USD/JPY Forecast: A bullish continuation likely on a better market mood

USD/JPY Current price: 110.27

- The yield on the US 10-year Treasury yield jumped to 1.30%.

- The Japanese Trade Balance posted a surplus of ¥383.2 billion, missing expectations.

- USD/JPY has room to extend its advance once above the 110.45 resistance.

The USD/JPY pair advanced to 110.38, its highest for the week, underpinned by soaring government bond yields and equities, which posted substantial gains in the European and American sessions. Meanwhile, the yield on the 10-year US Treasury note topped 1.30% after plummeting to 1.124% on Monday, a multi-month low.

On the data front, Japan published the June Merchandise Trade Balance Total, which posted a surplus of ¥383.2 billion, missing expectations. However, exports were up 48.6% while imports increased by 32.7%. much better than anticipated. The country won’t publish macroeconomic data on Thursday, as local markets will be closed amid the celebration on Marine Day.

USD/JPY short-term technical outlook

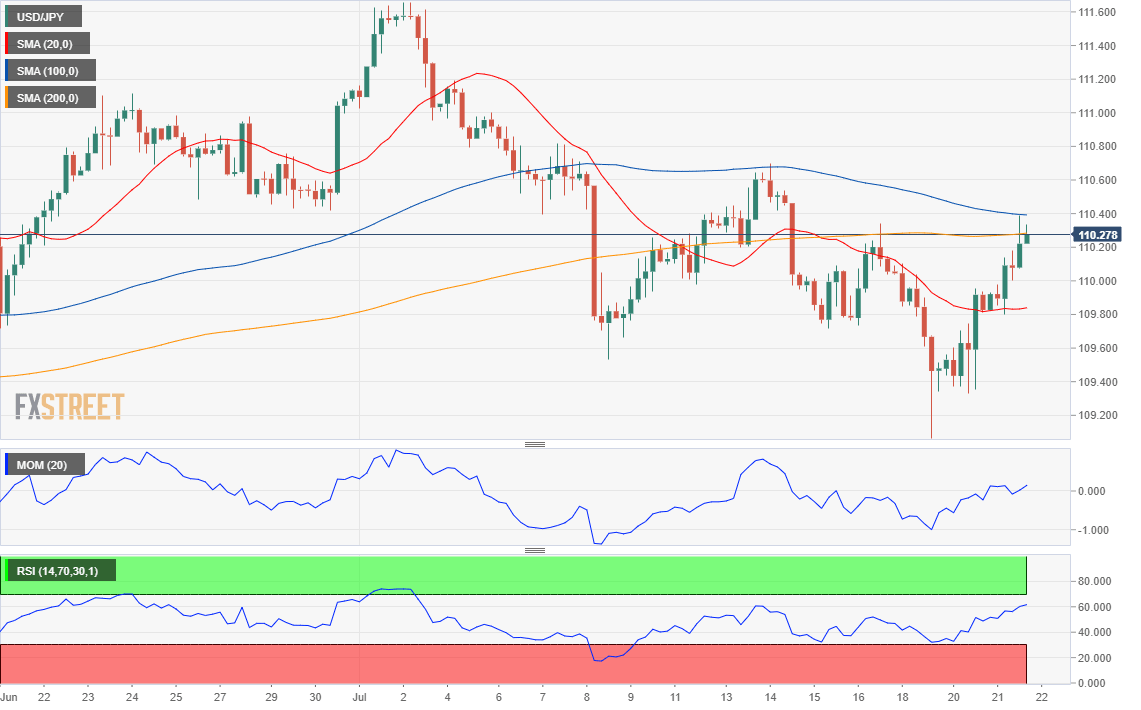

The USD/JPY pair is technically bullish but holding below a critical resistance area. The 4-hour chart shows that the pair met buyers around a directionless 20 SMA but was unable to extend gains beyond the 100 SMA, which is also flat. The Momentum indicator heads firmly higher near overbought readings, while the RSI consolidates gains around 61. The pair would need to break above 110.45 to sustain the bullish potential and recover towards the 111.00 region.

Support levels: 109.80 109.40 109.05

Resistance levels: 110.45 110.90 111.25

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.