USD/JPY Forecast: Bullish continuation depending on yields’ recovery

USD/JPY Current price: 106.57

- US Treasury yields retreated sharply ahead of the weekly close.

- The persistent dollar’s demand overshadowed falling equities and yields.

- USD/JPY is technically bullish, the next hurdle around 106.95.

The USD/JPY pair reached 106.68 on Friday, a level that was last seen in August 2020, to close the week with gains in the 106.50 price zone. The dollar’s demand overshadowed a sharp decline in US Treasury yields ahead of the weekly close, as the yield on the benchmark 10-year Treasury note settled at 1.40% after peaking earlier in the week at 1.61%, a one-year high.

Japan published February Tokyo inflation data, with the headline figure printing at -0.3% YoY, as expected. The core reading, which excludes fresh food prices, also printed at -0.3% YoY. Industrial Production was up 4.2% MoM in January but contracted 5.3% compared to a year earlier. Finally, Construction Orders were up by 14.1% in January, although Housing Starts decreased by 3.1%. Japan will publish the February Jibun Bank Manufacturing PMI this Monday, previously at 50.6.

USD/JPY short-term technical outlook

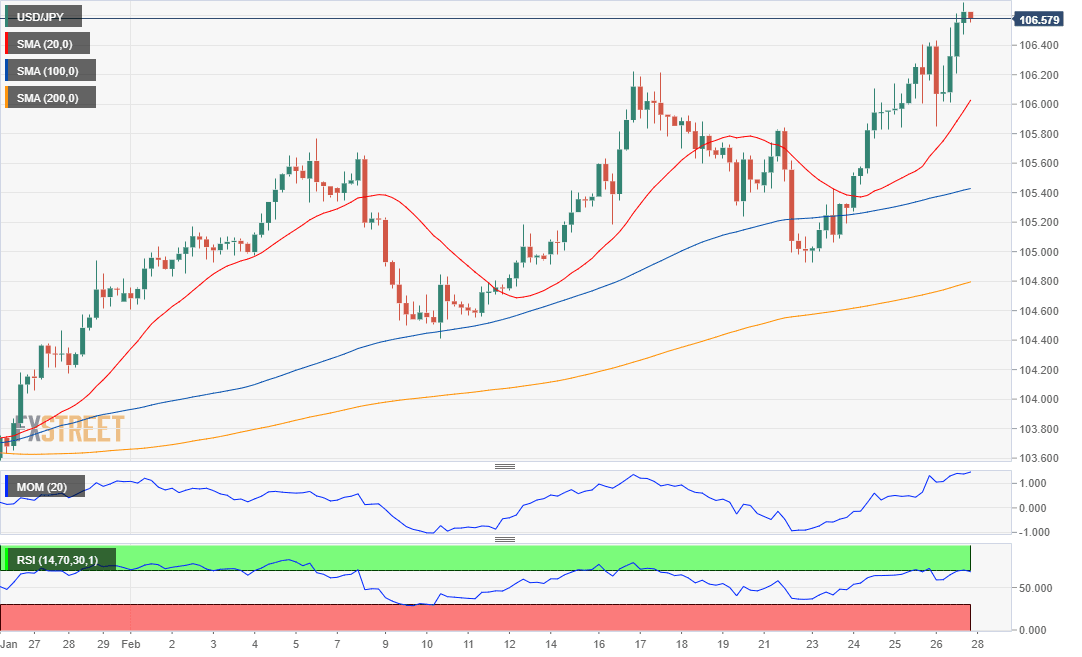

The USD/JPY pair is bullish, according to the daily chart, as technical indicators maintain their momentum upwards near overbought readings, as the pair develops above all of its moving averages. The 20 SMA has largely surpassed the 100 SMA and is about to cross above the 200 SMA. In the 4-hour chart, technical indicators retreat from overbought readings but hold well above their midlines, while the pair stands well above bullish moving averages. Further gains are likely, mainly if US government bond yields resume their advance.

Support levels: 106.20 105.75 105.30

Resistance levels: 106.95 107.20 107.60

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.