USD/JPY: First support at 109.00/108.90

USD/JPY, EUR/JPY, CAD/JPY

USDJPY bottomed exactly at the 100 month MA support at 109.00/108.90.

EURJPY appears to have made a false break above 16 month trend line resistance at 131.40/60 after reversing just pips from the target of 132.40/50.

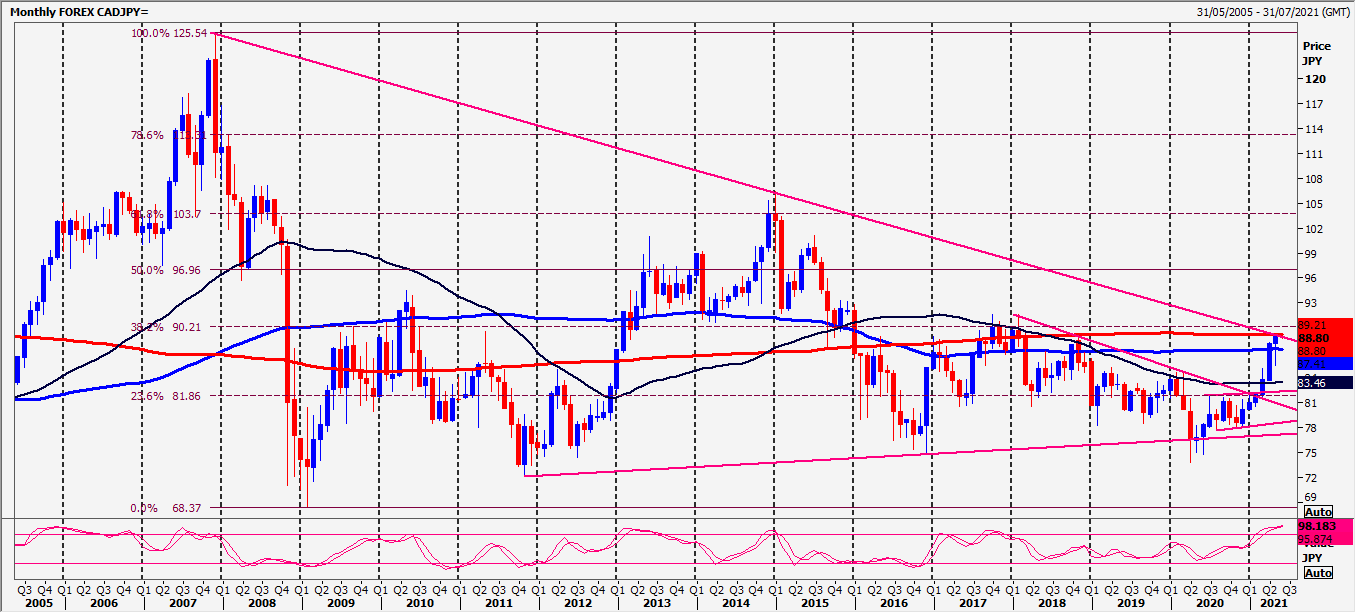

CADJPY meets 14 year trend line resistance at 8910/30. Shorts need stops above 8960.

Daily analysis

USDJPY holding above the 100 month MA support at 109.00/108.90 is more positive for this week targeting 109.60/70 & first resistance at 109.87/92. Above here look for 110.10/20.

First support at 109.00/108.90. Longs need stops below 108.70. A break lower to target 108.40/35.

EURJPY holding 16 month trend line resistance at 131.50/70 is more negative for this week. Below 131.35 targets 131.00/95 with strong support at 130.50/30 this week.

A break above 132.00 allows a retest of key resistance at 132.30/40. Shorts need stops above 132.65. A break higher meets 6 year trend line resistance at 133.05/25. Shorts need stops above 133.55.

CADJPY broke higher for break a buy signal targeting 8860/65 but we run in to important 14 year trend line & 200 month moving average resistance at 8910/30. Shorts need stops above 8960. A break higher can target 14 year 38.2% Fibonacci resistance at 9010/30.

Holding important resistance at 8910/30 targets 8860/50 with first support at 8820/10. A break below 8800 can target 8770/60 with strong support at 8735/15 this week.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk