USD/JPY analysis: Declined below 109.00

USD/JPY

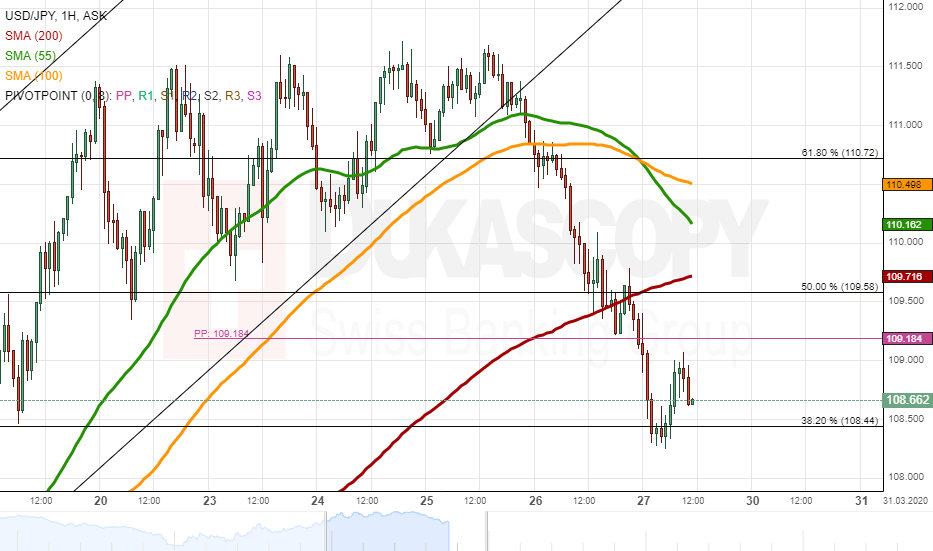

On Thursday, the USD/JPY currency pair declined below the 109.00. During today's morning, the pair re-tested the support level—the Fibo 38.20% at 108.44.

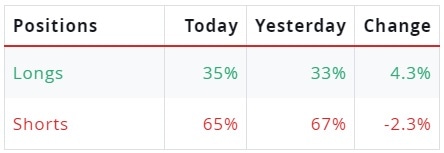

It is likely that the exchange rate could trade upwards in the nearest future. However, note that the rate would have to surpass the weekly PP, the Fibo 50.00% and the 200-hour SMA in the 109.18/109.71 area.

If the currency pair fails to surpass the given resistance cluster, it is likely that the US Dollar could consolidate against the Japanese Yen. Also, it is unlikely that bears could prevail in the market, and the pair could decline below the 107.50 mark.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.