USD/CAD Price Forecast: Seems vulnerable amid bearish USD; 100-day SMA holds the key

- USD/CAD attracts fresh sellers on the first day, though it lacks bearish conviction.

- Fed rate cut bets prompt some USD selling and exert some pressure on the major.

- Subdued Oil prices and Canadian politics undermine the Loonie and lend support.

The USD/CAD pair kicks off the new week on a weaker note and erases a major part of Friday's move up amid the emergence of fresh US Dollar (USD) selling. The Federal Reserve (Fed) gave a bump higher to its inflation projection, though it maintained the forecast for two 25 basis points rate cuts by the end of this year. Moreover, investors seem convinced that the US central bank will resume its policy-easing cycle sooner than expected amid concerns about a tariff-driven US economic slowdown. This, in turn, fails to assist the USD to capitalize on a three-day-old recovery from a multi-month low touched last week and exerts some downward pressure on the currency pair.

Meanwhile, reports over the weekend indicated that US President Donald Trump is planning a narrower, more targeted agenda for the so-called reciprocal tariffs set to take effect on April 2. Adding to this hopes for a positive outcome from Russia-Ukraine peace talks boost investors' appetite for riskier assets and further dent demand for the safe-haven Greenback. Delegations from the US have been holding meetings with Ukrainian officials as part of peace negotiations and will now meet Russian officials on Monday for further talks. Trump and Russian President Vladimir Putin earlier this month had agreed to a 30-day pause on Russian strikes on Ukrainian energy facilities.

The Canadian Dollar (CAD), however, might struggle to lure buyers in the wake of domestic political uncertainty. Canada's new Prime Minister, Mark Carney, called for a snap election on April 28, saying that Canadians deserve a choice on who should lead the country to deal with Trump's tariffs. Apart from this, subdued Crude Oil prices, which seem to struggle to build on the recent move up to a three-week high touched on Friday amid the uncertainty over Trump's impending reciprocal tariffs, should cap the commodity-linked Loonie. This, in turn, might hold back traders from placing aggressive bearish bets around the USD/CAD pair and help limit further losses.

Moving ahead, traders now look forward to the release of the flash US PMIs, which, along with speeches by influential FOMC members, will drive the USD demand later during the North American session. Apart from this, trade headlines and Oil price dynamics should contribute to producing short-term trading opportunities around the USD/CAD pair. The focus, however, will remain glued to the US Personal Consumption Expenditure (PCE) Price Index on Friday. The Fed's preferred inflation gauge could provide fresh cues about the future rate-cut path, which, in turn, will play a key role in determining the next leg of a directional move for the USD and the currency pair.

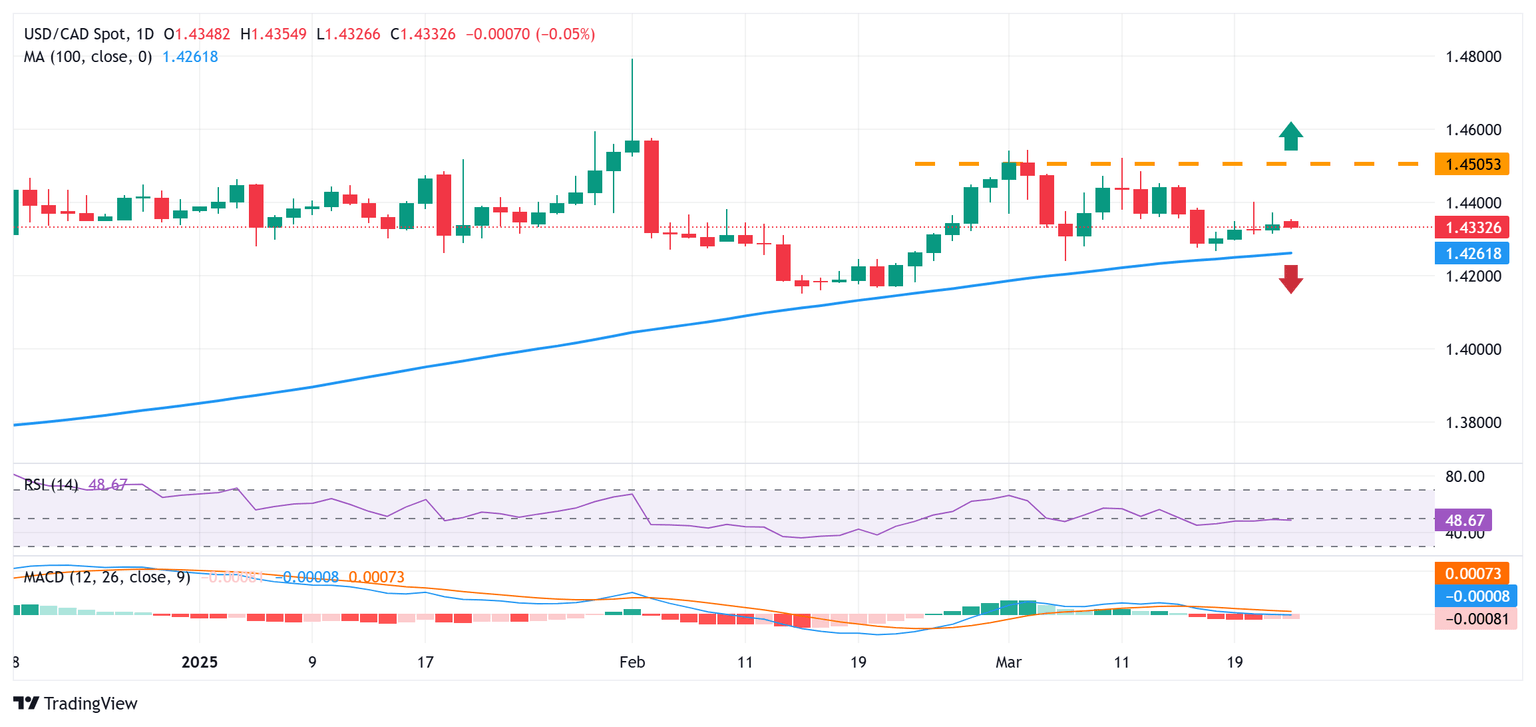

USD/CAD daily chart

Technical Outlook

From a technical perspective, last week's failure to find acceptance above the 1.4365-1.4370 horizontal support breakpoint and the subsequent pullback from the 1.4400 mark favors bearish traders. Moreover, oscillators on the daily chart have just started gaining negative traction and support prospects for a further depreciating move for the USD/CAD pair. Hence, some follow-through weakness below the 1.4300 round figure, towards last week's swing low around the 1.4260 area, looks like a distinct possibility. The latter near the 100-day Simple Moving Average (SMA), around the 1.4250 region, and should act as a key pivotal point, which if broken decisively should set the stage for deeper losses.

On the flip side, the 1.4366-1.4370 area might continue to act as an immediate hurdle ahead of the 1.4400 mark. A sustained move beyond the latter could trigger a short-covering rally and lift the USD/CAD pair to the 1.4470-1.4475 intermediate barrier en route to the 1.4500 psychological mark. This is followed by resistance near the 1.4520 area and the monthly peak, around the 1.4545 zone. Some follow-through buying should allow spot prices to reclaim the 1.4600 mark. The momentum could extend further towards the 1.4670 region en route to 1.4700 and the 1.4800 neighborhood, or over a two-decade high touched in early February.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.