USD/JPY Forecast: Bulls ready to challenge February’s high

USD/JPY Current price: 106.10

- US Treasury yields hit fresh one-year highs as global indexes advance.

- Japan’s December Leading Economic Index came in at 95.3, better than the 94.9 expected.

- USD/JPY is comfortably trading above 106.00 and poised to move higher.

Risk is on and the dollar fells against its high-yielding rivals but also runs against the JPY. The USD/JPY pair trades in the 106.10 price zone as global indexes advance in the aftermath of the Fed’s Powell testimony. The head of the US Central Bank has made it clear that there’s a long way ahead of an economic comeback, adding that the ultra-loose monetary policy will remain in place for as long as required.

US Treasury yields also advance, reaching fresh one-year highs, although helping the greenback only against safe-haven rivals. Data wise, Japan published the final version of the December Leading Economic Index, which came in at 95.3, better than the 94.9 previously estimated. The Coincident Index for the same month printed at 88.3, better than the 87.8 expected.

The US will release today January Durable Goods Orders, foreseen at 1.1% from 0.5% in the previous month. The calendar will include Initial Jobless Claims for the week ended February 19, foreseen at 838K, and January Pending Home Sales.

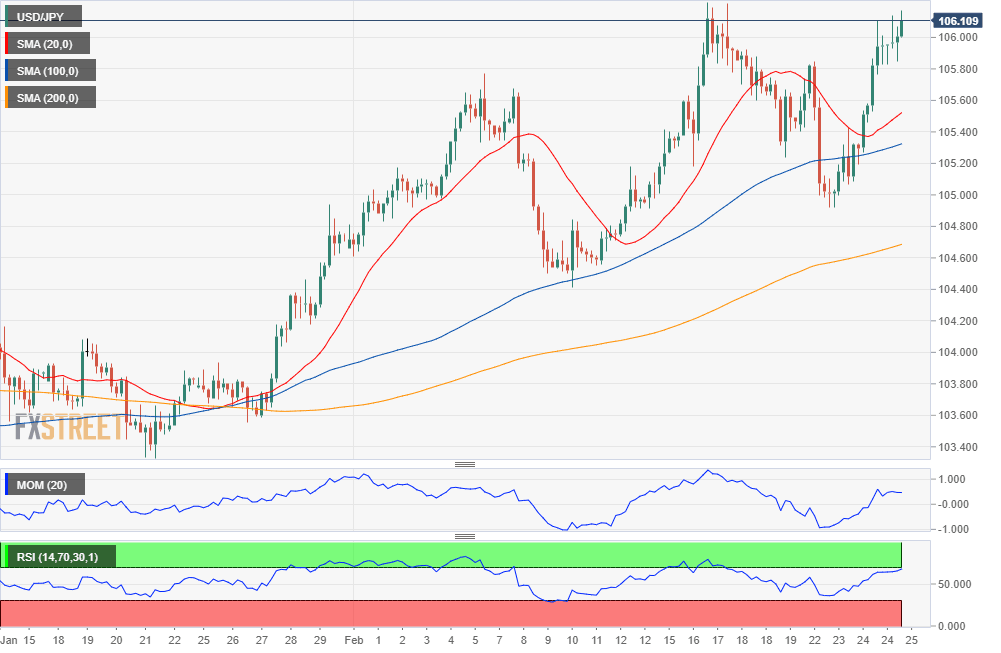

USD/JPY short-term technical outlook

The USD/JPY pair is trading near a 2021 high of 106.22. The near-term picture is bullish, as, in the 4-hour chart, the pair is trading above bullish moving averages. Technical indicators lack directional strength but stand near overbought levels. The pair has been meeting buyers on retracements towards the 105.80 level, the immediate support. As long as the pair holds above it, the risk will remain skewed to the upside.

Support levels: 105.80 105.35 104.90

Resistance levels: 106.25 106.60 106.95

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.