USD/CAD Forecast: Bulls have the upper hand above 100-day SMA amid Fed rate hike bets

- USD/CAD regains positive traction on Tuesday and is supported by reviving USD demand.

- Hawkish Fed expectations, elevated US bond yields, recession fears boost the Greenback.

- The Canadian GPD and the US Consumer Confidence Index could provide a fresh impetus.

The USD/CAD pair builds on the overnight bounce from the 1.3535 area and gains some traction during the Asian session on Tuesday. The momentum lifts spot prices back closer to the 1.3600 round-figure mark and is sponsored by the emergence of fresh buying around the US Dollar, which continues to draw support from hawkish Fed expectations. In fact, the markets seem convinced that the US central bank will stick to its hawkish stance in the wake of stubbornly high inflation. The bets were reaffirmed by the US PCE Priced Index released on Friday, which indicated that inflation isn't coming down quite as fast as hoped.

Adding to this, several FOMC policymakers have stressed the need to continue raising interest rates to bring inflation down to the 2% target. This, in turn, remains supportive of elevated US Treasury bond yields, which offsets Monday's mixed US Durable Goods Orders data and underpins the USD. The US Census Bureau reported that headline Durable Goods Orders fell by 4.5% in January, down sharply from the 5.1% strong growth recorded in the previous month. The disappointment, however, was overshadowed by orders excluding transportation items, which rose 0.7% during the reported month as compared to a modest 0.1% uptick anticipated.

Separately, the US Pending Home Sales posted their largest gain in 2-1/2 years. Adding to this, looming recession risks and geopolitical tensions also seem to benefit the Greenback's relative safe-haven status. Meanwhile, worries that rapidly rising borrowing costs will dampen economic growth and dent fuel demand act as a headwind for Crude Oil prices. Apart from this, speculations that the Bank of Canada (BoC) will pause the policy-tightening cycle, bolstered by the softer Canadian CPI released last week, undermines the commodity-linked Loonie. This, in turn, is seen as another factor lending support to the USD/CAD pair.

Market participants now look forward to Tuesday's economic docket, featuring the release of monthly Canadian GDP print and the Conference Board's US Consumer Confidence Index. This, along with the US bond yields and the broader risk sentiment, will drive the USD demand. Traders will further take cues from Oil price dynamics to grab short-term opportunities around the USD/CAD pair. The fundamental backdrop, meanwhile, favours bullish traders and suggests that the path of least resistance for spot prices is to the upside.

Technical Outlook

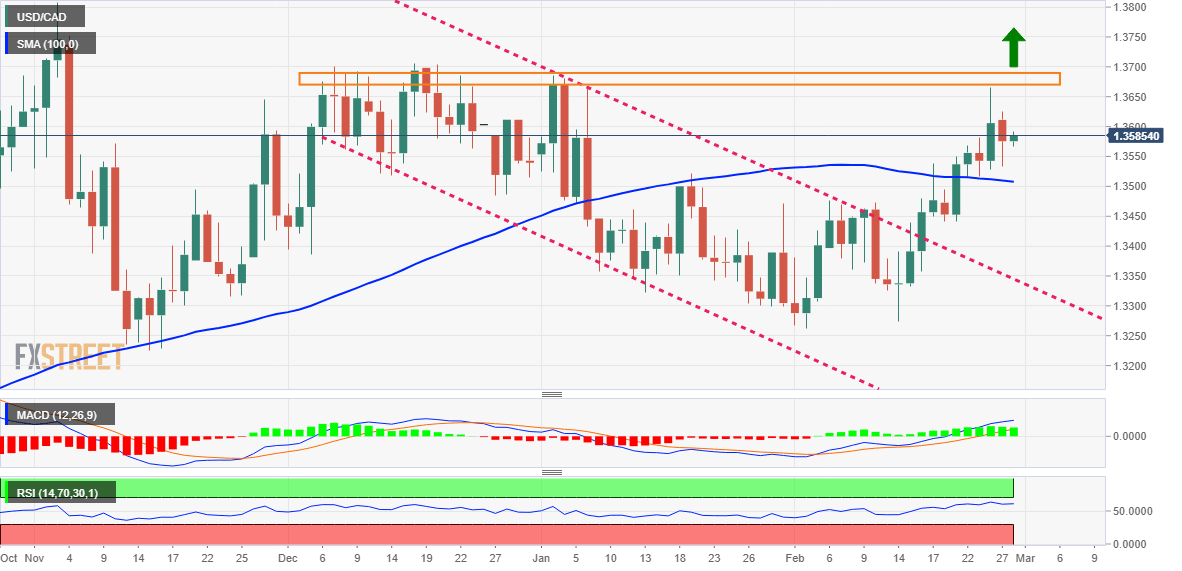

From a technical perspective, the emergence of fresh buying following the overnight corrective decline validates the recent breakout through the 100-day Simple Moving Average (SMA). Moreover, oscillators on the daily chart have just started gaining positive traction and add credence to the constructive setup. A sustained strength and acceptance above the 1.3600 mark will reaffirm the bullish outlook and lift the USD/CAD pair towards last week's swing high, around the 1.3665 area, en route to the 1.3685 zone, or the YTD peak set in January and the 1.3700 mark.

On the flip side, the overnight swing low, around the 1.3535 region, now seems to protect the immediate downside ahead of the 100-day SMA, currently pegged near the 1.3500 psychological mark. Any further decline could attract fresh buyers and remain limited near the 50-day SMA, around the 1.3460 area. This is followed by the 1.3440 horizontal support, which if broken decisively could drag the USD/CAD pair back towards challenging the 1.3400 mark. A sustained break below the latter is needed to negate the near-term positive outlook.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.