USD/JPY forecast: Fair value gap caps recovery, bears eye breakdown

- Main Headline: USD/JPY remains in bearish control in the short term, testing distribution after failing to sustain upside.

- Supplementary Headline: Price is currently battling a key H4 Fair Value Gap resistance zone; rejection here would reinforce downside continuation.

- Technical Forecast: Expect range expansion lower if the H4 Fair Value Gap holds — with a pullback first into ~155.19 then potential drop toward lower structure.

Where price stands

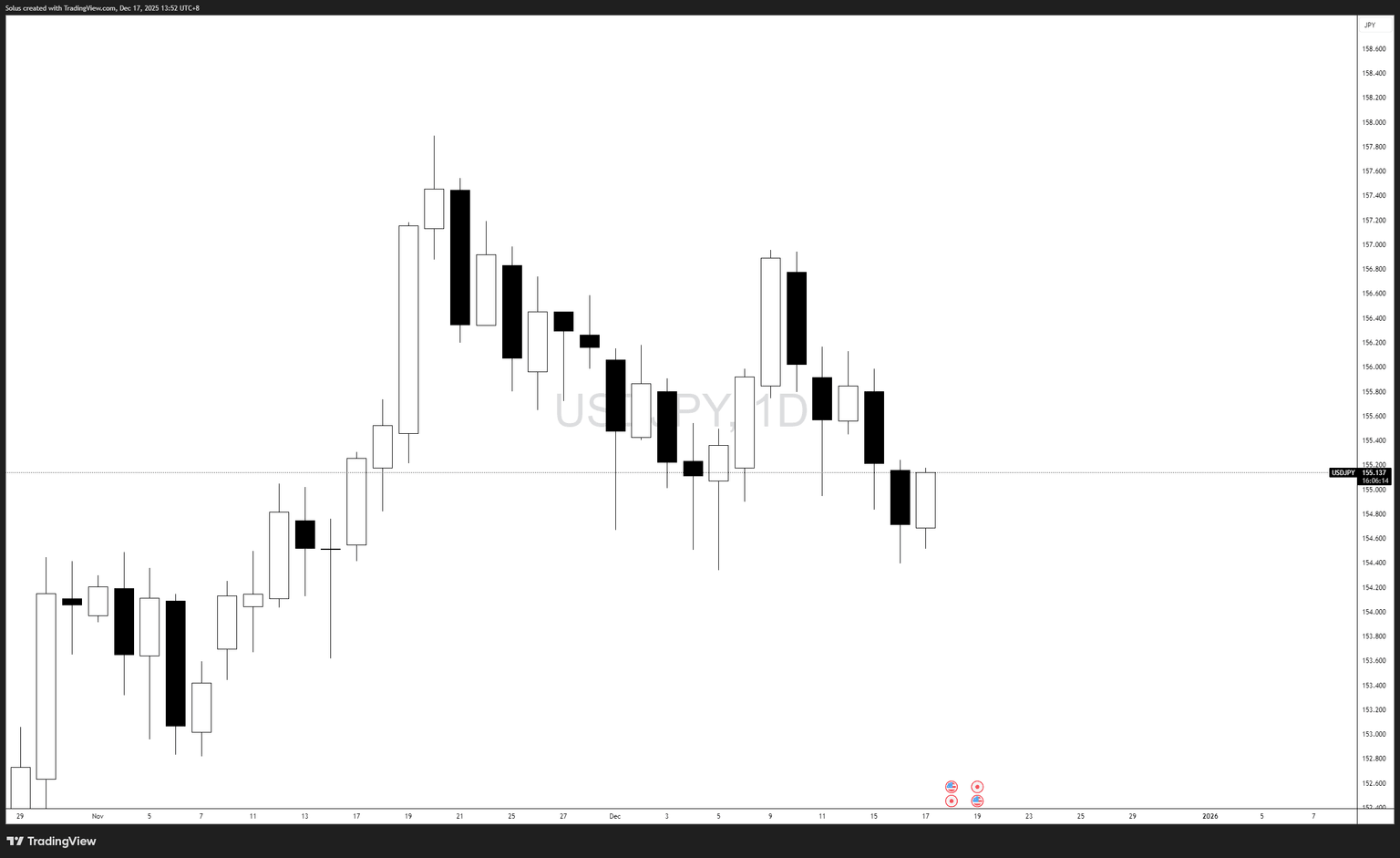

On the daily chart, USD/JPY has been correcting lower from recent highs near the 158 area. Price action shows a series of lower highs and lower lows — a classic pullback within a broader downtrend. The most recent candles show buyers trying to push — but struggling to break back above prior support turned resistance.

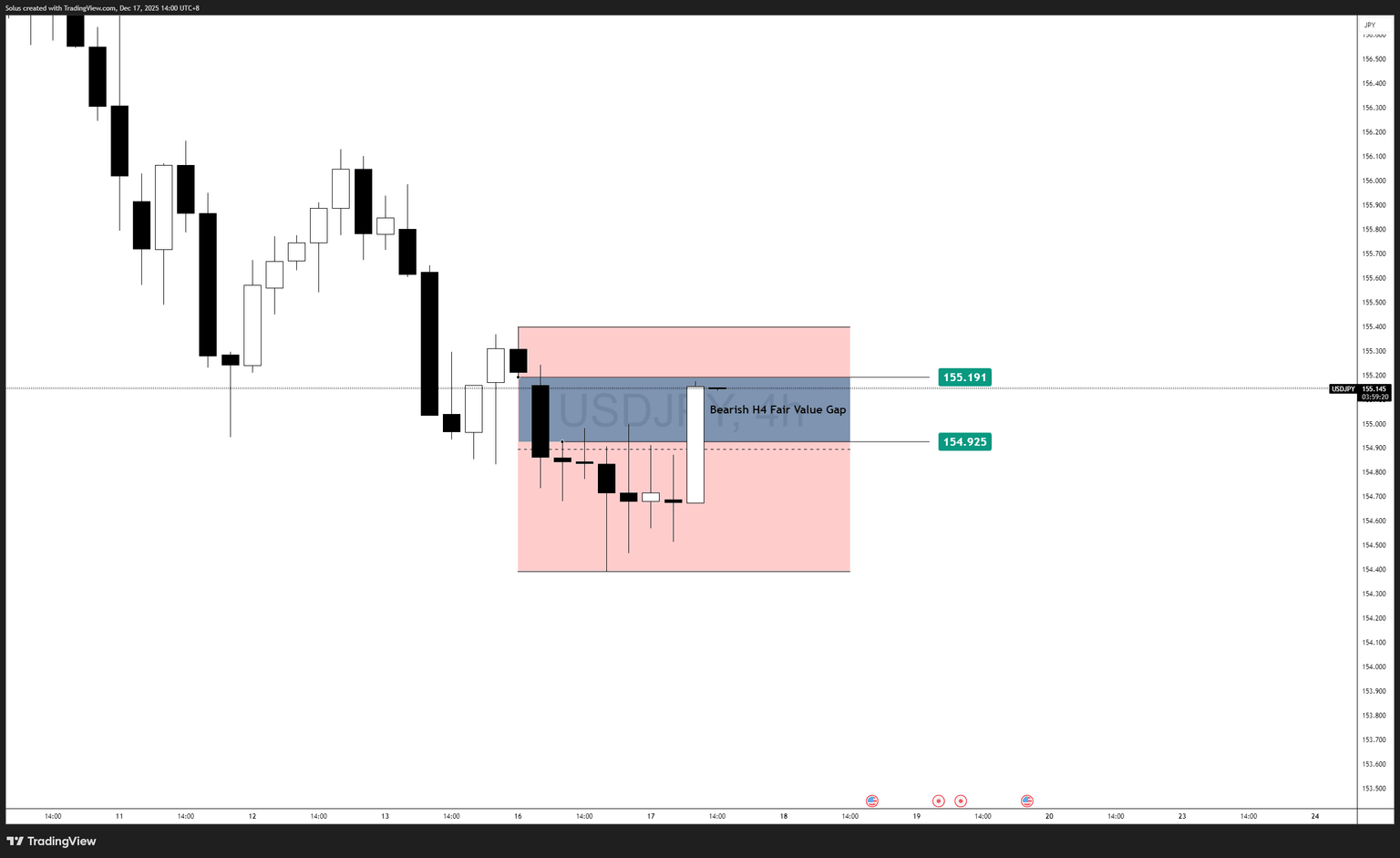

On the H4 timeframe, the key focus is the Fair Value Gap (FVG) marked in blue, sandwiched inside a broader zone (red) that represents distribution. Price has climbed back into that gap area — often a pivot zone where liquidity hunts occur — and is now testing it for either rejection (bearish continuation) or breakout (bullish pullback).

The market’s behavior around this zone will likely dictate the next directional leg:

- If price convincingly rejects the FVG and heads lower: sellers regain control, continuing the downtrend.

- If buyers reclaim above the FVG and break 155.19: a deeper retracement could unfold toward 156+ levels.

With daily structure still bearish and no clear impulsive reversal yet, the preferred bias remains downside continuation until proven otherwise.

What the price action tells us

Daily structure

- Lower highs and lower lows remain intact.

- No confirmed bullish reversal pattern (no higher low + higher high sequence yet).

- Recent daily wick rejection at upper levels shows selling pressure.

Four-hour fair value gap context

- FVGs are often mean reversion magnets and liquidity zones.

- The price has filled back into the gap — a normal retracement within a corrective move.

- How price reacts inside and just above the gap will reveal directional intent.

Technical outlook

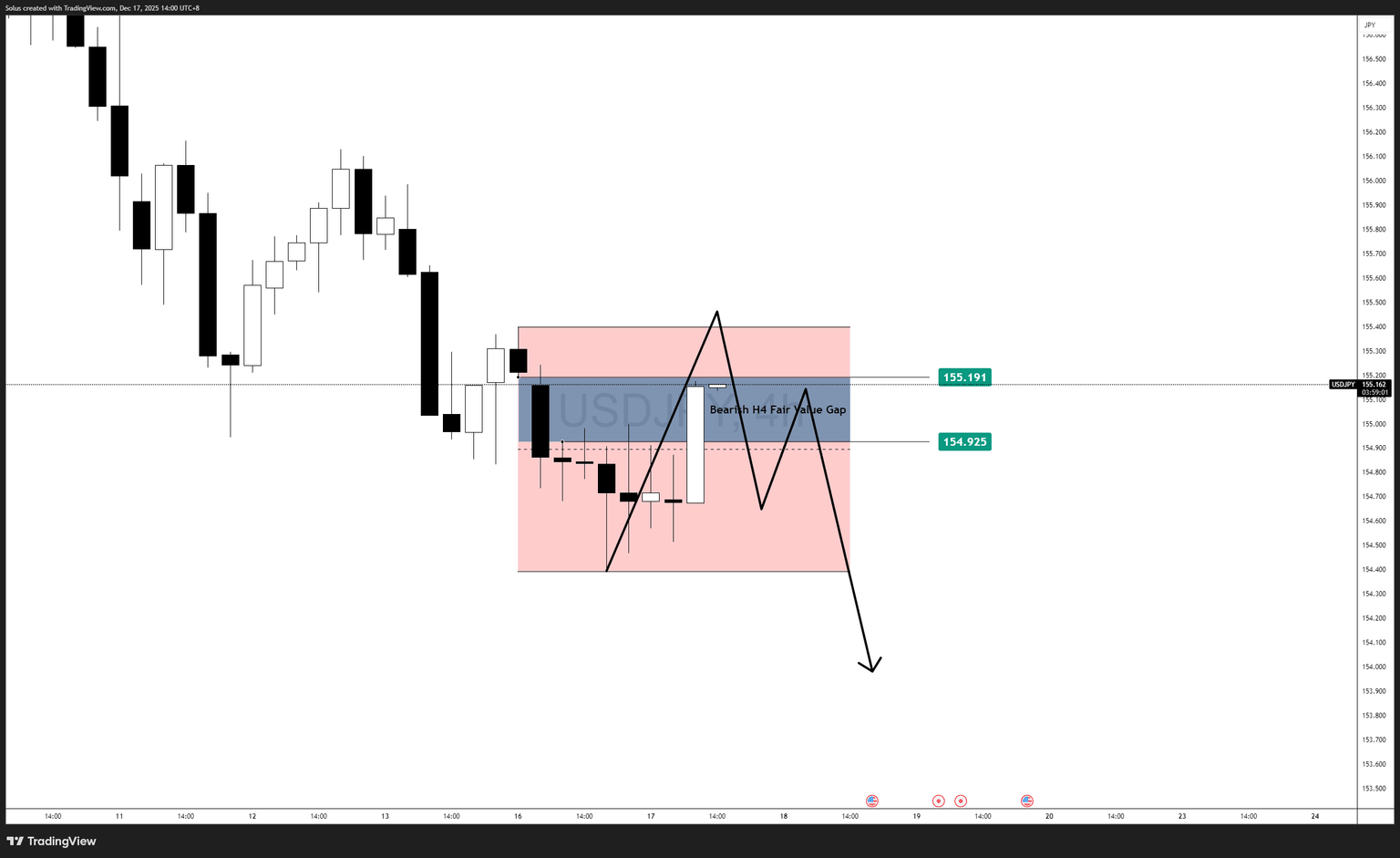

Bearish bias (Primary)

Scenario:

- Price fails to break above ~155.19.

- FVG acts as resistance.

- H4 forms bearish candlestick rejection (long upper wicks, bearish engulfing).

- Sellers push price lower through recent swing lows.

What to look for:

- H4 rejection pattern near upper range of zone.

- Continuation to structure lows near 154.20 → 153.80.

- Momentum pickup on break of minor lows.

Targets on bearish continuation:

- Initial: 154.20 – 153.80

- Extended: 153.50 → 152.80

- Psychological support: 152.00

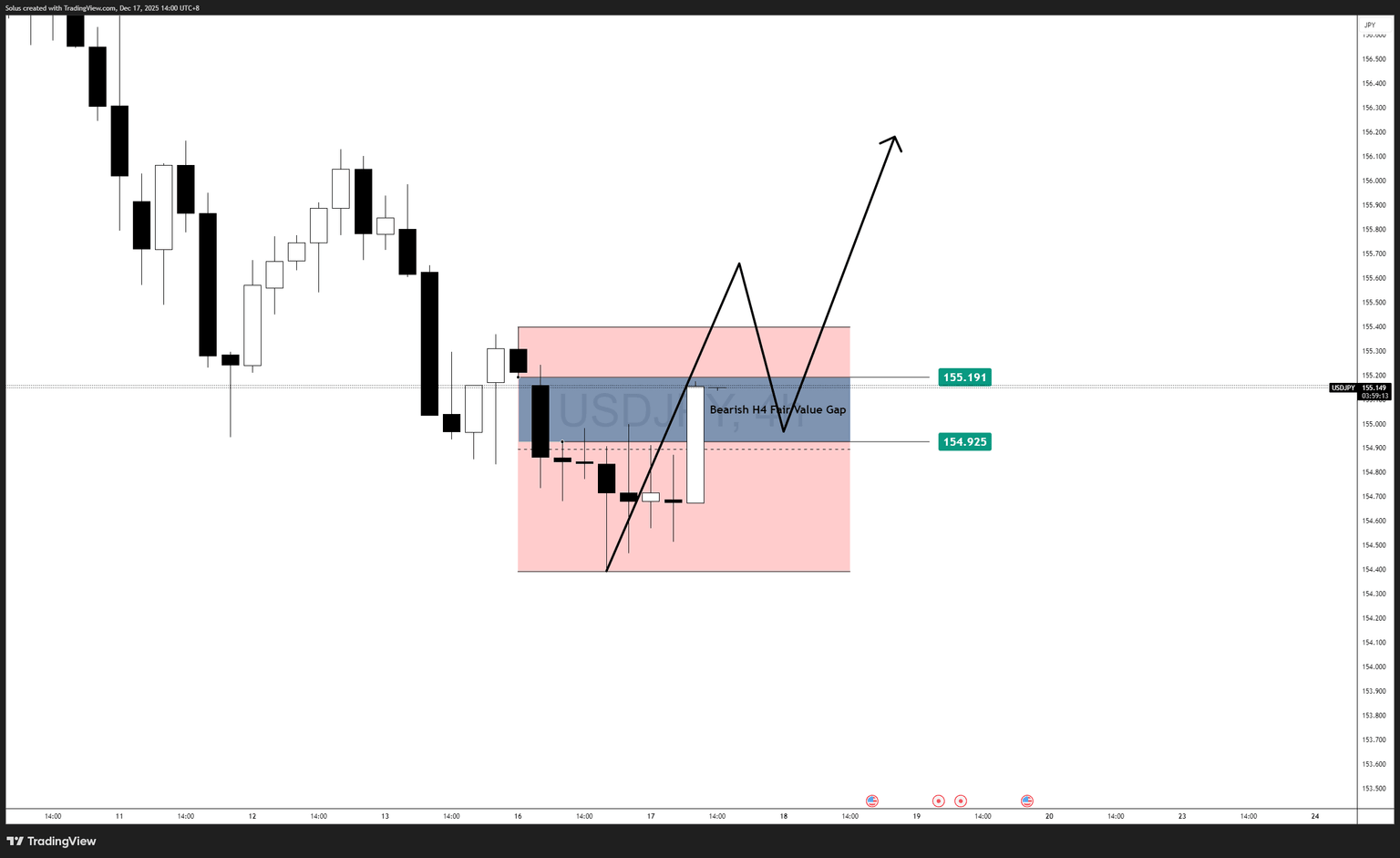

Bullish pullback (Alternative)

Scenario:

- Price breaks above the 155.19 resistance level.

- FVG turns supportive, not resistance.

- Buyers take control back into broader range resistance (155.90+).

Key Triggers:

- Clean H4 breakout above recent highs.

- Subsequent pullback holds above ~155.19 for support.

- H4 higher highs and higher lows begin to form.

Targets on pullback:

- Near-term: 156.00

- Secondary: 156.60 – 157.00

- Bullish invalidation of bearish trend if price breaks prior swing high above 157.20 on daily.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.