USD/CAD Forecast: Remains confined in a familiar trading range ahead of US PMIs

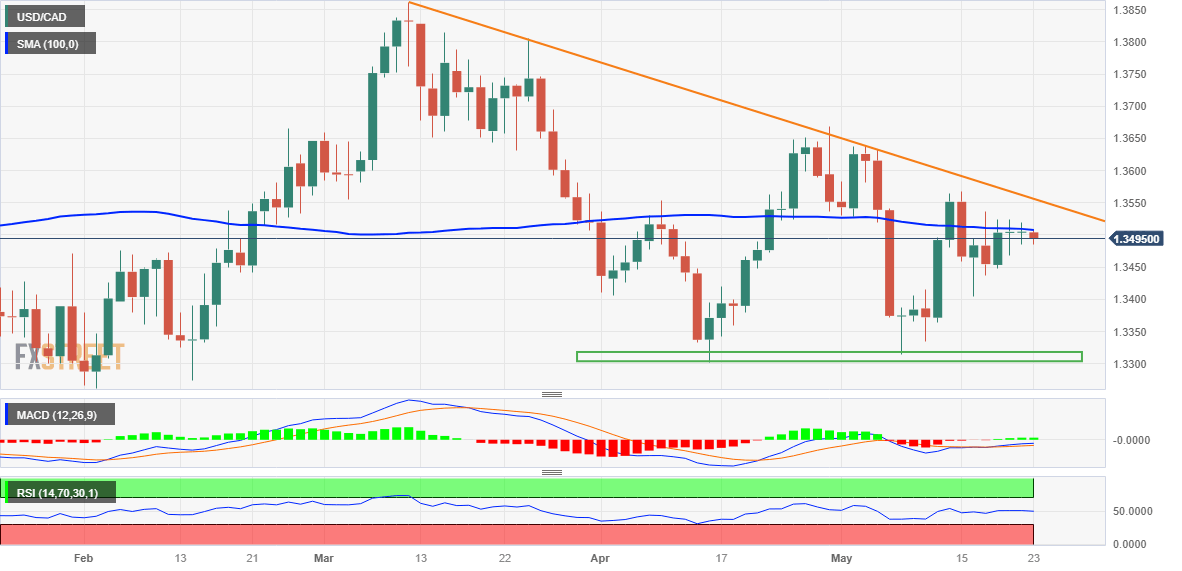

- USD/CAD remains confined in a multi-day-old trading range around its 100-day SMA.

- A modest uptick in Oil prices underpins the Loonie and caps the upside for the pair.

- The USD stands near a two-month high and could help limit any meaningful slide.

The USD/CAD pair continues its struggle to gain any meaningful traction and remains confined in a familiar trading band, around the 100-day Simple Moving Average (SMA) through the Asian session on Tuesday. Crude Oil prices edge higher for the second straight day amid hopes for an improvement in US fuel demand, which is seen underpinning the commodity-linked Loonie and acting as a headwind for the major. The US Dollar (USD), on the other hand, holds steady just below a two-month high touched last Friday and helps limit the downside for spot prices. Despite the less-hawkish remarks by Federal Reserve (Fed) Chair Jerome Powell, investors seem convinced that the US central bank is likely to continue hiking interest rates. This remains supportive of elevated US Treasury bond yields, which, along with worries about slowing global growth, further benefits the Greenback’s relative safe-haven status.

Speaking at a Fed research conference, Powell said Friday that tighter credit conditions could mean fewer rate hikes. That said, St. Louis Fed President James Bullard said Monday that the Fed may still need to raise its benchmark interest rate by another half-point this year. Furthermore, Minneapolis Fed President Neel Kashkari also said it was a close call whether he would vote to raise interest rates or to pause the central bank's tightening cycle when it meets next month. Separately, Atlanta Fed President Raphael Bostic said he was comfortable waiting a little bit before deciding on any further moves. Meanwhile, Richmond Fed President Thomas Barkin said he was still looking to be convinced that inflation is in a steady decline. This, in turn, pushed the yield on the benchmark 10-year US government bond higher for a seventh day in a row on Monday - the longest winning streak since April 2022.

That said, the US debt-ceiling impasse is holding back the USD bulls from placing aggressive bets and capping the USD/CAD pair, at least for the time being. In fact, US President Joe Biden and House Speaker Kevin McCarthy ended discussions on Monday with no agreement on how to raise the US government's $31.4 trillion debt ceiling and will keep talking just 10 days before a possible default. Market participants now look forward to the US economic docket, featuring the flash US PMI prints, New Home Sales data and the Richmond Fed Manufacturing Index, due later during the early North American session. This, along with the US bond yields and the broader risk sentiment, will influence the USD and provide some impetus to the USD/CAD pair. Traders will further take cues from Oil price dynamics to grab short-term opportunities, though the focus will remain glued to the FOMC meeting minutes on Wednesday.

Technical Outlook

From a technical perspective, some follow-through buying beyond the 1.3525-1.3530 region should lift the USD/CAD pair to the 1.3565-1.3570 area, en route to the 1.3600 mark. The upward trajectory could get extended further towards the 1.3635-1.3640 zone before spot prices eventually aim to reclaim the 1.3700 mark for the first time since March 27.

On the flip side, the 1.3465-1.3460 region now seems to protect the immediate downside ahead of the last week's swing low, around the 1.3400 round figure. This is closely followed by the 1.3370-1.3365 horizontal support, which if broken might turn the USD/CAD pair vulnerable to accelerate the fall towards the 1.3300 mark. A convincing break below the latter will be seen as a fresh trigger for bearish traders and pave the way for a further near-term depreciating move.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.