USD/JPY Forecast: Buyers side-lined amid weaker government bond yields

USD/JPY Current price: 109.84

- Easing US Treasury yields limited the upside for USD/JPY despite the broad dollar’s weakness.

- The Japanese Leading Economic Index improved to 99.7 in February.

- USD/JPY trades sub-110.00 without signs of an upcoming recovery.

The USD/JPY pair fell to 109.57 as the greenback remained weak, pressured by easing US government bond yields. The yield on the 10-year Treasury note fell intraday to 1.628%, ending the day at around 1.65%. The pair held at the lower end of its daily range after the US Federal Reserve published the Minutes of its latest meeting, which added nothing new to what the market already knew.

Japan published the preliminary estimate of the February Leading Economic Index, which improved from 98.5 to 99.7 but missed the market’s expectations of 100.7. The Coincident Index for the same period contracted from 90.3 to 89. Early on Thursday, the country will publish the February Current Account, March Consumer Confidence and the Eco Watchers Survey on the economy.

USD/JPY short-term technical outlook

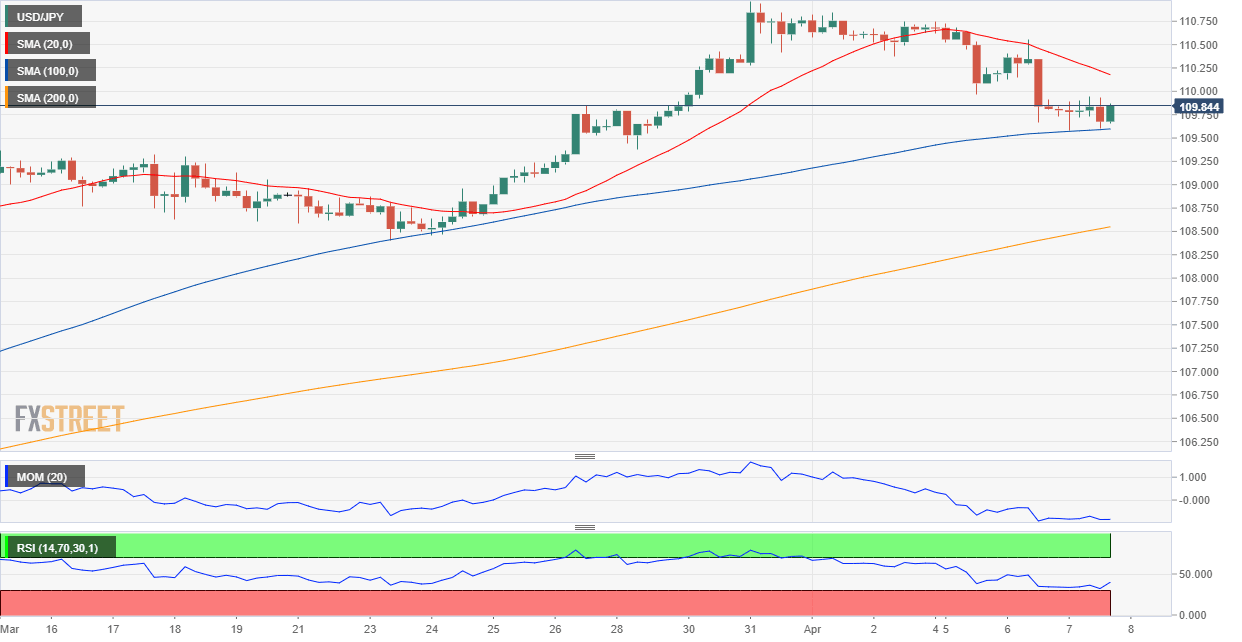

The USD/JPY pair trades in the 109.80 price zone and the 4-hour chart shows that it bounced twice from a directionless 100 SMA, but also that it remains below a firmly bearish 20 SMA. Technical indicators recovered modestly from intraday lows but remain well below their midlines, indicating limited buying interest. The pair now needs to break below 109.50 to confirm another leg south.

Support levels: 109.50 109.15 108.70

Resistance levels: 109.95 110.30 110.65

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.