USD/JPY: Bulls have been unable to get any real progress going in a recovery [Video]

![USD/JPY: Bulls have been unable to get any real progress going in a recovery [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/usdjpy_XtraLarge.jpg)

USD/JPY

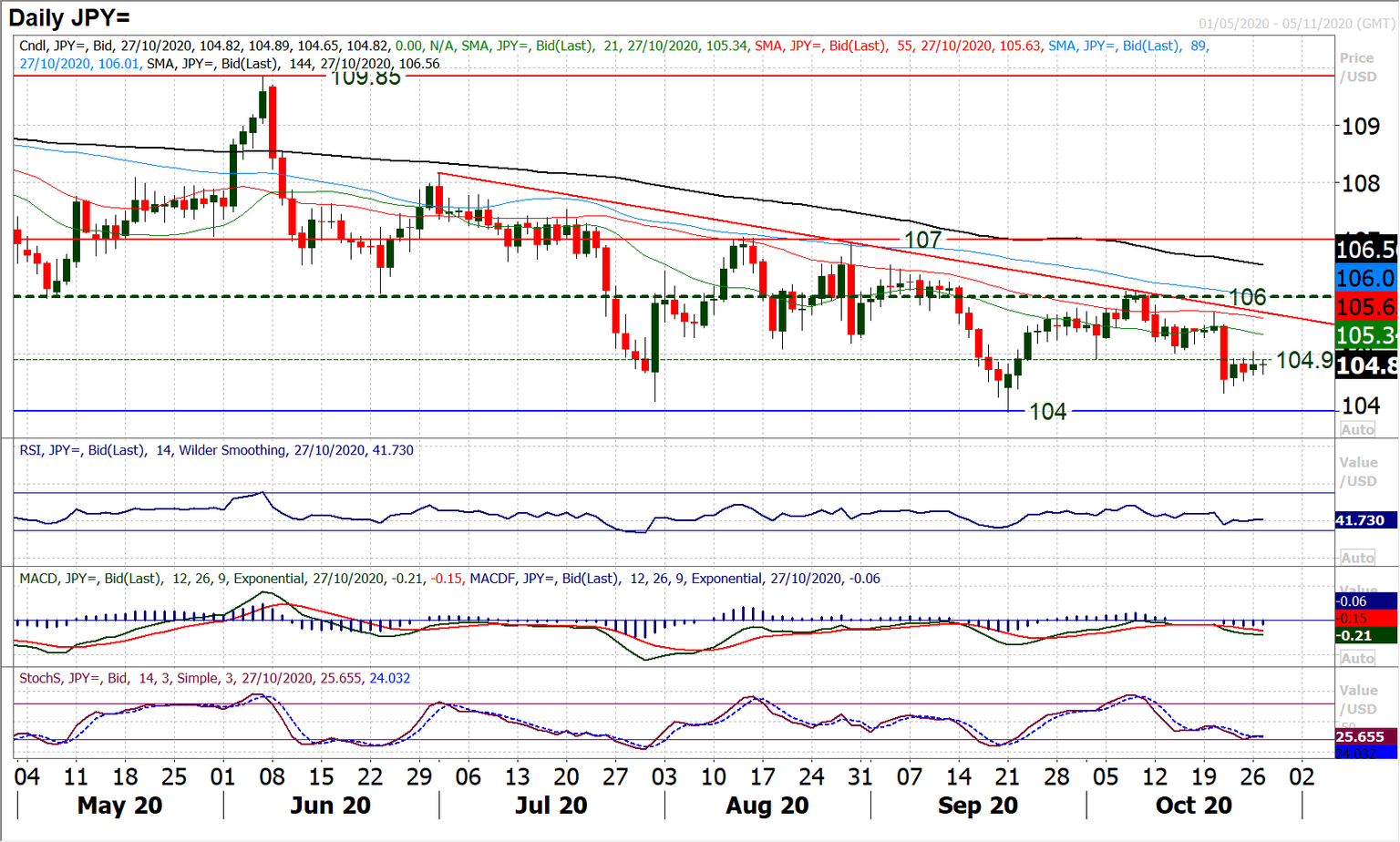

Since the big breakdown last week below 104.90, there has been an attempt to build support on Dollar/Yen. A moderate pick up over the past few sessions has set in, but the bulls have been unable to get any real progress going in a recovery. We consistently see overhead supply between 104.90/105.20 as restricting the rally. This is continuing this morning and there is no change to our view that we see Dollar/Yen as a sell into strength. The barrier of a four month downtrend comes in around 105.75 now, just around last week’s latest lower high. Even if the dollar can eek out some marginal gains versus the yen in the coming days, we would be looking for another lower high between 104.90/105.50 area. Momentum remains correctively configured (especially RSI and MACD) and near term strength appears to be fleeting before selling pressure resumes. With a run of higher lows in recent sessions, 104.65 (yesterday’s low) is initial support, and a breach would simply re-open pressure on 104.30 again. We continue to favour short positions towards 104.00 in due course. A close above 106.10 is needed to seriously suggest a sustainable recovery is underway.

Author

Richard Perry

Independent Analyst