USD/CAD analysis: Trades sideways

USD/CAD

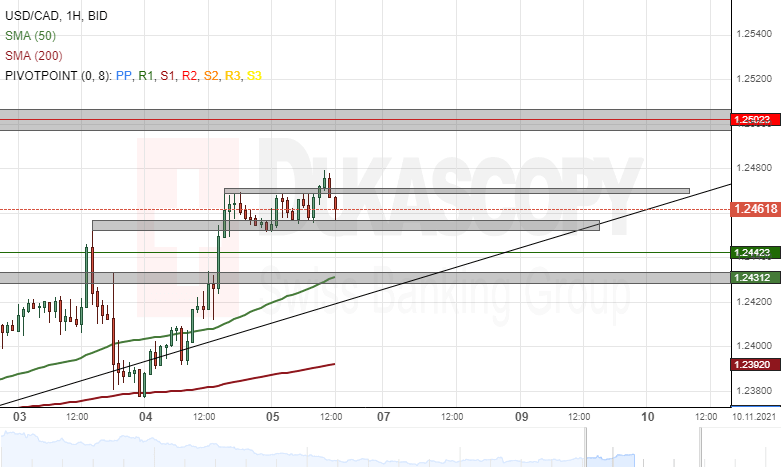

The USD/CAD reached the resistance of the 1.2452/1.2457 zone and passed it on Thursday. However, since the event, the rate has been trading sideways. Namely, the pair appears to be squeezed in between the support of the mentioned 1.2452/1.2457 zone and the resistance of the 1.2470/1.2472 levels.

Breaking of the 1.2470/1.2472 resistance zone could reach the 1.2500 mark. Note that the 1.2500 level is surrounded by the October 8 and 10 high and low-level zone at 1.2497/1.2507. In addition, the weekly R2 simple pivot point is located at 1.2502.

Meanwhile, a decline below the 1.2452/1.2457 zone's support, could result in a decline. A decline would look for support first in the weekly R1 simple pivot point at 1.2442. Below the pivot point, the 1.2428/1.2434 zone and the 50-hour simple moving average might provide support.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.