USD/CAD: A buying opportunity at 1.3270/60

EUR/USD – USD/CAD

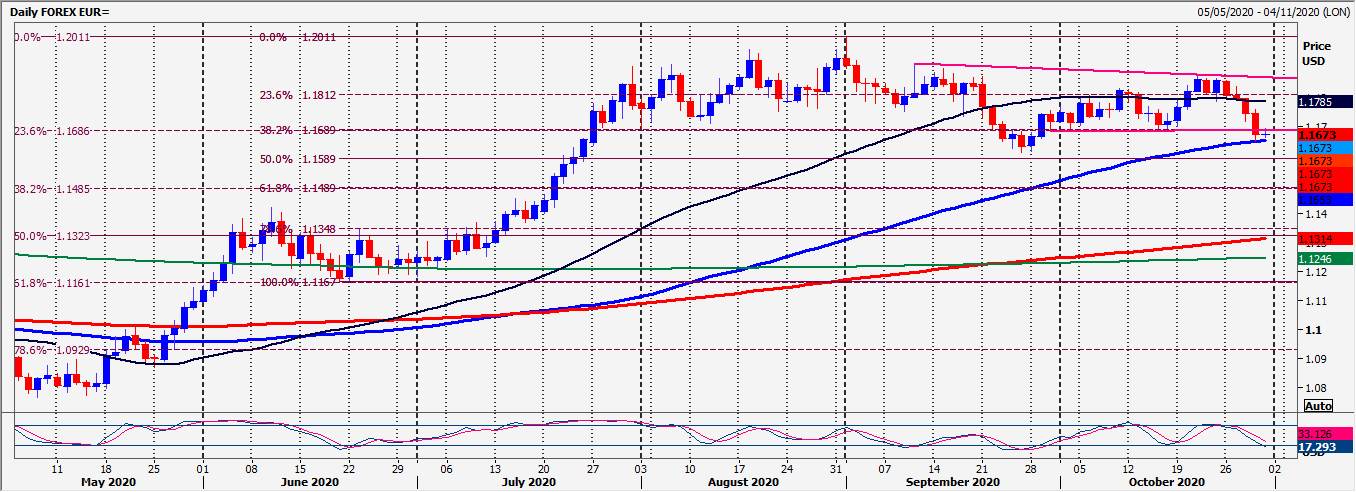

EURUSD broke strong support at 1.1740/30 for sell signal targeting 1.1690/80 then 100 day moving average support at 1.1655/50 for profit taking on shorts. We bottomed exactly here.

USDCAD hit our selling opportunity at 1.3380/1.3400 & we topped exactly here.

Daily Analysis

EURUSD bottomed exactly at 100 day moving average support at 1.1655/50 so this is obviously key to direction this morning. First resistance at 1.1690/1.1700. We could hold this range all morning. Shorts need stops above 1.1720. A break higher targets 1.1735/45. Try shorts with stops above 1.1765.

Longs at 1.1655/50 stop below 1.1645. A break lower is a sell signal targeting 1.1610/1.1590. A break below 1.1580 targets 1.1540/30 then a buying opportunity at 1.1490/80, with stops below 1.1460.

USDCAD topped exactly at our selling opportunity at 1.3380/1.3400. Holding above 1.3320/10 allows a retest of the selling opportunity at 1.3380/1.3400 with stops above 1.3420. A weekly close above here is a buy signal for next week initially targeting 1.3450/60 then 1.3520/40.

A buying opportunity at 1.3270/60 with stops below 1.3240.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk