USD/CAD Weekly Forecast: Oil, commodities and oil

- USD/CAD and crude oil trade inversely all week.

- Deputy BOC governor Gravelle explores the end of bond purchases.

- US 10-year Treasury yields stable on the week.

- US labor market and Gross Domestic Product data improves.

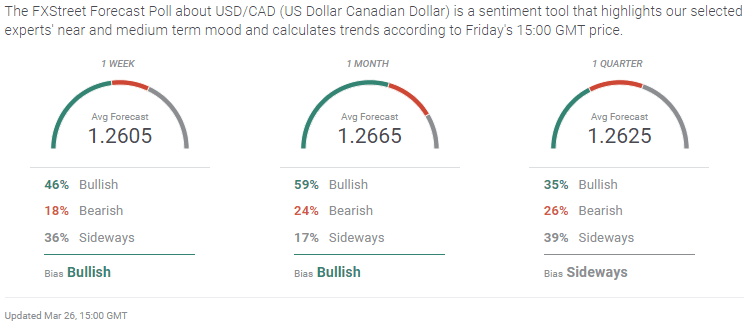

- FXStreet Forecast Poll forsees a rise in USD/CAD.

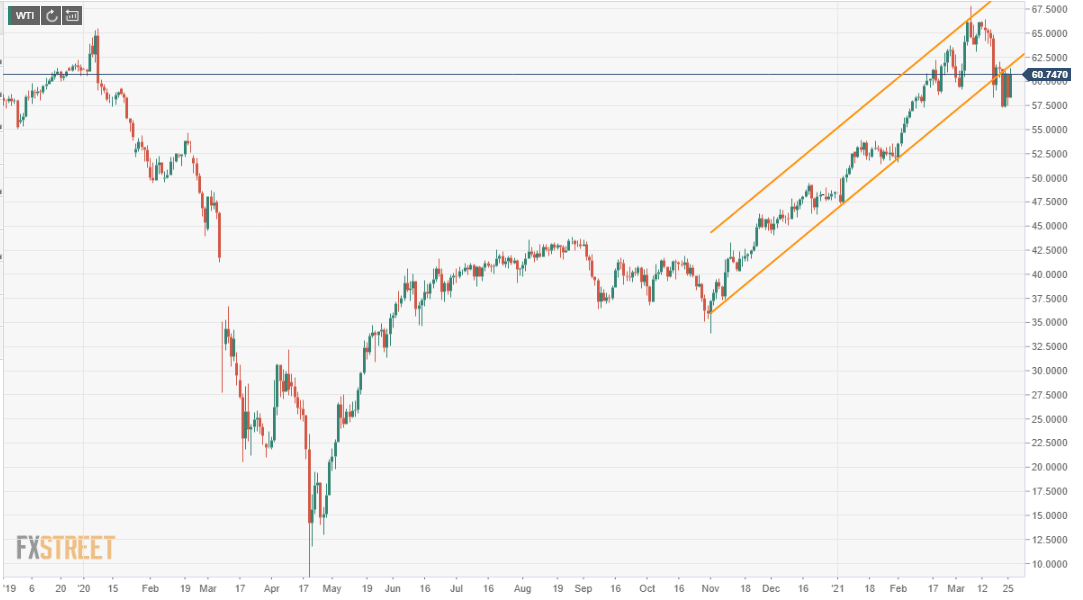

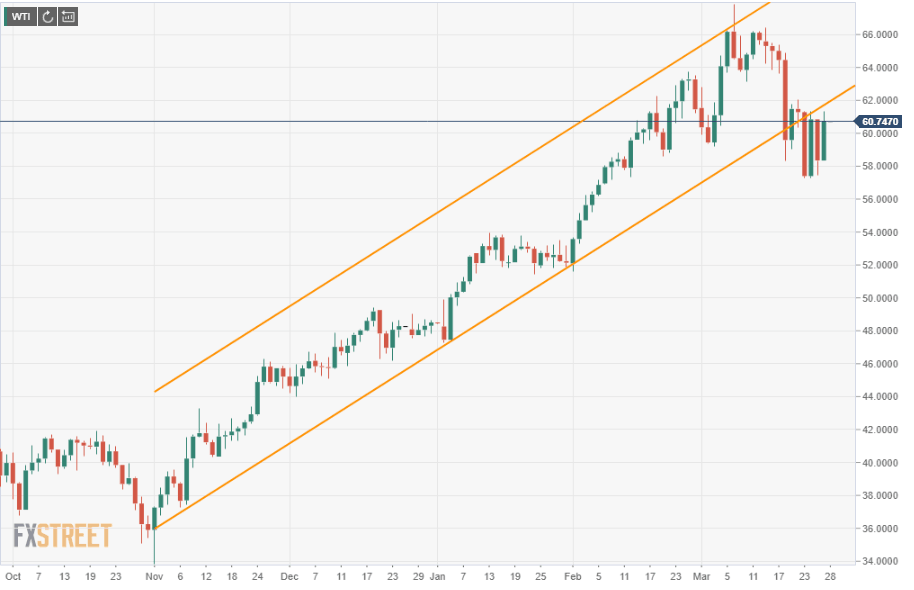

Oil was the USD/CAD's mirror image this week. The inversion kept perfect time with the USD/CAD rising every day West Texas Intermediate (WTI) fell and fading whenever it recovered.

From Monday to Friday WTI lost 1.2%, opening at $61.48 and finishing at $60.75 and the USD/CAD gained 0.6%. It started the week at 1.2500 and completed trading at 1.2577.

Resources and raw materials are an important aspect of the Canadian economy but it is hardly a one commodity export enterprise like some of the nations in the Middle East or even Russia. The unusual perfect correlation was due to the lack of competing inputs.

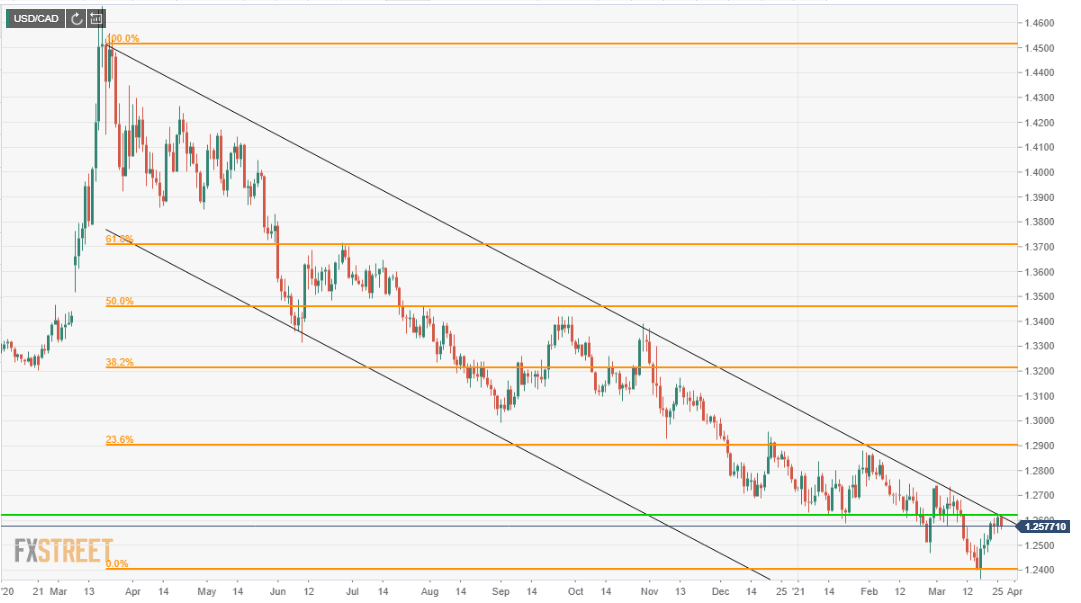

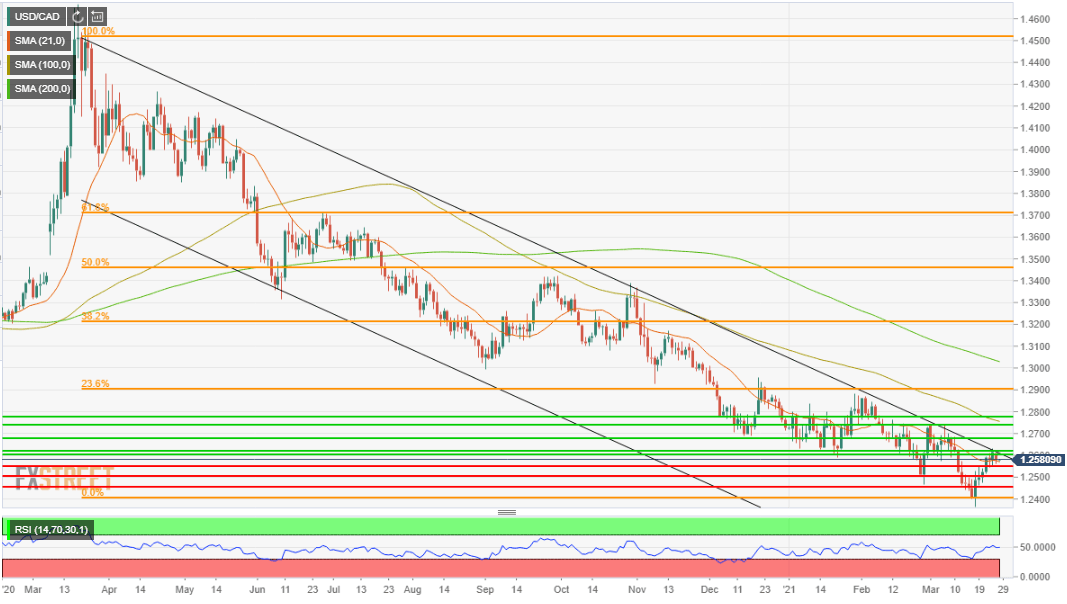

The year long 14.8% decline in the USD/CAD reached a three year low on March 18 at 1.2365.The modest rebound to Friday's close at 1.2577 has brought the pair to the upper border of the descending channel formation and just below the important resistance at 1.2600-1.2620.

The USD/CAD has been able to resist the US dollar reformation over the past several weeks because Canada's resource economy stands to benefit if a global recovery drives commodity prices, especially oil, to new highs.

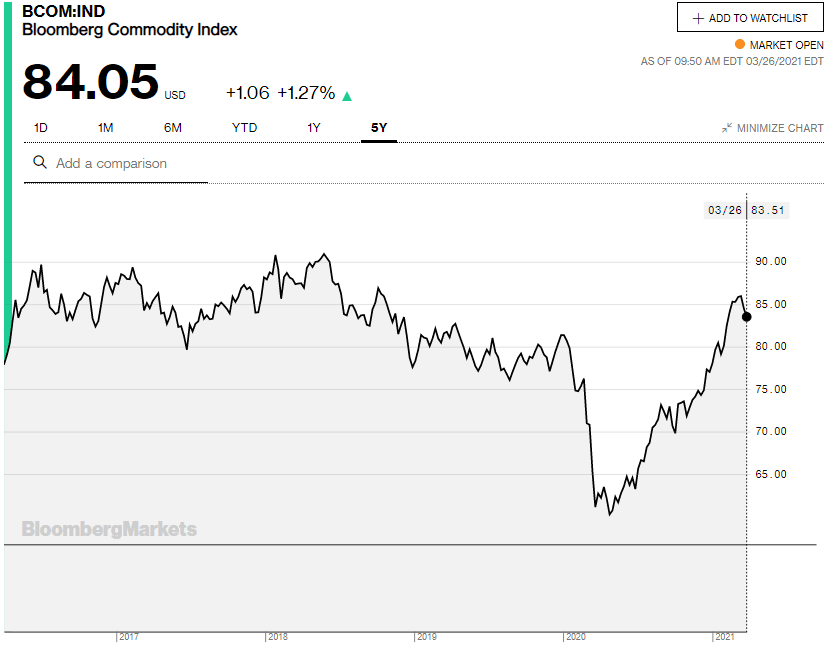

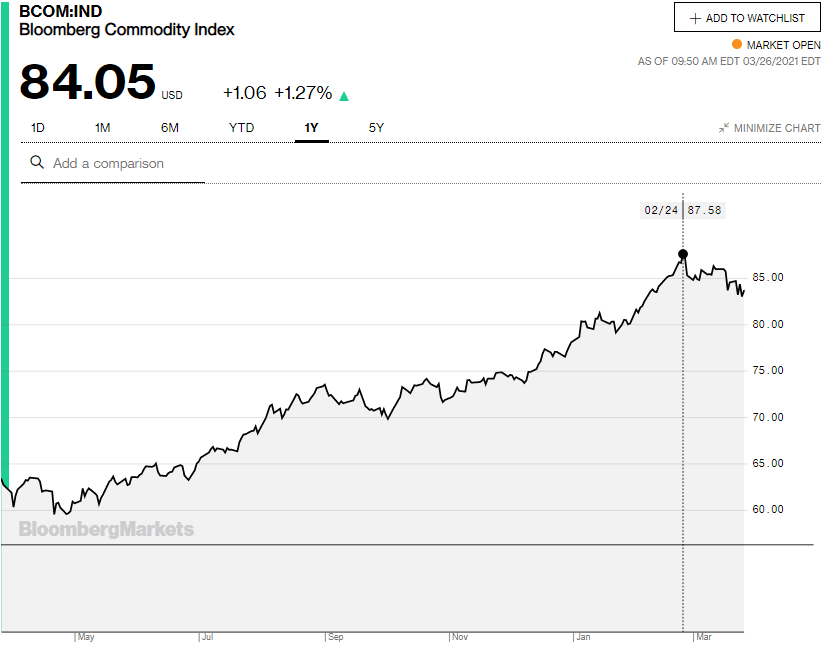

Recently that has not been conspicuously true. Commodity prices, which had been on a long and sharp increase from their April 2020 low, have reversed. The gain had brought the Bloomberg Commodity Index (BCOM) back to its level in the third quarter of 2018 and anticipated the global recovery from the pandemic.

Since the February 24 high at 87.58 the index has dropped 4%. Commodity prices are one of the earliest indicators of an economic recovery, they are also one of quickest to reverse when growth is at hand.

Oil prices have been indecisive this month touching a pandemic and more than one year high on March 8 at $67.87 then reversing ten days later losing 7.5% on March 18 and closing at $59.59.

Technically, the plunge on March 18 broke the five-month ascending channel. The attempted return in the next two trading sessions (March 19, 22) failed and the resulting 6.3% drop on March 23 has moved the price sideways. Each of the subsequent three sessions almost exactly reversed the previous day's verdict. The closing rates on the four days tell the story, March 23 open $61.28 close $57.40, March 24 close $61.34, March 25 close $58.34 and March 26 $60.75. The barrel price for WTI is but half-a-dollar from where it was on February 16 $60.24.

There was no economic data from Toronto and American Treasury rates, which have been the main driver of the US dollar this year, were stable on the week. The 10-year yield lost less than one point to 1.674% from 1.682%.

US 10-year Treasury yield

CNBC

The Bank of Canada (BOC) was the first central financial institution to explore the endgame for the pandemic interventions.

Deputy BOC Governor Gravelle explained the rules the bank expects to follow when it begins to slow bond purchases in a speech on Tuesday. The bank has been buying C$4 billion in government bonds each week, totaling more than C$250 billion in the past year. Broaching the end of the bond program, “easing our foot off the accelerator, not hitting the brake”, is how Mr. Gravelle phrased it, is a step the Federal Reserve has not been willing to make. If the BOC carries through this reduction before the Fed it could provide the Canadian dollar with notable support.

American economic data was upbeat. Initial Jobless Claims fell to the lowest of the pandemic era and fourth quarter GDP was revised to 4.3% annually from 4.1%. If Durable Goods Orders for February were both negative and weaker than forecast, they were restating Retail Sales figures and had no market impact.

USD/CAD outlook

Commodities and WTI have been the mainstay of the Canadian dollar over the past few months. That support has weakened in the last several weeks as commodity prices and then oil have turned south. The current direction of the USD/CAD is a function of resource pricing. Canada and US sovereign bond yields have largely risen in tandem and the two-economies are so closely tied that if the US does boom at 6.5% this year, Canada will be an equal participant. The differential has been commodities.

The technical poise at the channel border and just below resistance, both between 1.2600-1.2620 puts a break of the channel on the immediate agenda. Oil will be the likely determinate this week. If WTI drops below $60 and and especially if it maintains below $58, USD/CAD should surmount resistance at 1.2600 and break free of the formation that has controlled trading for more than a year.

Canada statistics March 22-March 26

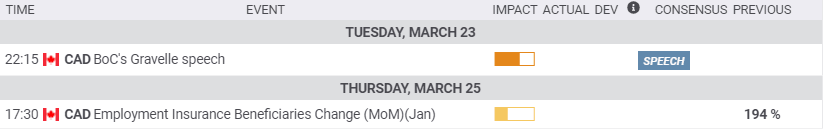

The sharp increase in unemployment beneficiaries in January was expected as parts of the country returned to lockdown that month.

Tuesday

Deputy Bank of Canada Governor Toni Gravelle speech.

Thursday

Employment Insurance Beneficiaries Change, which reports the number of people receiving unemployment benefits, jumped 11.2% in January from 2% in December.

FXStreet

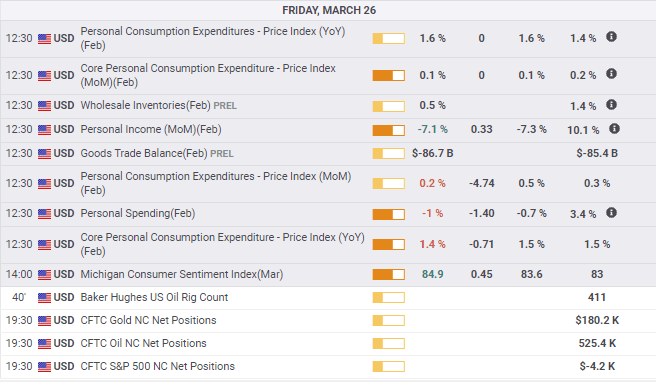

US statistics March 22-March 26

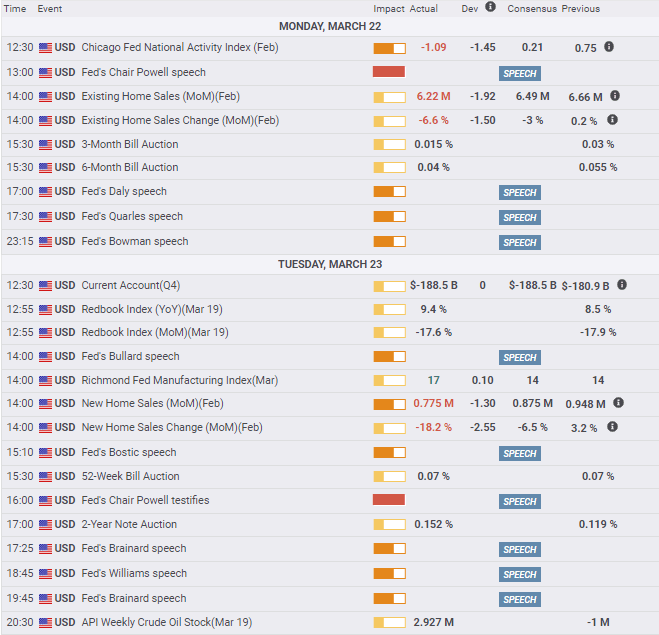

Fed Chairman Powell's Congressional had the most potential for a deliberate or inadvertent market impact. Neither was forthcoming. Mr. Powell is a practiced hand at communication and rarely makes a misstep. Economic data was good with Jobless Claims falling below 700,000 for the first time in the pandemic era and fourth quarter GDP improving to 4.3% from 4.1% annualized. Durable Goods Sales were worse than forecast in February but restated the already released Retail Sales information.

Likewise February Personal Income and Spending rehearsed old news.

Monday

Existing Home Sales fell 6.6% in February, twice the -3% prediction, to 6.22 million annually from 6.666 million.

Tuesday

New Home Sales plunged 18.2% in February almost three times the -6.5% forecast, to 775,000 from 948,000. Frigid weather in most of the country was the likely culprit.

Wednesday

Durable Goods Orders dropped 1.1% in February from 3.5% in January, 0.8% had been forecast. Goods orders ex Transportation sank 0.9% on a 0.6% prediction and 1.6% in January. Nondefense Capital Goods Orders ex Aircraft fell 0.8% on a 0.5% forecast and 0.6% gain in January.

Thursday

Initial Jobless Claims dropped to 684,000 in the March 19 week from 781,000. The forecast was 730,000. Continuing Claims fell to 3.87 million in the March 12 week, well below the 4.043 million estimate, from 4.134 million prior.

Fourth quarter GDP was revised to 4.3% from 4.1%. Personal Consumption Expenditure Prices (PCE) rose 1.5% on the quarter and Core PCE Prices rose 1.3%.

Friday

The PCE Price Index rose 0.2% on the month and 1.6% on the year in February from 0.3% and 1.4% in January. Core PCE Prices rose 0.1% and 1.4% from 0.3% and 1.5% in January. Personal Income fell 7.1% after January's 10.1% gain. Personal Spending fell 1% from 2.4% in January.

FXStreet

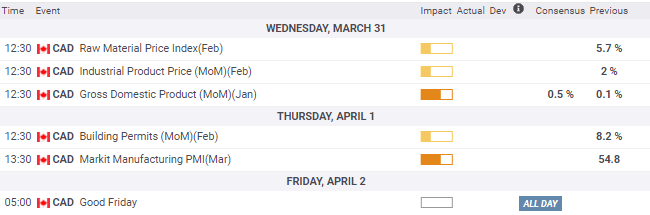

Canada statistics March 29-April 2

Wednesday

Raw Material price Index for February: January 5.7%. Industrial Product Price for February: January 2%. Gross Domestic Product January: expected 0.5%, December 0.1%.

Thursday

Building Permits for February: January 8.2%. Markit Manufacturing PMI for March: February 54.8

FXStreet

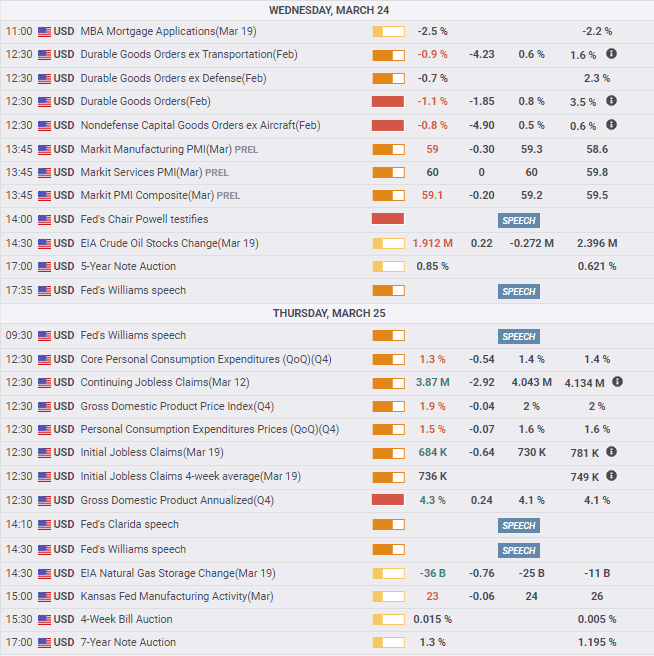

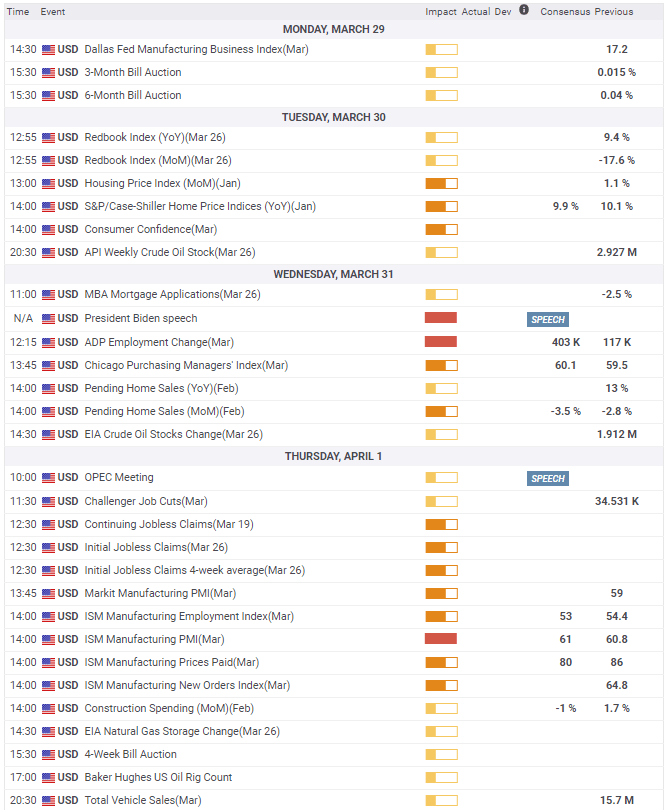

US statistics March 29-April 2

March payrolls rules the week with half-a-million new jobs forecast. If the prediction is accurate or better it will give the dollar and yields a healthy boost. ISM Manufacturing PMI for March could provide additional positive news.

Tuesday

Conference Board Consumer Confidence is forecast to rise ti 96 in March from 91.3.

Wednesday

ADP Employment Change is forecast to add 550,000 workers in March after 117,000 in February.

Thursday

Initial Jobless Claims are expected to rise to 690,000 in the March 26 week from 684,000. Continuing Claims should drop to 3.5 millionn in the March 19 week from 3.87. ISM Manufacturing PMI for March- expected 61.2, February 60.8; Employment-expected 53, February 54.4; New Orders-February 64.8. Total Vehicle Sales for March: February 15.7 million.

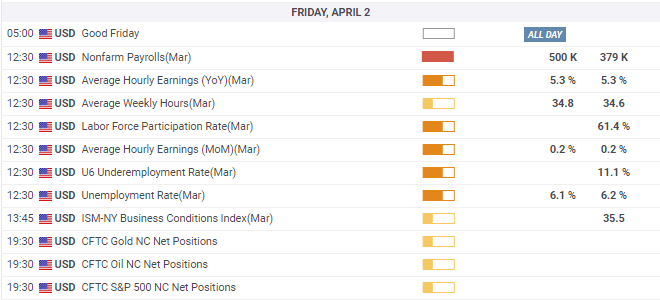

Friday

Nonfarm payrolls for March, 655,000 forecast, February 379,000. Unemployment Rate 6.0% expected, 6.2% February. Average Hourly Earnings expected 0.1% monthly, 4.6% annually. Underemployment Rate February 11.1%. Labor Force Participation Rate February 61.4%. Average Weekly Hours expected 34.7, February 34.6.

USD/CAD technical outlook

An interesting technical set-up this week. The USD/CAD is crouched just beneath the year-long channel descent and a band of substantial resistance between1.2600, the upper border of the formation, and 1.2620. The catalyst of the minor reversal since March 18 has not been technical but fundamental, the price of WTI. The USD/CAD has been able to largely resist the general currency trend of a higher US dollar this year because of the strength of commodity prices and their relevance for the Canadian economy. If that support wanes, then the USD/CAD can be expected to join the rest of the market in celebrating the greenback.

The placement of the USD/CAD at the verge of a channel break will, if the pair can sustain movement above 1.2620, likley encounter stop-loss buying. There is a great deal of short USD/CAD profit in the descent from 1.4500 that is waiting for an excuse to be converted into revenue.

The 21-day moving average (MV) at 1.2569, crossed on Tuesday and closing support since is weak but meaningful in an undecided market. The 100-day MV at 1.2755 and the 200-day MV at 1.3029 will be notable resistance when encountered.

Resistance: 1.2600, 1.2620, 1.2675, 1.2740, 1.2775

Support: 1.2550, 1.2500, 1.2455

USD/CAD Forecast Poll

The FXStreet Forecast Poll is optimistic for the USD/CAD in the immediate term, but the gains are limited and fade in the one quarter view. Our analysts see the greatest gain after the USD/CAD passes the resistance border at 1.2600-1.2620.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.