USD/CAD Weekly Forecast: Oil underlies Canadian strength

- WTI gains 6.5%, $83.66 highest close since October 2.

- USD/CAD drops to a two-month low on Thursday.

- Weak US Retail Sales do not deter Friday recovery in USD/CAD.

- US advantage in Treasury spreads narrows to 2 basis points.

- FXStreet Forecast Poll sees near-term technical weakness.

The USD/CAD touched a two-month low on Thursday at 1.2454 but closed a figure higher on Friday despite poor US data and a 6.5% jump in oil prices.

Treasury yields in the US rose on Friday after several Federal Reserve officials including Chair Jerome Powell, talked up the possibility of higher interest rates, in the days prior. Philadelphia Fed President Patrick Harker said he thought rates could be hiked three or four times this year and Chicago Fed President Charles Evans expected three increases but was open to more.

The 10-year Treasury yield finished at 1.793%, its highest since January 17, 2020. The 30-year return ended at 2.217%, its best level since October 21 last year.

This year’s steep climb in US Treasury rates has been over-matched by the gain in the Canadian equivalent yield, which is one reason USD/CAD has been unable to sustain its improvement. The other is oil prices.

The US 10-year has added 28.1 basis points since December 31 while the Canadian 10-year has climbed 34.3 basis points. On December 31 the spread favored the US by 8.2 basis points, on Friday the differential was just 2 points.

West Texas Intermediate (WTI) rose 6.5% on the week, completing its return from the December 2 low at $62.34. The North American crude oil pricing standard closed at $83.66, just below the October 26 seven-year high of $84.05.

Cases of the Omicron variant continue to rise around the world but the economic impact seems to be contained. Product, material and labor shortages are helping to fuel inflation in the US and Canada but the initial risk-aversion flight to the American dollar has reversed, sapping the greenback’s strong start to the year.

There were no Canadian statistics this week.

The US economy delivered a string of poor results. Annual consumer inflation rose to 7% in December, a four-decade apogee. Producer prices at 9.7% overall and 8.3% core, promised more price pain for American households in the months ahead. Retail Sales in December were far worse than forecast at-1.9% overall, -2.3% ex-Autos and -3.1% for the Control Group.

US Retail Sales plunge in December after a year of inflation

Initial Jobless Claims rose to 230,000, their highest count in eight weeks and the second increase in a row. Finally, Industrial Production fell 0.1% in December after rising 0.7% in November. It had been forecast to add 0.4%.

USD/CAD outlook

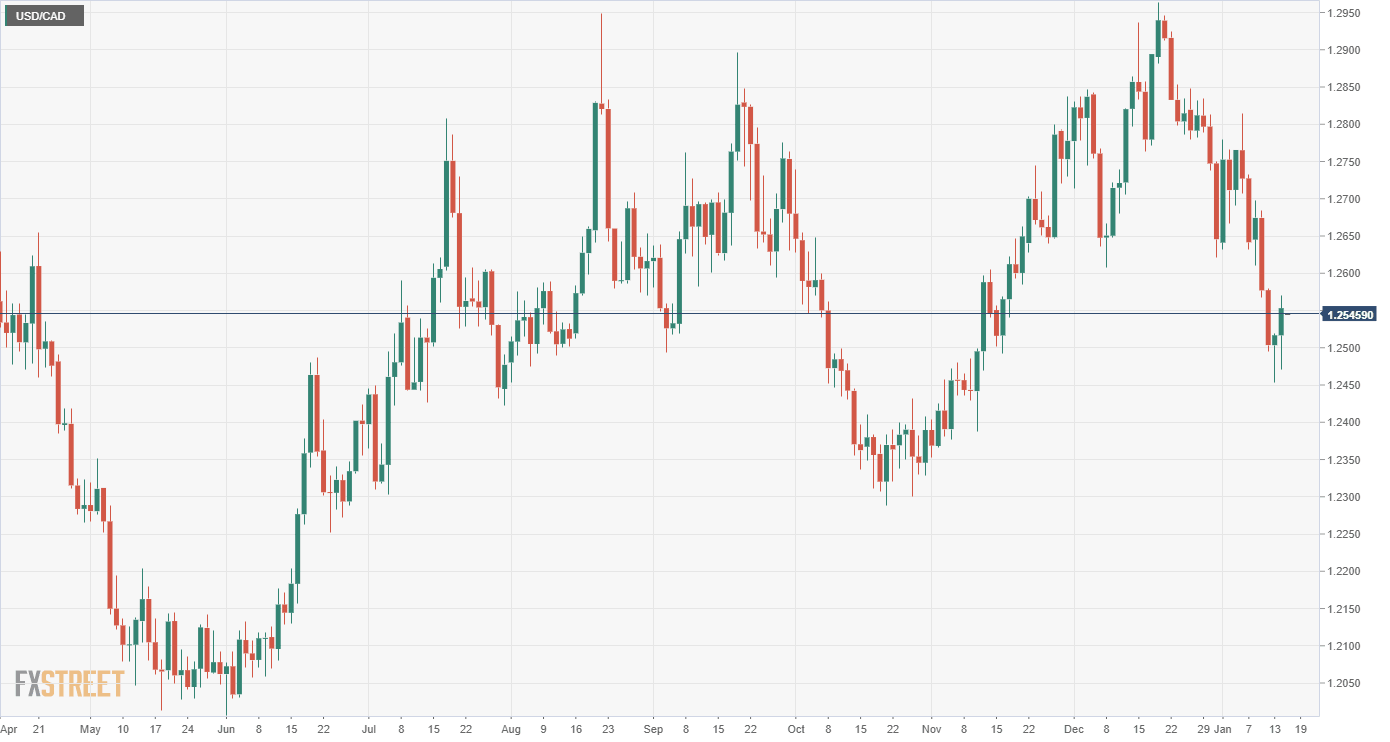

The ascending channel from the June 2021 low at 1.2029 remained intact, even though pierced on Thursday and Friday. The 200-day moving average of the March 2020 decline at 1.2502 provided support on Friday.

Rising oil prices give the Canadian economy a benefit unavailable to Europe or Japan and their currencies. The expected equal pace of interest rate increases from the Federal Reserve and the Bank of Canada in 2022 is a basic advantage for the two dollars against the euro and yen, whose central bank’s are not expected to tighten, though the policy equivalence is neutral for the USD/CAD.

The US and Canadian economies can be expected to prosper in tandem with neither having a notable edge in 2022. Canadian inflation was 4.7% annually in November and is forecast to duplicate that in December. Though this is more than 2% lower than the US rate, it has not evoked notably higher rates in the Treasury market. It is possible that the US rates will forge ahead, but for the past two months that has not happened.

Technical indicators in the USD/CAD have turned south and the inability to sustain a higher trend after the 18%,15-month decline, despite two major and several minor attempts, argues for fundamental weakness in the USD/CAD, or strength in the loonie. After the long downward trend, the USD/CAD rebound never reached the 38.2% Fibonacci retracement level at 1.3041 and this week’s fall brought it back below the 23.6% level at 1.2659. Friday’s close at 1.2553 is more than a figure beneath that first retracement marker.

Canadian inflation for December on Wednesday is the most relevant information for the USD/CAD. November Retail Sales on Friday will not provoke a response.

Amercan data centers on the housing market with Existing Home Sales, Building Permits and Housing Starts for December, interesting statistics but not market movers.

The USD/CAD bias is neutral to lower with the emphasis on technical weakness.

Canada statistics January 10–January 14

No statistics

US statistics January 10–January 14

FXStreet

Canada statistics January 17–January 21

FXStreet

US statistics January 17–Janaury 21

FXStreet

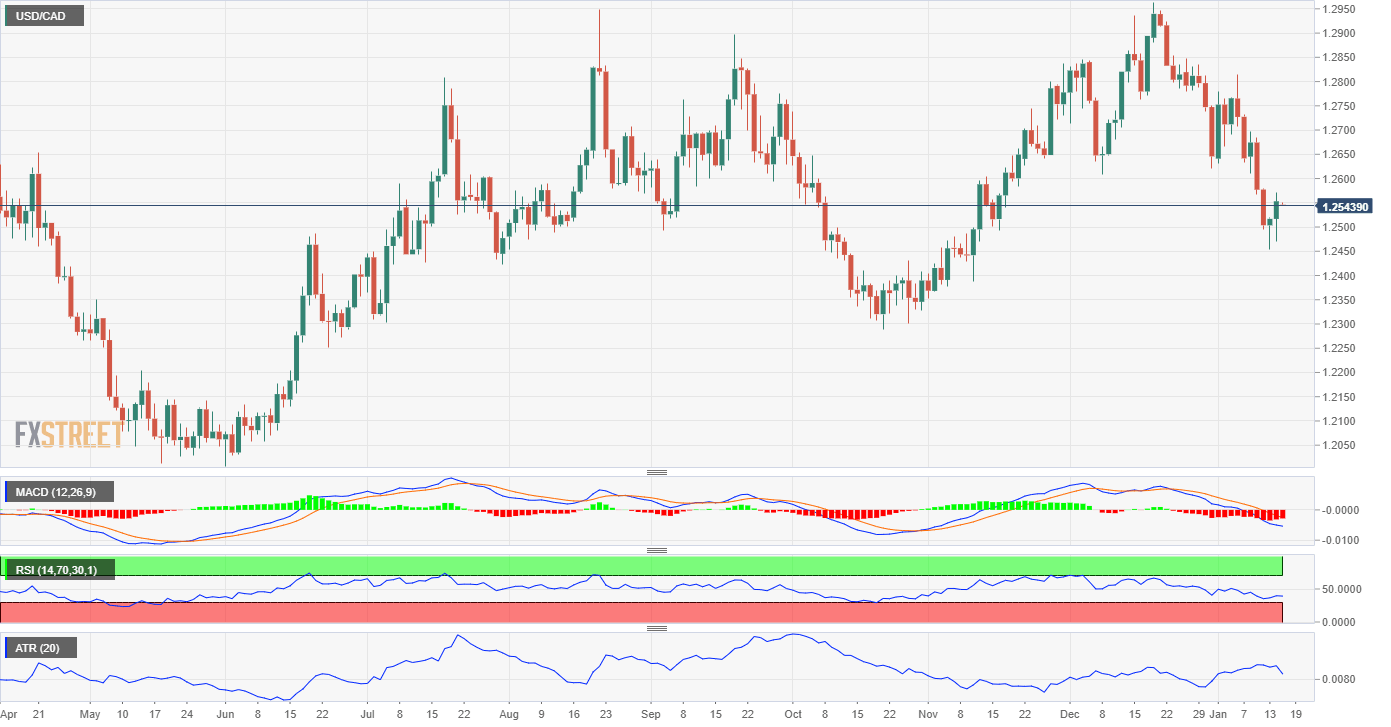

USD/CAD technical outlook

The MACD (Moving Average Convergence Divergence) price line crossed into decline two days before Christmas. Since then the divergence has widened, the slope has steepened and it has moved deeper into negative territory. The Relative Strength Index (RSI) became negative in the first week of trading, though it has recovered slightly from last week's two-month low. both indicators retain downward bias. Average True Range (ATR) volatility declined last week but it remains above most readings for the year. Volatility should continue to decrease as the USD/CAD encounters support below 1.2500.

The 100-day moving average (MA) was crossed on Tuesday, leaving only the 200-day MA at 1.2502 in play where it coincides with support at 1.2500 and the up-sloping trend line at 1.2499.

Resistance: 1.2600, 1.2650 (1.2659, 23.6% Fibonacci), 1.2675, 1.2700, 1.2750

Support: 1.2500, 1.2450, 1.2400, 1.2360, 1.2320, 1.2280

FXStreet Forecast Poll

The FXStreet Forecast Poll sees technical weakness failing at the multiple support level below the current market.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.