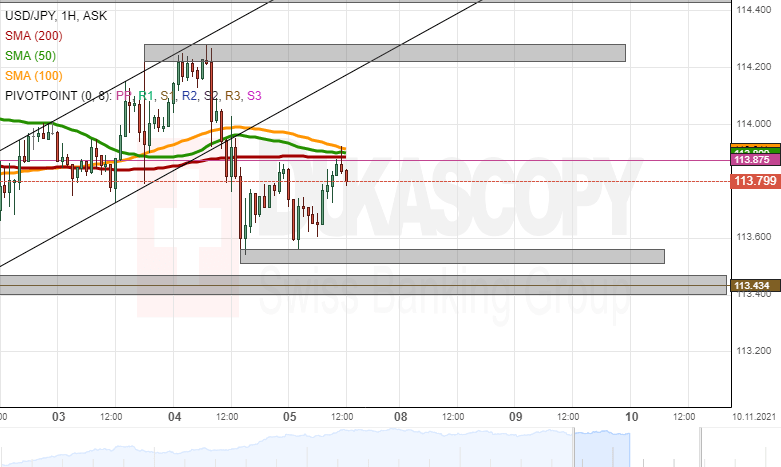

USD/JPY analysis: Tests resistance of SMAs

USD/JPY

The USD/JPY currency pair has revealed that it respects the support of the 113.51/113.56 zone. Namely, the rate has found support in this range two times and recovered from it. Meanwhile, since Thursday, the pair has been kept down by the combined resistance of the weekly simple pivot point and the 50, 100, and 200-hour simple moving averages from 113.88 to 113.92.

A breaking of the resistance of the weekly simple pivot point and the three simple moving averages might result in a surge to this week's high-level zone at 114.22/114.28. Above this week's high levels, a resistance zone is located above the 114.40 mark.

On the other hand, a decline would once again look for support in the 113.51/113.56 zone. Below this zone, the late October low-level zone at 113.40/113.47 and the weekly S1 simple pivot point might provide support.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.