USD/JPY Forecast: Consolidation continues

USD/JPY Current Price: 107.57

- Japanese data in-line with expectations, economic contraction extended in May.

- Equities gained some ground, but the market’s mood is extremely cautious.

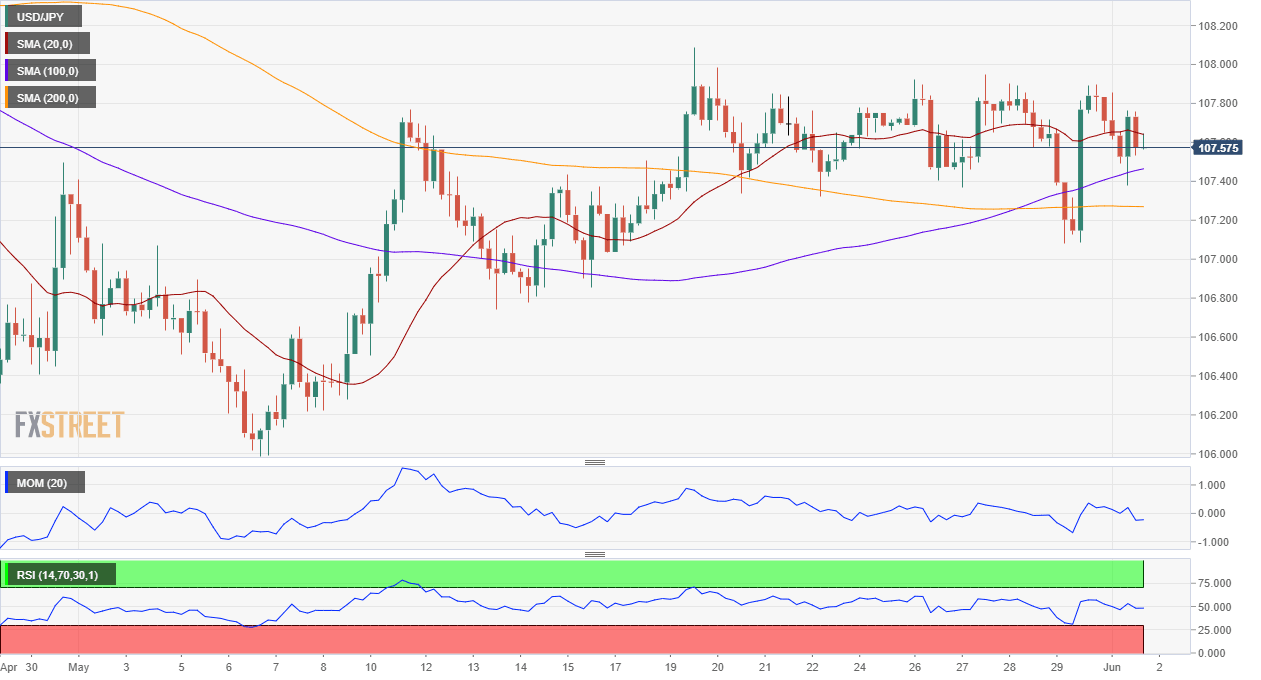

- USD/JPY needs to clearly break either below 106.90 or above 108.10.

The USD/JPY pair closed the day little changed around 107.60, having spent these last few sessions within Friday’s range. The pair fell to 107.37 during Asian trading hours as market players dumped the greenback, later dragged higher but the positive tone of equities. Also, US Treasury yields ticked higher, with the yield on the benchmark 10-year note reaching an intraday high of 0.69% providing support to the pair.

Japanese data released at the beginning of the day was generally positive, as Capital Spending in the first quarter of the year increased by 4.3% much better than the -4.2% expected. The May Jibun Bank Manufacturing PMI was confirmed at 38.2. Early Tuesday, the country will see the release of the May Monetary Base report, foreseen at 2.1% YoY.

USD/JPY short-term technical outlook

The USD/JPY pair continues to lack directional strength, having spent over two weeks around the current level. In its 4-hour chart, it continues to seesaw around moving averages, now struggling with a directionless 20 SMA, but having found support in a bullish 100 SMA, Technical indicators in the meantime, head nowhere around their midlines, failing to provide directional clues. Bears could have some chances on a break below 106.90, while bulls can become more courageous if the pair surpasses 108.10.

Support levels: 107.30 106.90 106.65

Resistance levels: 108.10 108.45 108.80

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.