USD/JPY Forecast: Challenge of 109.00 on the cards

USD/JPY Current price: 109.09

- BOJ Minutes showed no aims to change the ongoing monetary policy.

- US employment-related data takes center stage ahead of the Nonfarm Payrolls report.

- USD/JPY is poised to extend its decline, weighed by softer US Treasury yields.

The USD/JPY pair trades near a daily low of 109.05 as the greenback sheds ground across the FX board. The American currency weakens on the echoes of US Federal Reserve policymakers´ comments, which reaffirmed that inflation spikes would likely be temporary, adding that they will maintain the ultra-loose monetary policy in place until noting clear substantial progress toward the central bank’s goals. US Treasury yields keep retreating, adding pressure on the pair.

The Bank of Japan published the Minutes of its latest meeting, which brought no surprises. The central bank will maintain its quantitative easing, despite some members expressed concerns about its effects on the financial system in the long run. The focus now shifts to US employment data. The country will publish Q1 Challenger Job Cuts and Nonfarm Productivity and Initial Jobless Claims for the week ended April 30, foreseen at 540K.

USD/JPY short-term technical outlook

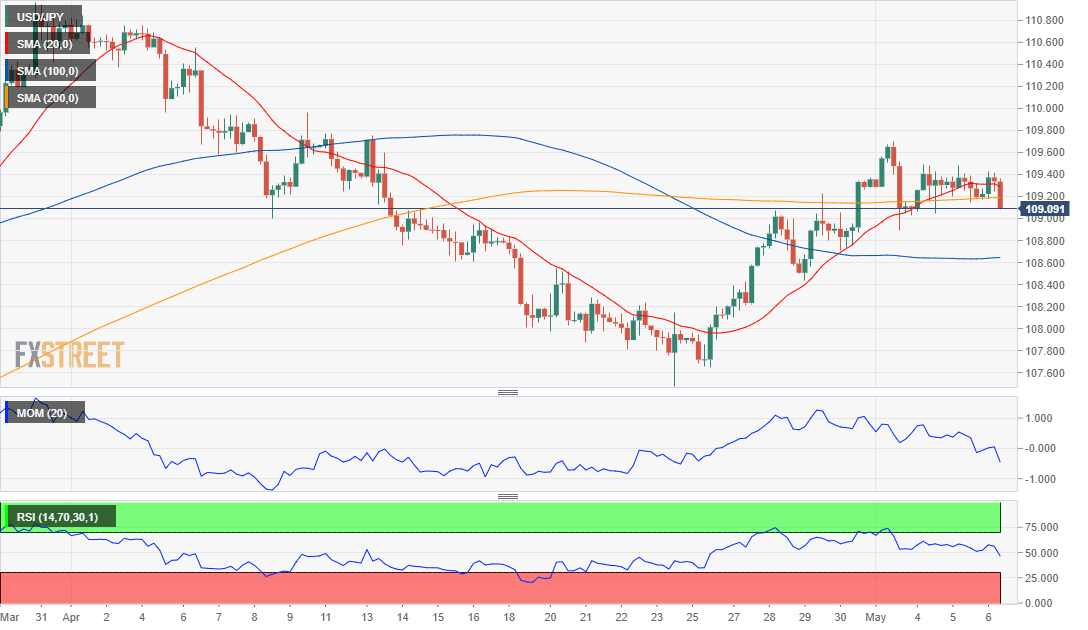

The near-term picture for USD/JPY is bearish, with room for a steeper slide once below the 108.70, the immediate support level. In the 4-hour chart, the pair is accelerating its decline below its 20 and 200 SMA, which anyway lack directional strength. Technical indicators turned sharply lower, gaining bearish momentum within negative levels.

Support levels: 108.70 108.25 107.90

Resistance levels: 109.25 109.70 110.10

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.