USD/CAD Outlook: Bears await a break below multi-week trading range support

- USD/CAD declines to a fresh weekly low and is weighed down by a combination of factors.

- An uptick in Crude Oil prices underpins the Loonie and exerts pressure amid a weaker USD.

- The Fed’s higher-for-longer narrative could lend support to the USD and the currency major.

The USD/CAD pair drifts lower for the second straight day on Thursday and touches a fresh weekly trough, around the 1.3460-1.3455 region during the early part of the European session. Crude Oil prices draw support from signs of tightening global supplies due to disruptions in the Middle East and continue to underpin the commodity-linked Loonie. This, along with the prevalent selling bias around the US Dollar (USD), despite the Federal Reserve's (Fed) hawkish outlook on interest rates, exerts downward pressure on the currency pair.

The Israel-Hamas war, so far, has shown little signs of de-escalation, while attacks on commercial vessels by the Iran-aligned Houthi rebels in Yemen have raised worries about trade flow through the critical Red Sea and Bab al-Mandab strait waterway. This, along with expectations that demand from the US refiners will improve after the recent service outages, helps offset a build in inventories and acts as a tailwind for Crude Oil prices. Data from the American Petroleum Institute showed on Wednesday that US inventories grew by 7.2 million barrels in the week to February 16, much more than market expectations. This was the third straight week of builds in US inventories and suggested that the world’s largest fuel consumer remained well-supplied.

That said, investors remain concerned about the worsening economic conditions across the globe, especially after Japan and the UK entered a technical recession during the fourth quarter of 2023. Furthermore, the minutes of the FOMC policy meeting revealed that policymakers are in no hurry to cut interest rates in the wake of sticky inflation and the still-resilient US economy. This could hinder economic activity and in turn, dent fuel demand, which might hold back bulls from placing aggressive bets around Crude Oil prices. Moreover, the Fed's higher-for-longer rates narrative remains supportive of elevated US Treasury bond yields and favours the USD bulls. This could further contribute to limiting any meaningful downfall for the USD/CAD pair.

Meanwhile, softer-than-expected Canadian consumer inflation data released on Tuesday could further act as a headwind for the Canadian Dollar (CAD) and offer some support to the currency pair. In fact, Canadian CPI decelerated to the 2.9% YoY rate in January and core inflation measures dropped to the lowest levels in more than two years. This warrants caution before positioning for a further depreciating move for the USD/CAD pair. Traders now look to the US economic docket – featuring the usual Weekly Initial Jobless Claims, the flash PMI prints for February and Existing Home Sales. Apart from this, Fed Governor Philip Jefferson's speech and the official inventory data from the US Energy Information Administration (EIA) might provide some impetus.

Technical Outlook

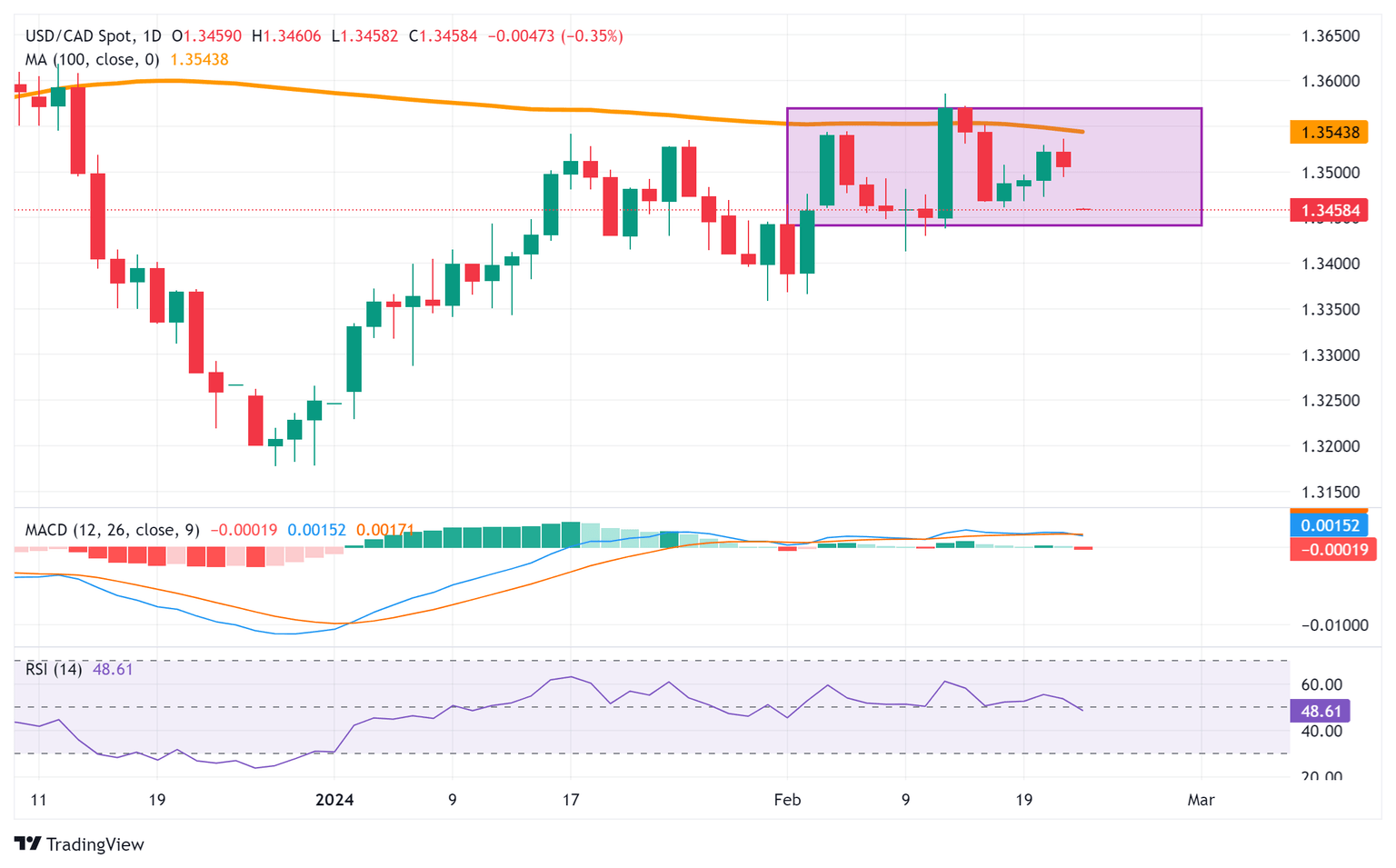

From a technical perspective, any subsequent fall is likely to find some support near the 1.3415-1.3410 region or the lower end of a short-term trading range held over the past three weeks or so. Some follow-through selling, leading to a subsequent break below the 1.3400 mark, will be seen as a fresh trigger for bearish traders and make the USD/CAD pair vulnerable to accelerate the slide to the 1.3360-1.3355 horizontal support. A convincing break below the latter will be seen as a fresh trigger for bearish traders and pave the way for a further near-term depreciating move.

On the flip side, the daily swing high, around the 1.3500 psychological mark, now seems to act as an immediate hurdle. This is followed by the 100-day Simple Moving Average (SMA) barrier near the 1.3565 zone and a two-month peak, near the 1.3585 area touched last week. A sustained strength beyond the latter will negate any near-term bearish bias and lift the USD/CAD pair to the 1.3700 mark en route to the next relevant hurdle near the 1.3745-1.3750 region.

USD/CAD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.