USD/JPY: Finally, something seems to be stirring, and it is to the downside [Video]

![USD/JPY: Finally, something seems to be stirring, and it is to the downside [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/japanese-currency-1-000-yen-bank-notes-60861026_XtraLarge.jpg)

USD/JPY

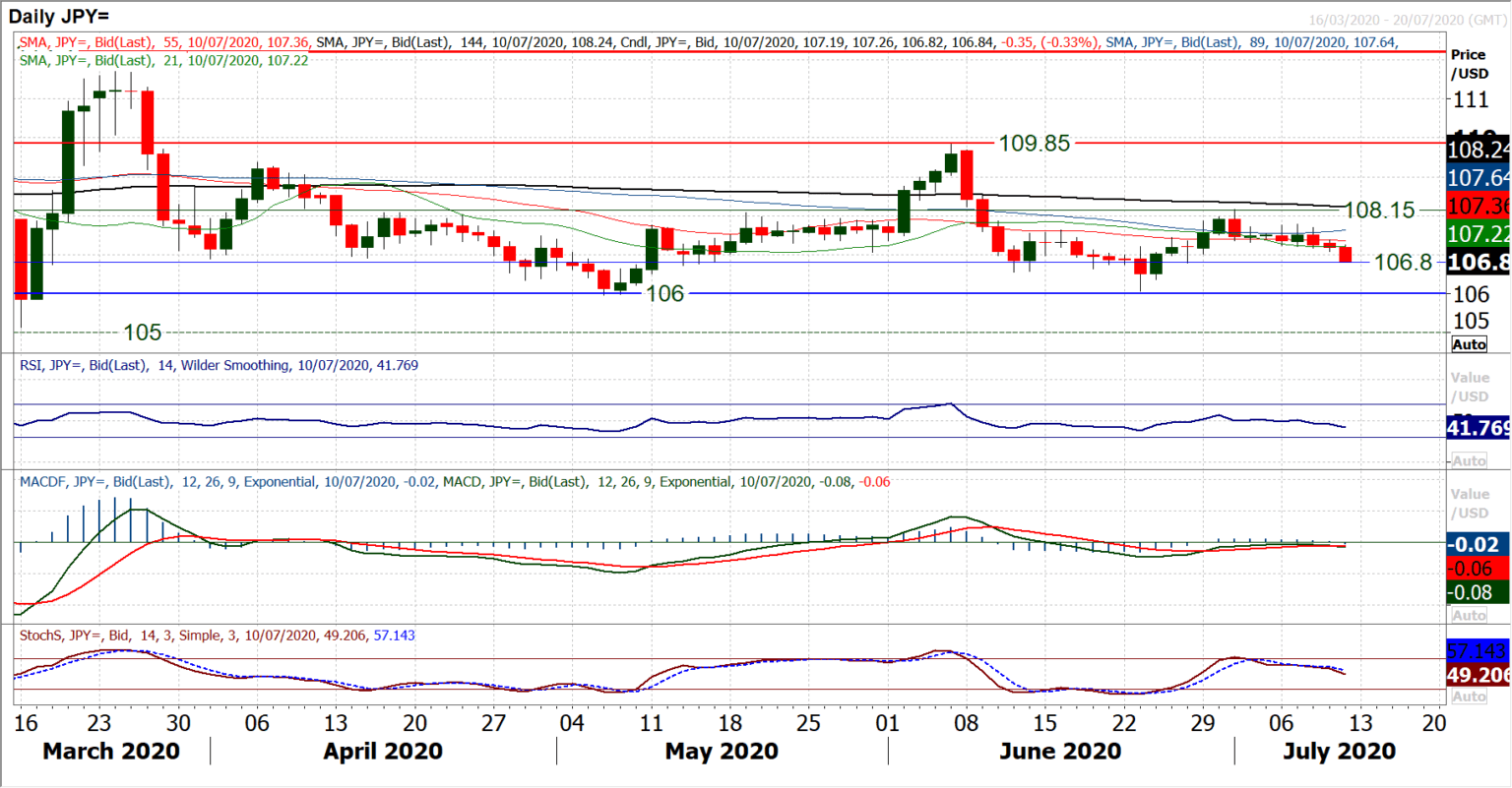

After about a week of trading where Dollar/Yen was looking for direction, finally something seems to be stirring, and it is to the downside. With Treasury yields beginning to threaten lower, it is notable that Dollar/Yen is also beginning to slide. Technically, we see a run of negative candles beginning to develop, with two negative closes in a row and a move lower early today. Near term support at 107.20 has been broken and negative momentum is being generated. MACD lines are now ticking lower, whilst daily RSI falls away along with Stochastics. This is growing further today as the market moves to test 106.80 support. A closing breach of 106.80 would once more open the key medium term range lows around 106.00. The hourly chart momentum signals are now taking on a growing negative configuration, with hourly RSI consistently now failing at 50 and pressurising 30 as intraday rallies are now failing at lower levels. Initial resistance is beginning to develop between 107.20/107.40.

Author

Richard Perry

Independent Analyst