USD/JPY analysis: Finds support in 113.00

USD/JPY

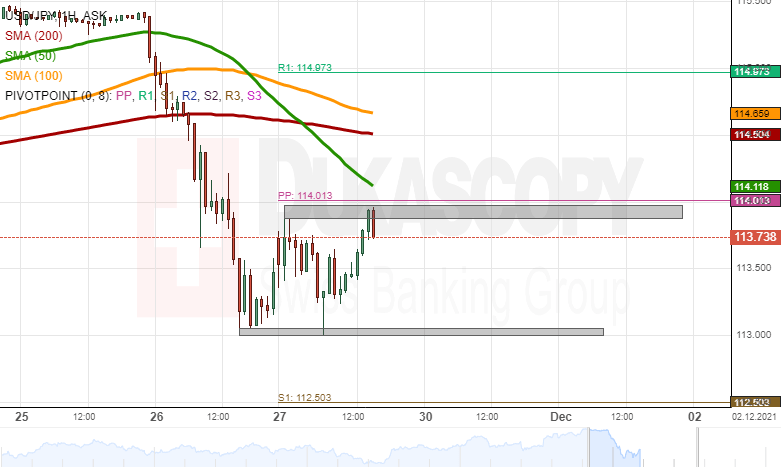

Most recently, on Monday, the USD/JPY currency exchange rate found support in the 113.00 level and reached the resistance of the 114.00 mark. The rate has been trading in the range between the two round exchange levels since the middle of Thursday when the pair found support in 113.00.

In the case that the rate breaks the resistance of the 114.00 mark, it could encounter resistance in the 100 and 200-hour simple moving averages at the 114.50 level. Meanwhile, take into account that the 114.00 mark was being strengthened by the 50-hour SMA and the weekly simple pivot point.

However, a bounce off from the resistance of the 114.00 level would most likely reach the 113.00 mark. If the 113.00 fails to provide support, the USD/JPY might reach the 112.50 level and the weekly S1 simple pivot point.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.