USD/CAD Forecast: Descending channel breakout in play ahead of Canadian jobs report

- USD/CAD steadily climbs back closer to the weekly high, albeit lacks any follow-through.

- A combination of factors lifts the USD to a one-month high and lends support to the pair.

- Traders now look forward to the monthly Canadian employment data for a fresh impetus.

The USD/CAD pair trades with a positive bias for the third successive day and climbs to the top end of its weekly range, around the 1.3470-1.3475 area during the Asian session on Friday. The uptick is sponsored by some follow-through buying around the US Dollar, which climbs to a one-month top and draws support from a combination of factors. Against the backdrop of hawkish signals from Fed officials, the prevalent risk-off environment is seen benefitting the safe-haven buck.

a slew of FOMC members, including Chair Jerome Powell, stressed the need for additional interest rate hikes this week to fully gain control of inflation. The comments dashed hopes for an imminent pause in the Fed's rate-hiking cycle. The prospects for further policy tightening by the US central bank, along with growing concerns about an imminent recession, temper investors' appetite for riskier assets. The fears were further fueled by the deeply inverted US Treasury yield curve. In fact, the difference between two-year and 10-year US Treasury notes was the widest margin since the early 1980s on Thursday.

Meanwhile, growing worries about a deeper global economic downturn keep oil prices on the defensive for the second successive day. This further undermines the commodity-linked Loonie and offers additional support to the USD/CAD pair. That said, the latest optimism over a pickup in Chinese fuel demand acts as a tailwind for the black liquid and keeps a lid on any further gains for the major. Traders also seem reluctant to place aggressive bets and prefer to wait on the sidelines ahead of the release of the monthly Canadian employment details, due for release later during the North American session.

Traders on Friday will further take cues from the US economic docket, featuring the release of the Preliminary Michigan Consumer Sentiment Index. This, along with a scheduled speech by Fed Governor Christopher Waller, the US bond yields and the broader market risk sentiment, will influence the USD. Apart from this, oil price dynamics should provide some impetus to the USD/CAD pair and allow traders to grab short-term opportunities on the last day of the week.

Technical Outlook

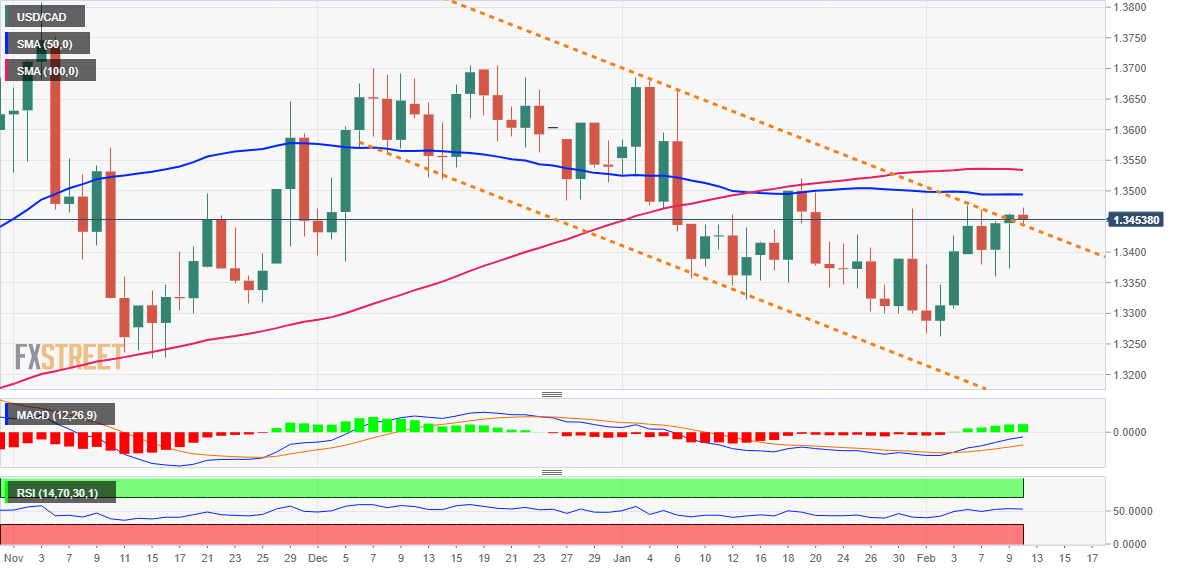

From a technical perspective, the overnight move-up pushes spot prices through the top boundary of over a two-month-old descending trend channel. That said, the lack of follow-through buying beyond the 1.3470-1.3475 supply zone warrants some caution before positioning for any further gains. The said barrier is closely followed by the 1.3500 psychological mark and the 100-day SMA, currently around the 1.3530 region. A sustained move above the latter will be seen as a fresh trigger for bulls and pave the way for a move towards reclaiming the 1.3600 mark. The momentum could get extended further towards the 1.3645-1.3650 horizontal resistance en route to the December swing high, around the 1.3700 round figure.

On the flip side, any meaningful pullback is more likely to attract fresh buyers around the 1.3400 mark. This, in turn, should help limit the downside near the 1.3360 area, or the weekly low touched on Thursday. Failure to defend the said support levels would make the USD/CAD pair vulnerable to weaken further below the 1.3300 mark and test the November 2022 swing low, around the 1.3230-1.3225 region. Spot prices could then slide further towards the 1.3200 round figure before eventually dropping to the descending channel support, currently near the mid-1.3100s.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.