USD forecast: Fed cuts 25 bps, but Powell keeps December “optional”

- Fed cuts rates to 3.75%–4.00%, confirms QT wind-down by December 1, and restores policy flexibility heading into year-end.

- Markets price 68.6% odds of another cut in December, but Powell’s “optional” stance keeps traders cautious.

- DXY holds above key support, trading inside a 4H FVG between 98.63–99.35 with a bullish bias.

Fed cuts in October but December is still optional

The Federal Reserve delivered a 25‑basis‑point cut on October 29, lowering the federal‑funds target range to 3.75%–4.00% while announcing that quantitative tightening will end on December 1.

The decision marks a careful pivot—easing without surrendering control. The Fed cited slowing job gains and tightening financial conditions, but Chair Jerome Powell made clear that policy isn’t on a preset path.

“We are not on autopilot,” he emphasized, underscoring that future adjustments will depend on incoming data.

Markets had already priced in the cut, but the press‑conference tone turned the event into a dollar‑supportive catalyst. Powell’s refusal to pre‑commit to another move cooled expectations of an aggressive easing cycle.

December FOMC outlook: 68.6% odds of another cut

According to the CME FedWatch Tool, traders now assign a 68.6% probability of a December rate cut to 3.75–4.00%, versus a 31.4% chance of no change.

How October shapes December

- Flexibility restored: October’s pre‑emptive cut gives the Fed optionality to pause if data stabilizes.

- QT wind‑down cushion: Liquidity will rise modestly from December 1, reducing urgency for another cut.

- Data dependence: CPI, jobs, and GDP in November remain decisive for December’s call.

- Shutdown blind spot: Any data‑release delays strengthen the argument for patience.

The market may lean dovish, but Powell’s tone leaves room for a pause if core inflation steadies.

Dollar reaction: Resilient, not reactive

Despite a rate cut, the USD held firm. The reason: the cut was already expected, and the Fed’s credibility premium remains intact.

DXY rebounded from its session lows as traders priced out the odds of consecutive cuts, signaling confidence in a “measured‑easing” narrative rather than a dovish pivot.

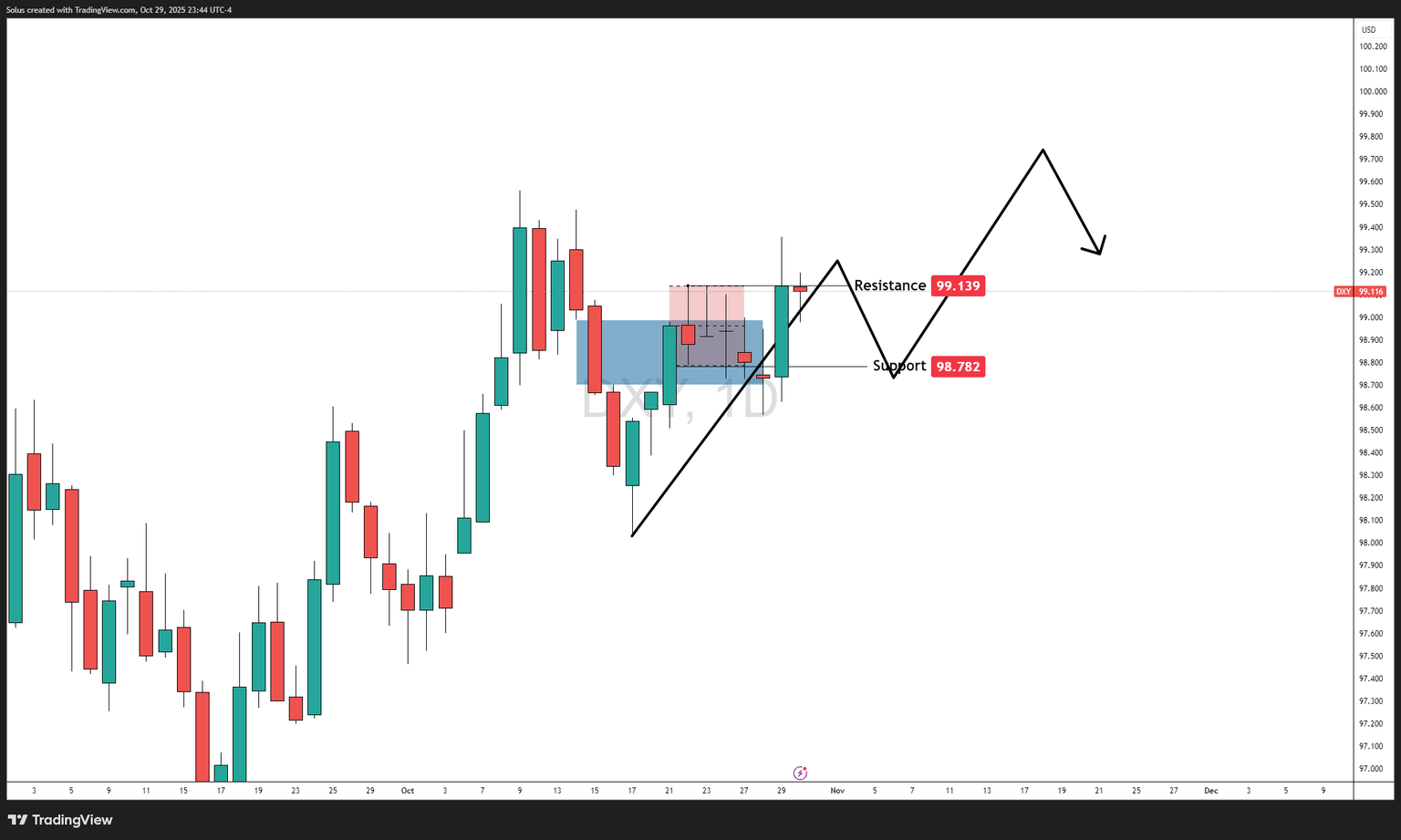

Dollar holds its ground: Still structurally bullish

The U.S. Dollar Index is defending the 98.60–98.80 support area, forming a higher‑low structure on the daily timeframe.

Powell’s data‑dependent approach preserved yield differentials, keeping the greenback supported against its peers.

Until that floor gives way, the technical posture stays bullish heading into November.

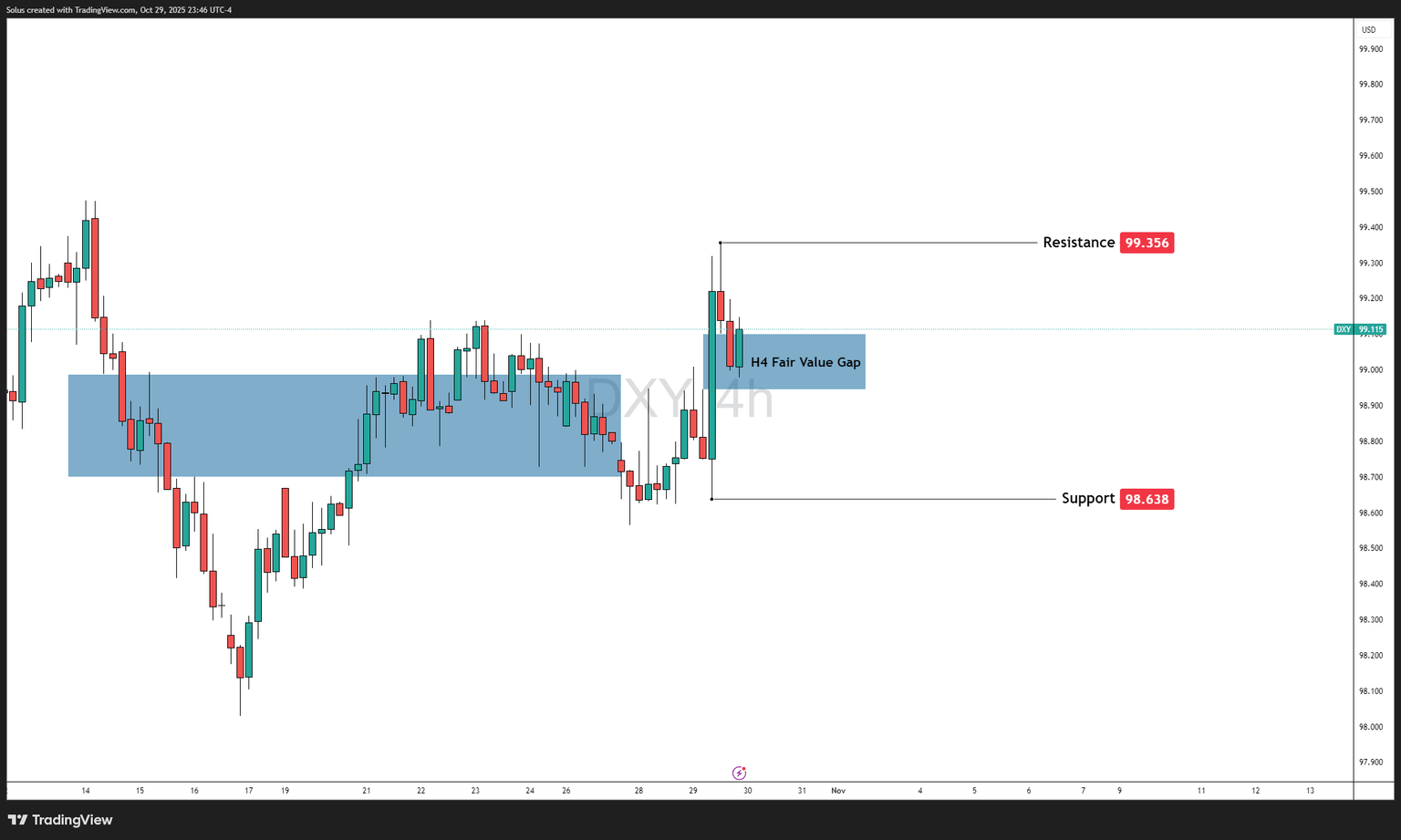

Technical outlook (4H chart)

The DXY is consolidating inside a 4H Fair Value Gap (FVG) between 98.80–99.00, using it as a short‑term equilibrium zone before its next move.

Support: 98.638 Resistance: 99.356 Current bias: Neutral to bullish

Bullish scenario: FVG reclaim and breakout

If the index continues to respect 98.63–98.80, a rebound from the FVG could fuel a push toward 99.35–99.70.

A 4H close above 99.35 confirms breakout intent, targeting 100.00.

Triggers: hawkish Fed remarks, risk‑off sentiment, or stronger‑than‑expected data. Targets: 99.35 → 99.70 → 100.00

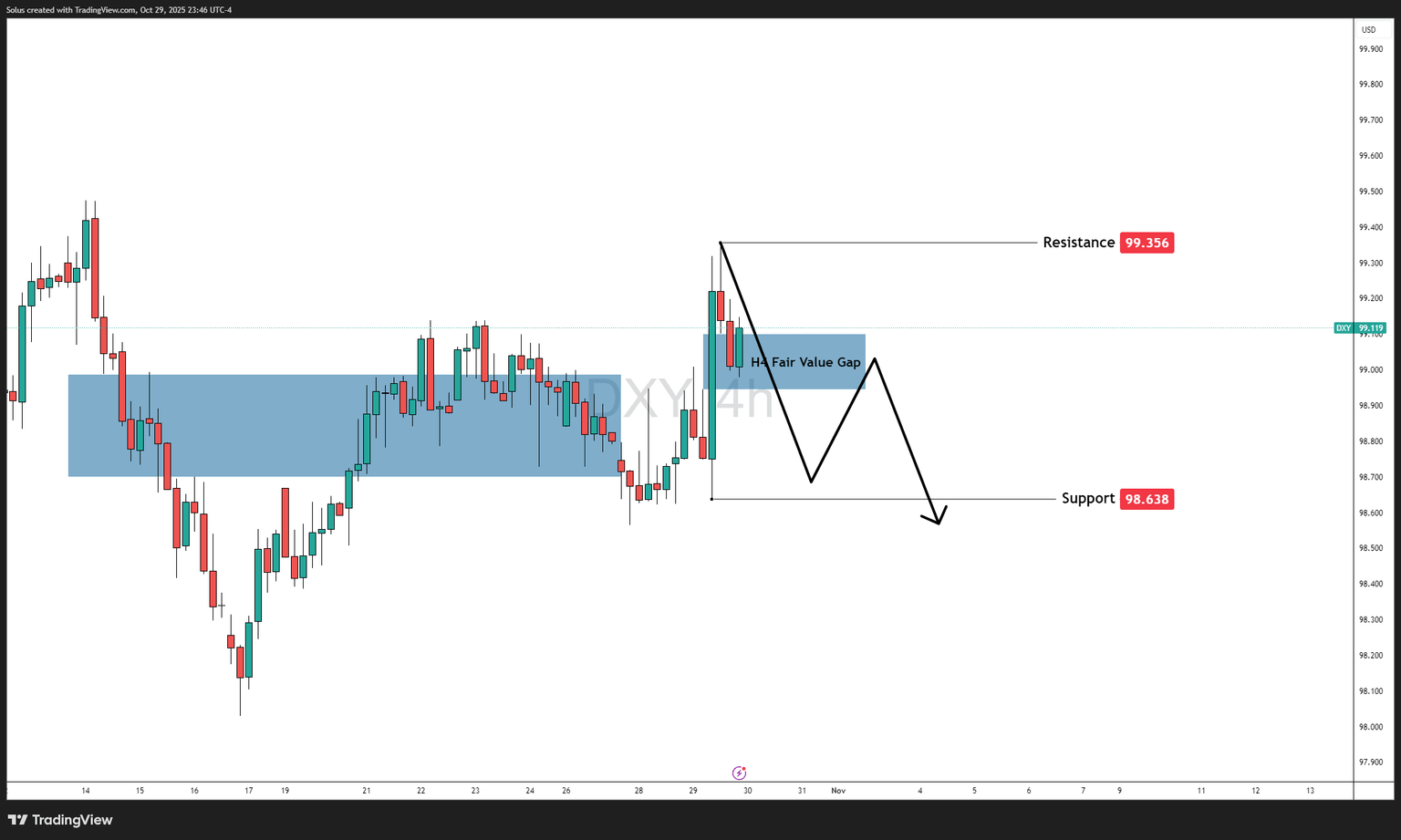

Bearish scenario: FVG failure and breakdown

Failure to hold the 98.63 support would invalidate the bullish structure.

A decisive 4H close below this level opens 98.20–98.00 liquidity before recovery.

Triggers: dovish rhetoric, risk‑on markets, or soft economic data. Targets: 98.63 → 98.20 → 98.00

Summary

The Fed’s October move was strategic, not reactionary. By ending QT and cutting once, Powell restored policy flexibility while keeping inflation vigilance alive.

As markets head into the December 10 meeting, the dollar’s tone remains firmly supported — proof that credibility, not cuts, defines this cycle.

DXY outlook: Hold above 98.60 keeps a bullish bias → break below 98.60 flips the short‑term trend bearish.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.