USD/JPY Forecast: Back south ahead of US data

USD/JPY Current price: 107.02

- Downbeat Chinese data weighed on the market’s mood during Asian trading hours.

- US Retail Sales, Industrial Production, and Consumer Sentiment coming next.

- The USD/JPY pair struggles to retain the 107.00 level, could accelerate its decline.

The USD/JPY pair eased from a daily high of 107.43, as demand for the greenback receded, now trading just above the 107.00 level. Downbeat Chinese data released during the Asian session weighed on the market’s mood, with local share market’s trading with a soft tone. Still, European indexes are up and government yields stable, limiting the dollar’s decline.

Japan published the April Producer Price Index, which was down in the month by 1.5%. The annual reading came in at -2.3%, worse than anticipated. The US session will be quite interesting, as the country will publish April Retail Sales, seen down by 8.6% in the month. Industrial Production in the same month is foreseen at -11.4%. Finally, it will also publish the preliminary estimate of the Michigan Consumer Sentiment Index for May, expected at 68 from 71.8.

USD/JPY short-term technical outlook

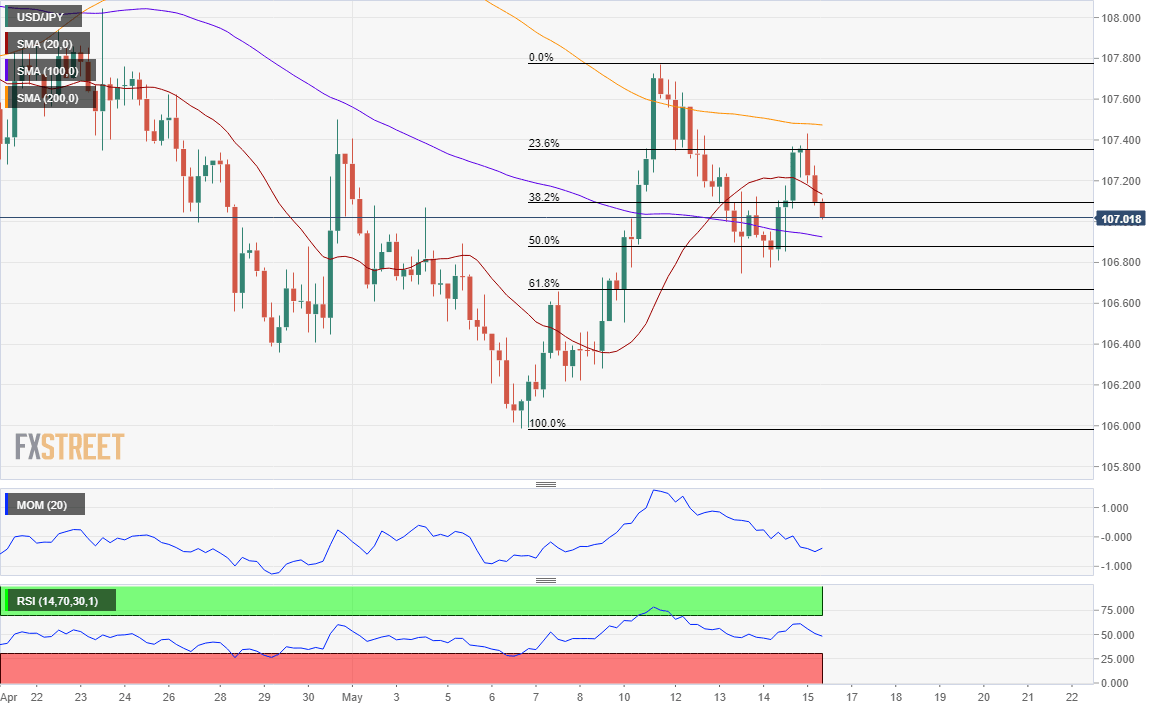

The USD/JPY is neutral-to-bearish in the short-term, hovering around the 38.2% retracement of its latest daily advance. The 4-hour chart shows that the pair is trading between bearish moving averages, while technical indicators have turned lower after failing to overcome their midlines. The 106.65 level is the immediate support, as it stands for the 61.8% retracement of the mentioned advance.

Support levels: 106.65 106.30 106.00

Resistance levels: 107.30 107.70 108.00

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.