USD/CAD Price Forecast: Bears await trading range breakdown after Canadian election results

- USD/CAD struggles to gain any meaningful traction amid mixed fundamental cues.

- Canadian election results fail to impress the CAD bulls amid falling Crude Oil prices.

- A modest USD strength contributes to limiting any meaningful slide for the major.

The USD/CAD pair lacks any firm intraday direction on Tuesday and seesaws between tepid gains/minor losses through the early European session as traders digest Canadian election results. Multiple reports indicated that the incumbent Prime Minister Mark Carney’s Liberal Party won a tightly contested election held on Monday for the historic fourth term. However, Liberals fell short of the 172 seats required for an outright majority in the parliament and would need to rely on one or more smaller parties to form a government, and pass legislation. Nevertheless, the outcome strengthens Canada's position in trade negotiations with the US, which, in turn, lends some support to the domestic currency and caps the pair's intraday move higher to the 1.3870 area.

Meanwhile, Crude Oil prices dropped to a nearly two-week low amid mixed signals regarding the US-China trade war, which could trigger a global recession and dent fuel demand. In fact, US President Donald Trump said last week that trade talks with China were underway, though China has denied that any tariff negotiations were taking place. Adding to this reports that several members of OPEC+ will suggest an acceleration of output hikes for the second straight month in June weigh on the black liquid. This, in turn, undermines the commodity-linked Loonie, which, along with the emergence of some US Dollar (USD) dip-buying, assists the USD/CAD pair to hold above the 1.3800 mark. Any meaningful USD appreciation, however, seems elusive amid the uncertainty over US President Donald Trump's tariff plans and bets for more aggressive easing by the Federal Reserve.

Trump's rapidly shifting stance on trade policies has been received poorly by investors and led to a mass pivot away from US assets recently. In fact, the Wall Street Journal reported on Monday that Trump was considering easing some duties imposed on foreign parts in domestically manufactured cars. Moreover, heightened concerns over the economic impact of tariffs have been fueling speculations that the Fed will resume its rate-cutting cycle in June and lower borrowing costs by a full percentage point by the year-end. This might hold back the USD bulls from placing aggressive bets and cap any attempted USD/CAD recovery. Investors now look to this week's key US macro releases – JOLTS Job Openings data on Tuesday, the Advance Q1 GDP print and the Personal Consumption and Expenditure (PCE) on Wednesday and the Nonfarm Payrolls (NFP) report on Friday.

The crucial data could provide a fresh insight into the Fed's policy outlook, which, in turn, will play a key role in influencing the near-term USD price dynamics and provide some meaningful impetus to the USD/CAD pair. Meanwhile, the fundamental backdrop favors the USD bears and suggests that the path of least resistance for spot prices remains to the downside.

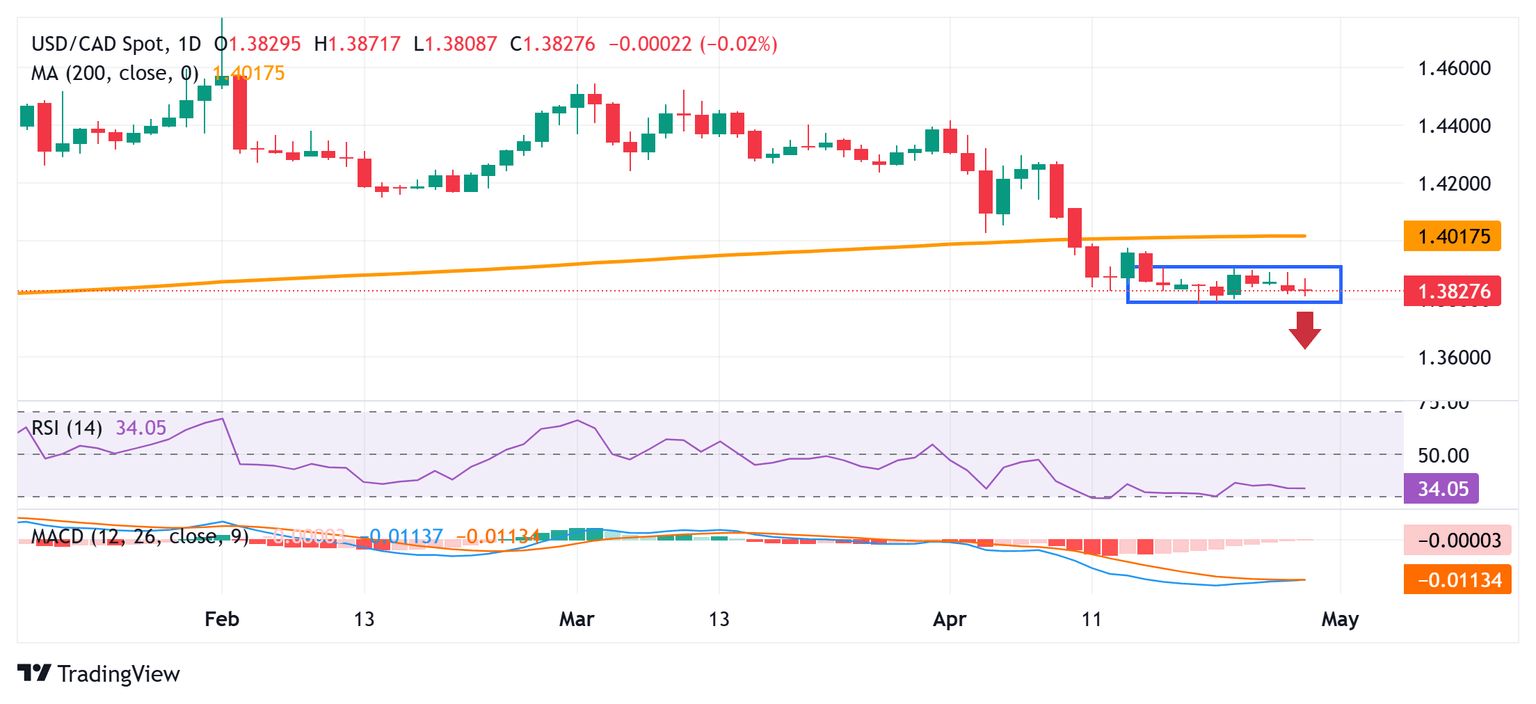

USD/CAD daily chart

Technical Outlook

From a technical perspective, the range-bound price action witnessed over the past two weeks or so might still be categorized as a bearish consolidation phase against the backdrop of a sharp pullback from over a two-decade high touched in February. Moreover, oscillators on the daily chart are holding deep in negative territory and are still away from being in the oversold zone. This, in turn, favors bearish traders and validates the near-term negative outlook for the USD/CAD pair.

That said, it will still be prudent to wait for acceptance below the 1.3800 mark and a subsequent slide below the 1.3780 region, or the year-to-date touched last week, before positioning for further losses. The USD/CAD pair might then accelerate the fall towards the 1.3740 intermediate support before eventually dropping to test sub-1.3800 levels.

On the flip side, the 1.3870-1.3875 region, followed by the 1.3900 mark or the top end of the short-term trading range, might continue to act as immediate hurdles. A sustained strength beyond the latter might trigger a short-covering move and lift the USD/CAD pair to the 1.3950-1.3955 region. Any subsequent move up, however, might still be seen as a selling opportunity and remain near the 200-day Simple Moving Average (SMA), currently pegged around the 1.4000 psychological mark, which should act as a key pivotal point.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.