USD/JPY: an increasingly clouded outlook [Video]

![USD/JPY: an increasingly clouded outlook [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/japanese-yens-7972406_XtraLarge.jpg)

USD/JPY

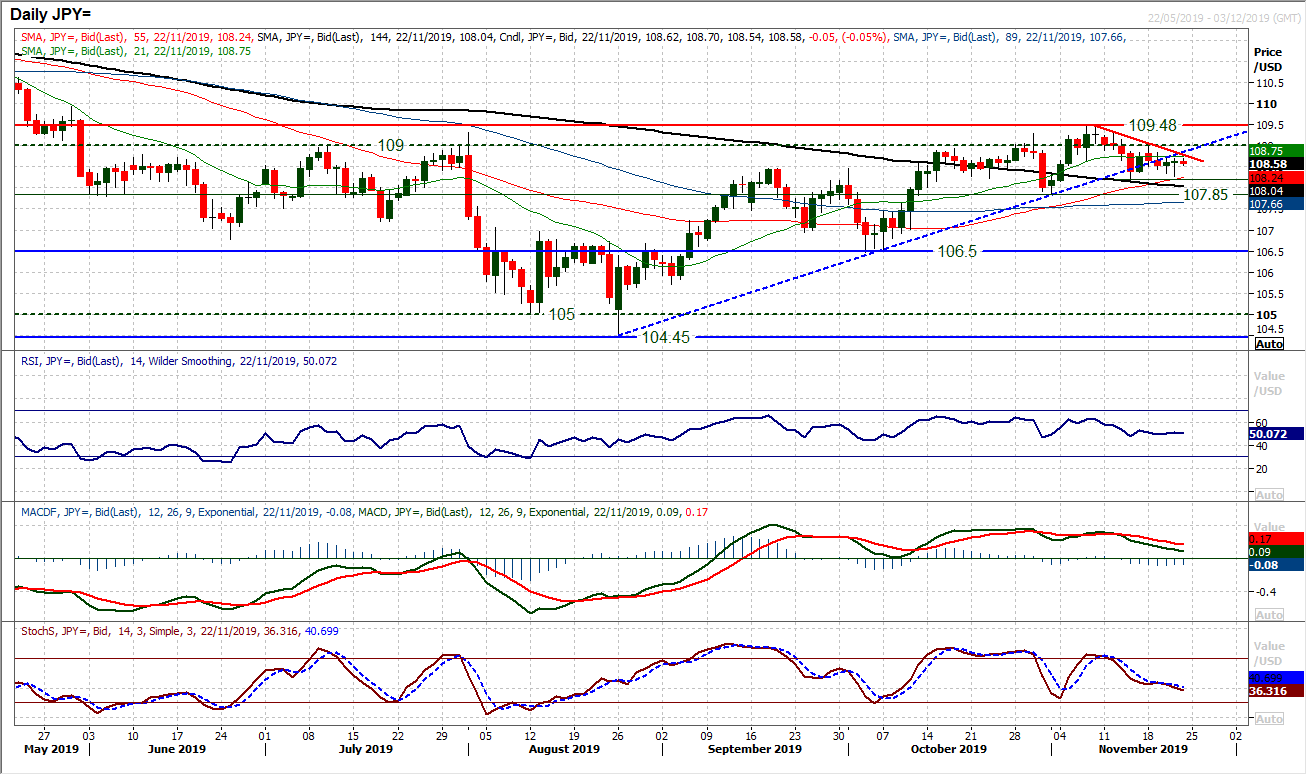

Another session of uncertainty on Dollar/Yen is not helping to clear what is an increasingly clouded outlook. The 11 week uptrend has been decisively broken now and the bulls are no longer in control. However, on the flipside, the initial support at 108.25 also remains intact, so the selling pressure is restricted too. Although there is a new downtrend of the past two weeks building (comes in at 108.75 today), the sellers will not be in control (and subsequently the outlook neutral is retained) whilst 108.25 is intact. Therefore if this lack of conviction continues,, the new downtrend could also be broken. Momentum indicators are slipping away to reflect the near term drop back under 109.00, however, it is important to note that this remains within the context of still positive medium term configuration. Below 108.25 opens a test of 107.85 whilst above 109.00 creates a more positive outlook again.

Author

Richard Perry

Independent Analyst