USD/CAD Analysis: Remains below 23.6% Fibo. ahead of US macro data, FOMC minutes

- USD/CAD remains supported near a one-week high amid weaker Crude Oil prices.

- A modest USD downtick holds back bulls from placing fresh bets and caps gains.

- Traders also seem reluctant ahead of key US macro releases and FOMC minutes.

The USD/CAD pair oscillates in a narrow trading band through the early European session on Wednesday and consolidates its recent gains to over a one-week high, around the 1.3330-1.3335 region touched the previous day. The fundamental backdrop, meanwhile, seems tilted in favour of bulls and suggests that the path of least resistance for spot prices is to the upside. Crude Oil prices languish near the lowest level in more than two weeks amid easing concerns about the potential supply disruptions from ongoing tensions in the Red Sea. Apart from this, expectations that the Bank of Canada (BoC) will start cutting interest rates in 2024 undermine the commodity-linked Loonie and act as a tailwind for the currency pair.

The US Dollar (USD), on the other hand, is likely to draw support from the overnight sharp rally in the US Treasury bond yields, which further validates the positive outlook for the USD/CAD pair. In fact, the yield on the benchmark 10-year US government bond climbed back to the 4.0% threshold on Tuesday amid doubts over early interest rate cuts by the Federal Reserve (Fed). The CME group's FedWatch Tool, however, indicates that the markets are pricing in a greater chance that the US central bank will ease its monetary policy as early as March and 150 basis points of cumulative rate cuts by the year-end. Hence, the crucial FOMC minutes, due later today, will be scrutinized for cues about the Fed's future policy moves.

Investors on Wednesday will also confront important US macro releases – ISM Manufacturing PMI and JOLTS Job Openings data. Apart from this, the US bond yields will influence the USD demand, which, along with Oil price dynamics should produce short-term trading opportunities around the USD/CAD pair later during the North American session. In the meantime, the USD trims a part of the previous day's strong gains to over a one-week high amid some repositioning trade ahead of the key releases and for now, seems to have stalled its recent recovery move from a multi-month trough touched last week. This, in turn, holds back traders from placing aggressive directional bets and keeps a lid on further gains for the currency pair.

Technical Outlook

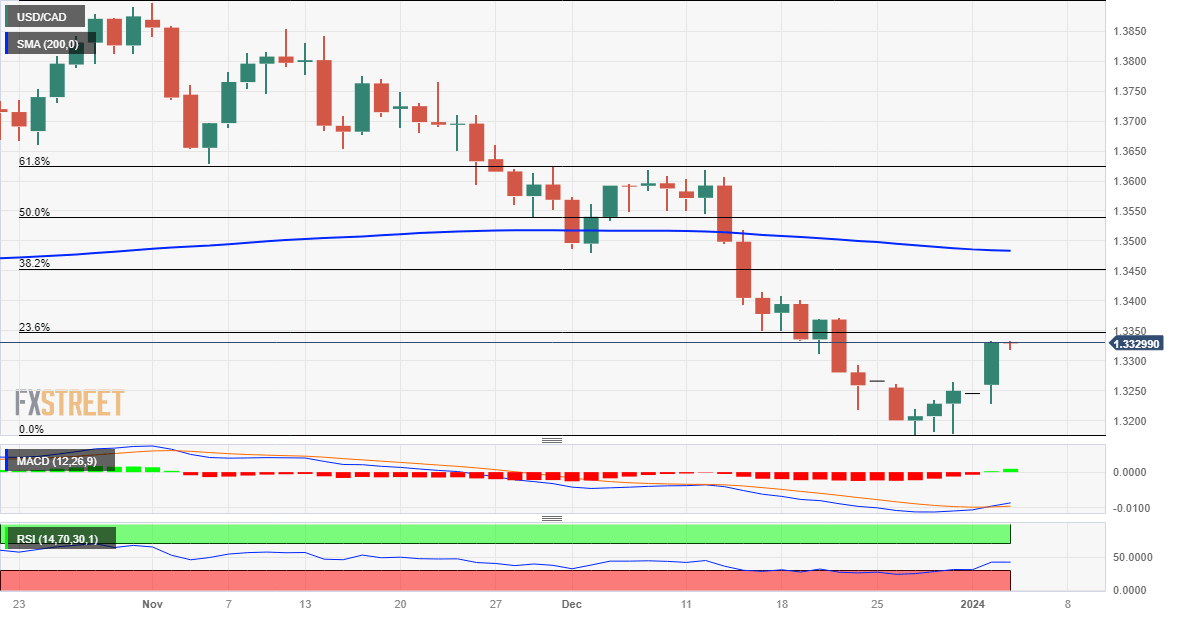

From a technical perspective, the USD/CAD pair is currently placed just below the 23.6% Fibonacci retracement level of the November-December 2023 downfall. The said hurdle is pegged near the 1.3345 region, which if cleared decisively should allow spot prices to reclaim the 1.3400 mark. The momentum could get extended further towards testing the 38.2% Fibo. level, around the 1.3440-1.3445 zone, en route to the 1.3500 psychological mark and the 1.3535 area, or the 50% Fibo. level.

On the flip side, the 1.3300 round figure now seems to protect the immediate downside ahead of the 1.3265-1.3260 horizontal support. Some follow-through selling would make the USD/CAD pair vulnerable to weakening further below the 1.3200 mark and retesting the multi-month low, around the 1.3175 region touched last week. The latter should act as a key pivotal point, which if broken will be seen as a fresh trigger for bears and set the stage for an extension of a two-month-old downtrend.

USD/CAD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.