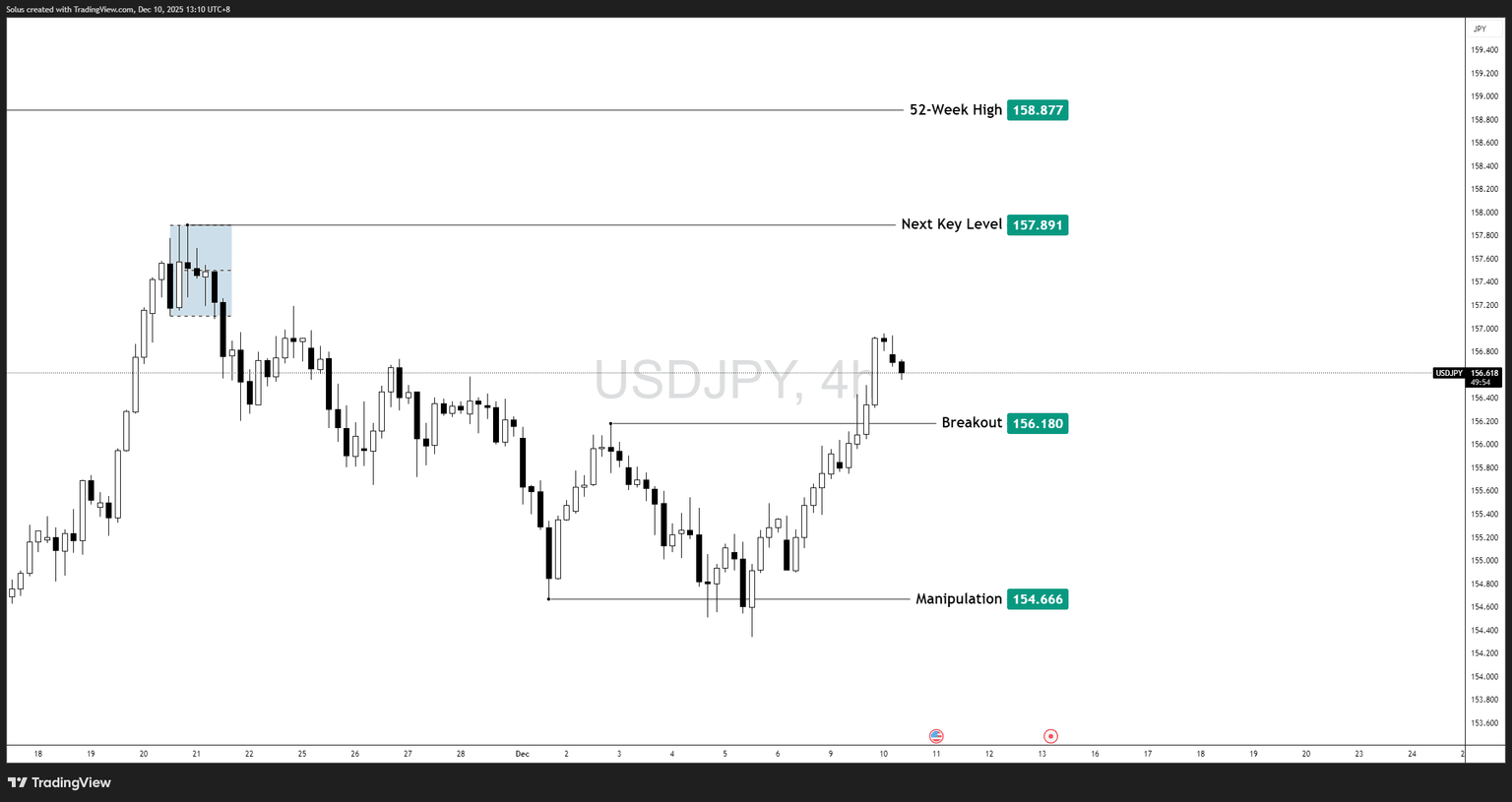

USD/JPY has bounced impressively after tapping into the 154.66 manipulation zone, a level where liquidity was engineered before the latest rally. The recovery pushed price back above the 156.18 breakout level, signaling a short-term bullish continuation—but the bigger question remains:

Is USD/JPY gearing up for another run at 158.80, or is this just a retracement before another wave lower?

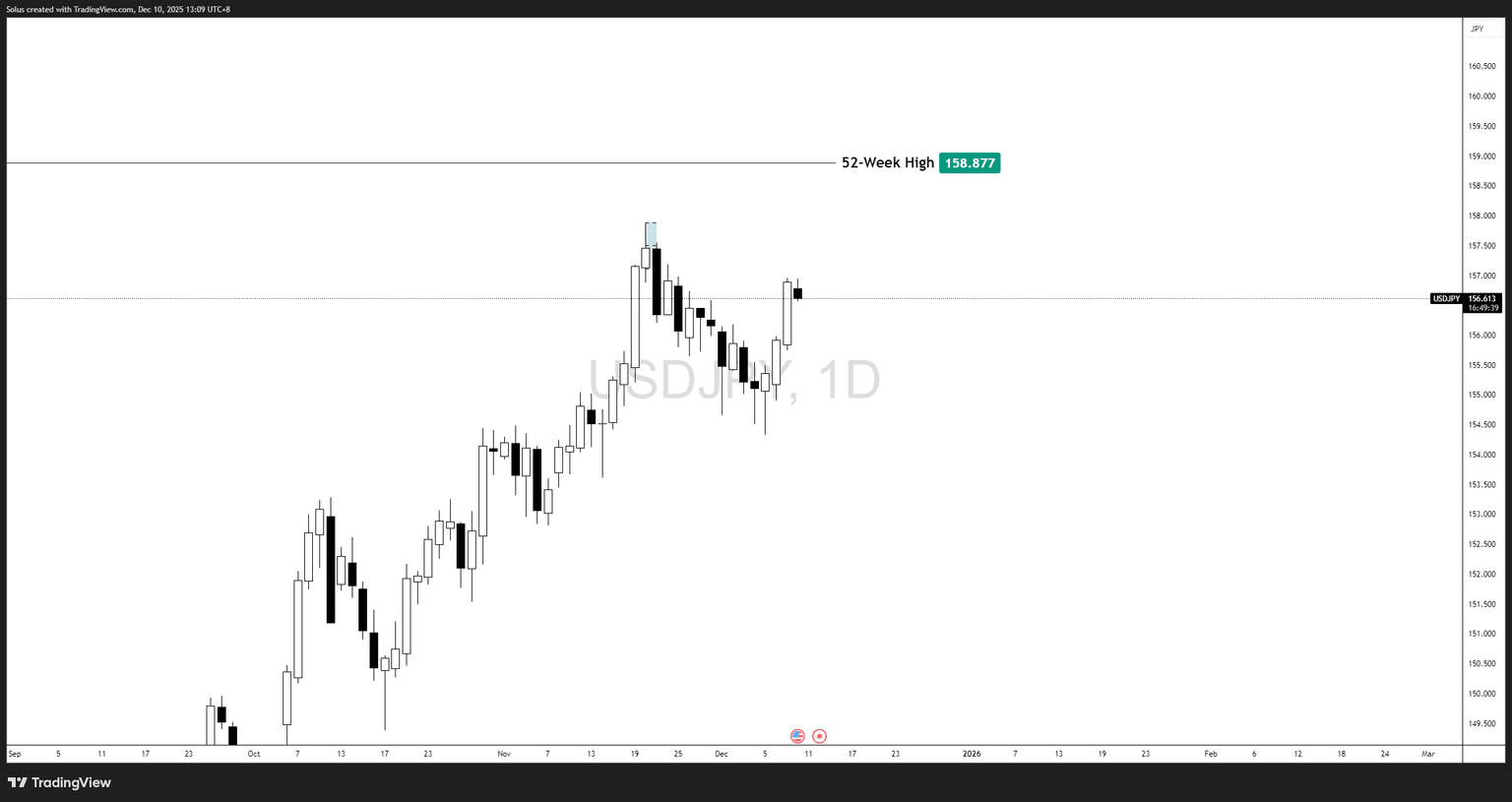

The daily chart shows a clean reaction after the November sell-off, but price remains below the major swing high at 158.877, which represents the 52-week high and a key psychological barrier where the BOJ previously intervened.

This makes the current zone extremely important:

Breakout = momentum continuation. Rejection = macro-driven pullback.

Fundamental tailwinds and headwinds: USD strength vs BoJ uncertainty

1. Fed Rate-Cut Expectations Are Pressuring USD — but Not Enough to Flip the Trend

The market is now pricing a December rate cut, which typically weakens USD.

Yet USD/JPY remains elevated because:

- The Fed cutting slowly is still USD-supportive

- Japanese yields remain near zero

- No BOJ tightening is visible yet

This creates a scenario where USD can weaken, but JPY still cannot strengthen meaningfully.

2. BOJ Hawkish expectations keep volatility high

Traders continue to speculate that the Bank of Japan may normalize policy in 2026 — but officials remain silent.

This uncertainty creates the sharp swings we see on the 4H chart.

3. Risk sentiment also matters

As global indices push higher, USD/JPY often rises with them.

If markets turn risk-off, USD/JPY becomes vulnerable to a sudden unwinding.

Why 156–158 is such a critical zone

Recent U.S. data (NFP, CPI components, ISM employment) has softened the USD outlook but not enough to reverse the broader trend.

At the same time:

- BOJ refuses to commit to rate hikes

- Yen intervention threats remain verbal only

- FX markets expect BOJ action only if USD/JPY spikes dramatically

This leaves USD/JPY in a delicate balance where one strong U.S. data release could lift price back to 158+, but one weak print could trigger a fast drop back to 154.

Technical outlook

USD/JPY is currently pulling back after rejecting near 157, but the structure remains bullish above 156.18.

The next major upside magnet is:

- 157.891 (Next Key Level).

- 158.877 (52-Week High).

Daily order flow suggests buyers still control momentum as long as the 154.66 zone remains intact.

The 4H shows the cleanest roadmap:

- 154.666 → manipulation and liquidity sweep.

- 156.180 → the breakout and key structural level.

- 157.891 → next upside objective.

The current pullback is normal as long as price stays above 156.18.

Failure to hold above this level would shift momentum.

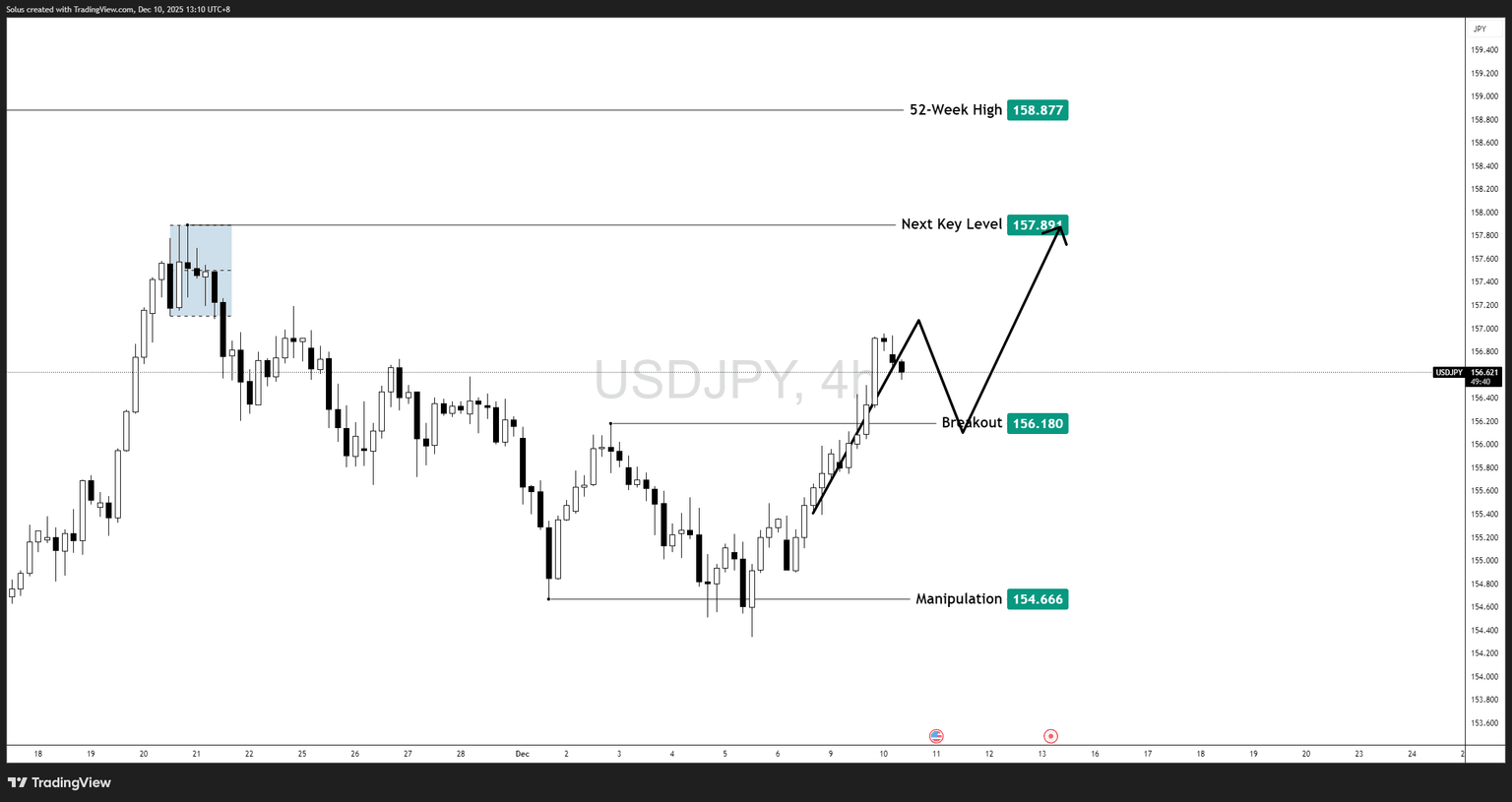

Bullish scenario: Breakout toward 158.88

The bullish case strengthens if:

- USD/JPY holds above 156.18

- Generates a higher low on the 4H

- Breaks through 157.891

If these align, price can extend toward:

- 158.877 (52-Week High)

- 159.20 – 159.50 liquidity pockets

This scenario aligns with Fed caution + BOJ hesitation.

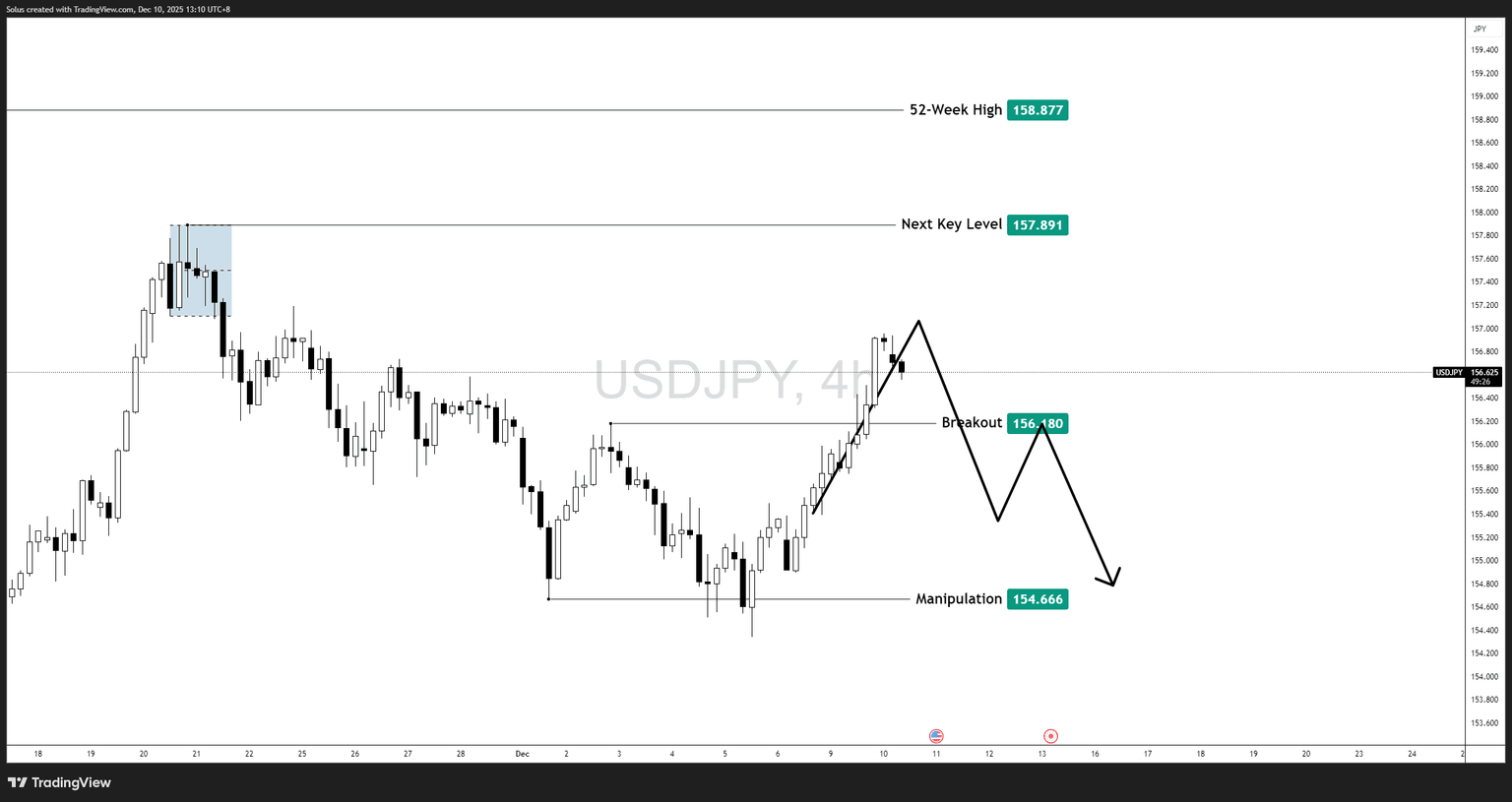

Bearish scenario: Failed retest and rotation lower

USD/JPY becomes vulnerable if:

- Price rejects 157.891.

- Drops back below 156.18.

- Breaks internal lows toward 155.00 – 154.66.

Targets include:

- 155.50 inefficiency fill.

- 154.666 manipulation zone (retest).

This path suggests risk-off sentiment or stronger Japanese commentary.

Final thoughts

USD/JPY is now at a pivotal point.

The pair has the technical structure to retest its 52-week high — but it also sits close to levels where liquidity hunts often begin.

The next move will be decided at 156.18 and 157.89.

Hold above → bullish continuation.

Break below → deeper corrective cycle.

Until price resolves these levels, expect choppy, liquidity-driven moves ideal for tactical setups.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.