USD/JPY forecast: 200+ pips surge – Key levels and scenarios to watch [Video]

- USD/JPY surged over 200 pips after perfectly respecting the 4-hour Fair Value Gap (FVG) at 147.50–147.60 and triggering a clean M15 confirmation entry.

- The Fed’s pause on rate cuts, coupled with a still-cautious BOJ, reinforced dollar strength and provided the macro tailwind for the move.

- Price is now anchored at a new 4-hour FVG (148.173–148.828) as the market awaits NFP, which could trigger the next leg toward 151.20–151.50 or break lower into deeper retracement zones.

![USD/JPY forecast: 200+ pips surge – Key levels and scenarios to watch [Video]](https://editorial.fxsstatic.com/images/i/currency-jpy_XtraLarge.jpg)

USD/JPY surges 200+ pips

This week’s USD/JPY price action perfectly validated the top-down approach we discussed during the webinar. Check the video below for reference:

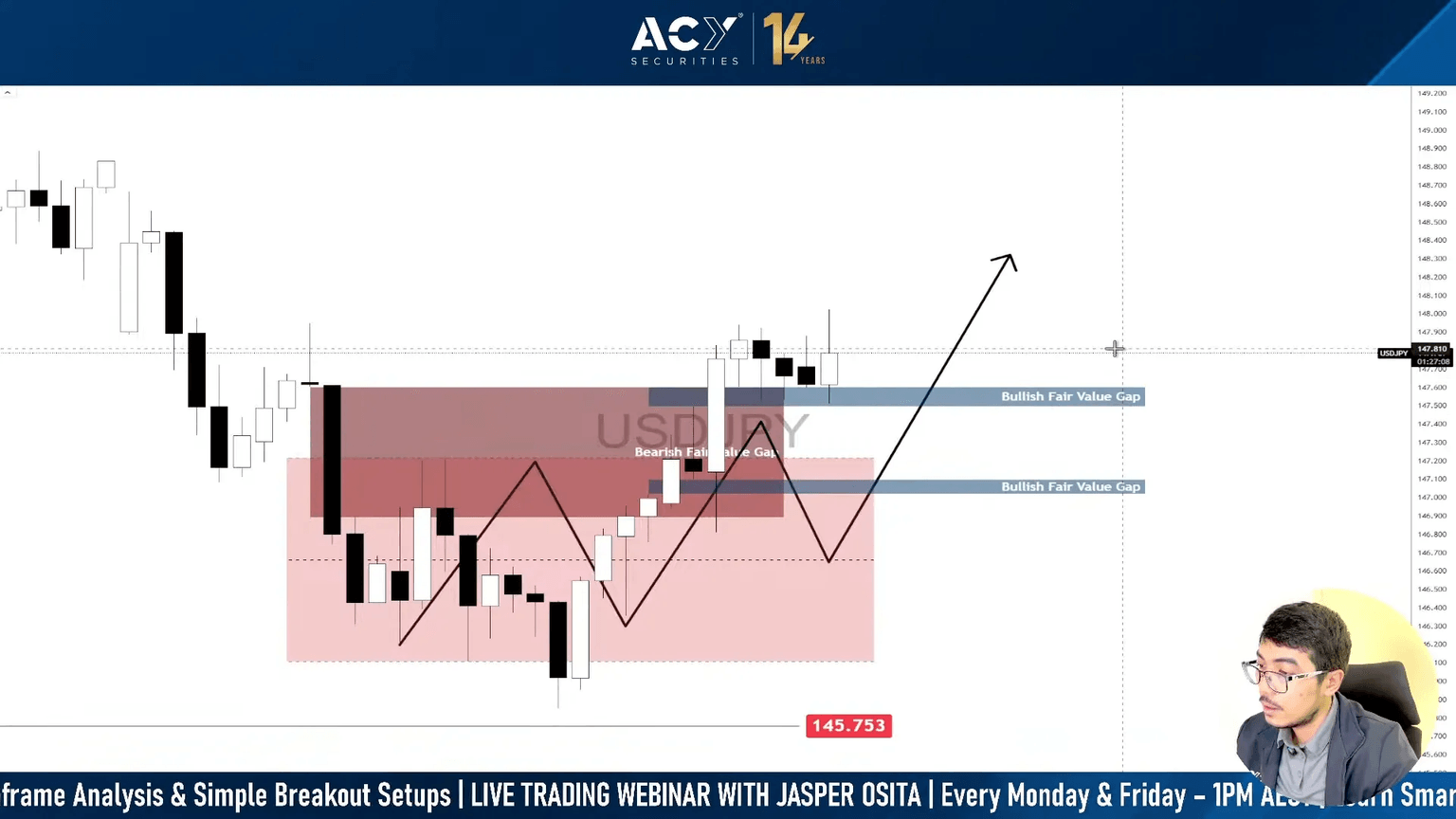

We began our analysis on the 4-hour chart, identifying a key Bullish Fair Value Gap (FVG) around the 147.50–147.60 zone. With the 4-hour timeframe providing the directional bias, we then dropped down to the 15-minute chart to refine our entry.

The plan was straightforward:

- Wait for price to retrace into the 4-hour Bullish FVG.

- Use the M15 chart to identify a confirmation trigger before entry.

- Target the next liquidity cluster above 149.00.

What followed was a textbook Smart Money Concepts execution:

- Price retraced into the 61.8–78.6% Fibonacci confluence and the 4-hour FVG (chart reference).

- On the M15 chart, a bullish engulfing candle formed right at the zone, validating the setup.

- USD/JPY then surged higher, clearing intermediate highs and tagging 149.19, exactly in line with our higher-timeframe targets.

This is the power of starting with a strong anchor timeframe and only dropping lower to fine-tune the entry.

What’s moved the USD/JPY?

The macro backdrop added conviction to our bullish bias:

- Fed’s pause strengthens the dollar: As highlighted in the webinar, the Federal Reserve’s decision to pause further rate cuts was net positive for the U.S. dollar. With no additional liquidity entering the market, dollar demand firmed up, pushing USD/JPY higher.

- BOJ’s subtle shift not enough: Although the Bank of Japan kept rates at 0.5% and raised inflation forecasts, the divergence with the Fed still favored the dollar. The market interpreted the BOJ’s stance as cautious, not aggressively hawkish.

- Fading risk-off events: Initial safe-haven yen buying on tsunami alerts from the Kamchatka earthquake quickly reversed as fears subsided, allowing the broader bullish narrative to dominate.

- Positive trade sentiment: Improved U.S.–Japan trade outlooks further reinforced dollar demand and risk-on sentiment.

Technical outlook

USD/JPY is currently testing the newly created 4-hour Fair Value Gap (FVG) zone at 148.173–148.828, which remains the key support area in the short term. Price has already respected this zone once, and it is now serving as a base for the next potential leg higher.

Bullish scenario: Continuation from the FVG

If price holds its ground at the 4-hour Fair Value Gap (FVG) zone at 148.173–148.828, and price uses this area as a launchpad for the next upward leg. This scenario aligns with the existing bullish structure and broader dollar strength.

- A confirmed rejection from the FVG with a strong bullish candle closing above 149.00 would validate upside continuation.

Targets:

- First target: 151.20, which aligns with prior higher timeframe liquidity.

- Extended target: 151.50, a major psychological and liquidity level.

Bearish scenario: Breakdown of FVG support

If buyers fail to hold the 4-hour FVG zone, it would signal a potential shift in short-term sentiment. Price breaking below 148.00 could trigger a deeper retracement, erasing the recent bullish momentum.

- A decisive 4-hour or daily candle close below 148.00 would confirm breakdown and invalidate the bullish continuation thesis.

Targets:

- First target: 147.50, which is the prior swing low.

- Extended target: 147.00.

Final takeaway

The deciding factor for which scenario plays out on USD/JPY will ultimately come down to the U.S. dollar’s strength or weakness. With the NFP report due tomorrow, another round of volatility is possible, and traders should be prepared for sharp swings as the market reprices expectations.

To stay on the right side of the move, use the same process we followed in the recent setup:

- Anchor your directional bias on the 4-hour chart.

- Drop down to the M15 timeframe for confirmation at the key FVG zone or breakout levels.

- Only act when price provides a clear signal, rather than pre-empting the move.

By aligning higher timeframe structure with lower timeframe confirmation, you avoid being caught in the noise and can execute with conviction when the market shows its hand.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.