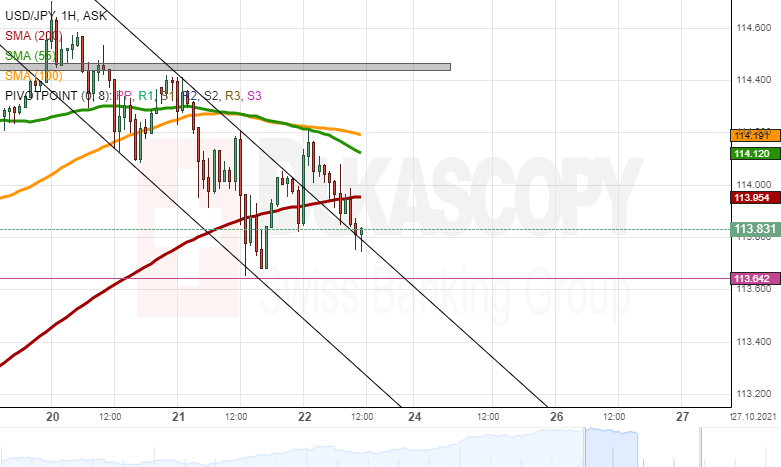

USD/JPY analysis: Breaks pattern

USD/JPY

The small channel down pattern of the USD/JPY was broken, as its upper trend line held for four hours before the USD/JPY passed it. The following surge eventually stopped at the combined resistance of the 55 and 100-hour simple moving averages. The SMAs forced the pair into a decline, which on Friday afternoon was heading to the weekly simple pivot point at 113.64.

If the rate once again finds support in the weekly simple pivot point at 113.64, a potential surge would highly likely encounter resistance in the 200-hour SMA at 113.95 and the 55 and 100-hour SMAs near 114.10/114.20. Above the SMAs, previous high levels might provide resistance at 114.40, 114.50 and 114.60.

Meanwhile, a passing of the support of the 113.64 level would have no technical support as low as the weekly S1 simple pivot point at 112.82. Due to that reason it is more likely that round exchange rate levels could provide support. For example, the 113.00 mark could provide support, as it managed to reverse a decline on October 12.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.