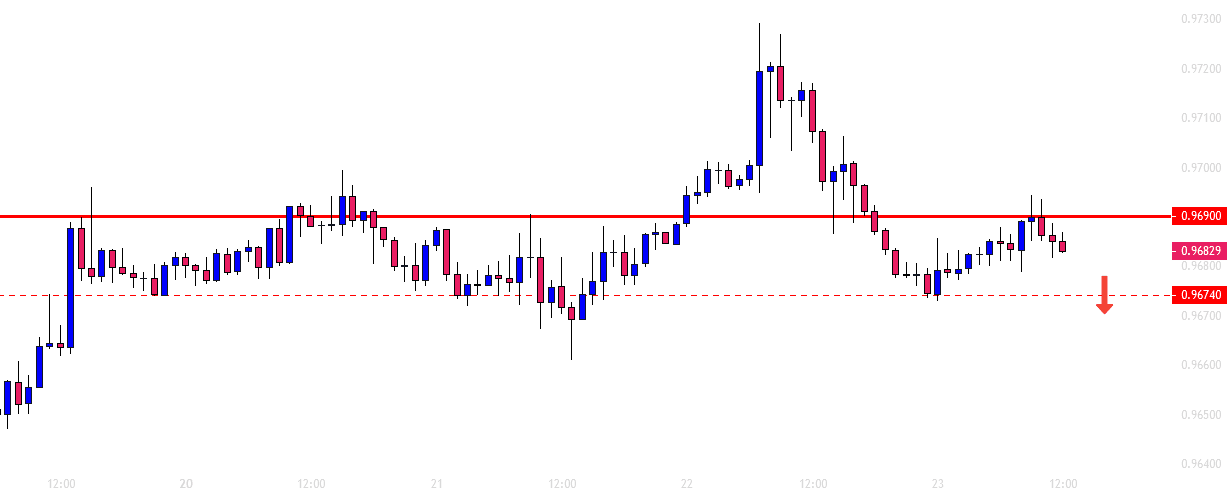

USD/CHF: bearish engulfing candle is in play

USD/CHF had a bearish day yesterday. The price had a strong rejection and closed with a long upper shadow. The price of the H1 chart made an upward correction. It seems that it may have found its resistance. As of writing, the last two candles have been bearish. If the price continues to go towards the South and makes a bearish breakout, the sellers may get a chance to go short on the pair.

The chart produced a bearish engulfing candle at the level of 0.96900. If the price makes an H1 breakout at the level of 0.96740, the sellers may trigger a short entry upon the breakout confirmation.

Trade Summary

Entry: Sell below 0.96740

Stop Loss: Above 0.96900

Take Profit 1: 0.96490

Take Profit 2: 0.96385

Take Profit 3: 0.96245

Please Note: The price has a lot of space to travel towards the downside. Thus, the sellers may consider taking partial profit at Take Profit level 1, 2, 3 and let the rest of it run to grab more pips.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and