US unemployment sees no light at the end of the tunnel

Risk assets may have yet to reach the bottom, short USD/JPY at peak

US employers cut 701,000 jobs in March and the unemployment rate jumped to 4.4% – its highest level since August 2017, as reported by the US Department of Labour last Friday. Economists expect more pain to come in April as many workplaces remain closed due to measures aimed at stemming the spread of the coronavirus pandemic.

Bad as Friday’s report is – showing more than 700,000 jobs lost in March – it shows us conditions before the worst of the coronavirus-related layoffs hit. Even Thursday’s jaw-dropping tally of more than 6 million initial claims for unemployment insurance filed last week does not tell us how deep the job loss will be or how long it will last. It isn’t just the magnitude of this shock that is unprecedented, but the uncertainty surrounding almost every facet of it—uncertainty that is corrosive in its own right.

In normal times, we know enough about the historical probabilities of certain things, such as mortality rates, recessions or bear markets, to quantify risks around future. Today, we are struggling, not with risk but with uncertainty, as we do not know enough about the underlying nature of our circumstances to measure risk meaningfully. This situation has been compared to calculating the odds of rolling a seven without knowing whether the die is fair or how many sides it has.

Today, there are at least four distinct sources of uncertainty:

-

Severity and spread of the pandemic

-

Breadth and duration of social-distancing measures

-

Economic and financial impact of those measures

-

Policy response

These factors are inter-related: the more infectious the disease appears to be, the tougher the social-distancing measures must be enforced. As a result, the greater the economic fallout and a more aggressive policy response is needed.

Markets hate uncertainty and gravitate to those with the most confidence in their predictions, but these days, excessive confidence should be greeted with scepticism.

Right now, things are worsening at an accelerating rate. As pessimistic as forecasters were, in anticipation of last week’s job numbers, they weren’t nearly pessimistic enough. But at some point, things will get worse at a decelerating rate. Rates of infection, hospitalisation and death will decline. There are glimmers of that in some of the hardest hit regions, followed by the economic consequences.

When will that happen? Given that stocks are still volatile but around a relatively stable level in the last two weeks, it suggests that investors think that moment is close. Of course, even that interpretation is highly uncertain.

The unemployment rate includes only those who say they are actively looking for jobs. Broader measures of so-called underemployment, which include discouraged workers who have given up searching for jobs, rose sharply in March. The broadest measure of underemployment, which also includes part-time workers who would like to work as full-time employees, hit a three-year high.

The percentage of those who are actively job-hunting in the US labour force dropped sharply in March. The percentage of the population currently in the workforce also took a hit after trending upward in recent years.

Labour-force participation dropped sharply in March, even for so-called prime-aged workers (aged 25 to 54) who are less likely to be out of the labour force due to retirement or education. Economists expect this rate to drop further next month as the coronavirus pandemic and related lockdowns continue to spread.

Average weekly wages ticked slightly lower — likely because many workers saw their hours cut, which would lower weekly totals. Average hourly wages rose slightly. However, economists say wages tend to lag recessions and recoveries. Hence, do expect the April jobs report to give a bleaker picture of wage developments.

The total number of nonfarm payroll jobs was up 1% in March from a year earlier because this one month’s losses were exceeded by the gains over the prior 11 months. Still, that gain marked a slowdown from the year-over-year pace in previous months.

Our Picks

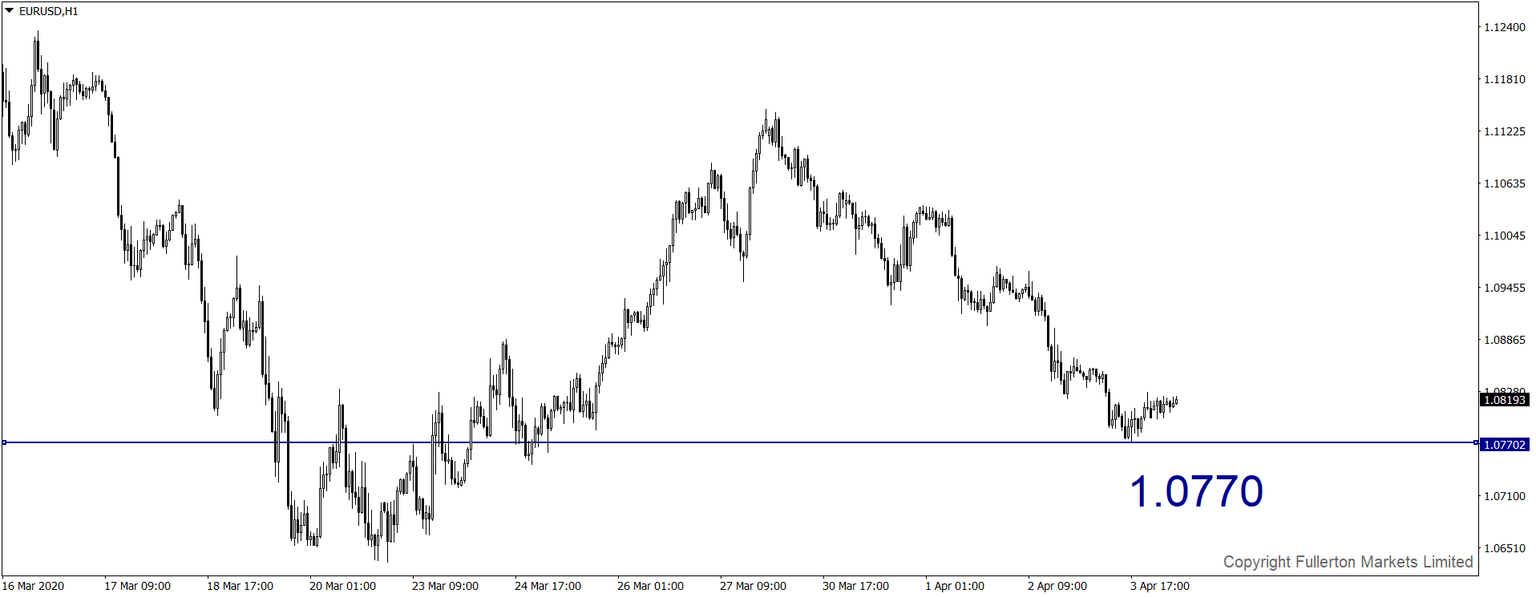

EUR/USD – Slightly bearish

This pair may fall towards the 1.0770 price level this week as the market hasn't priced in much euro zone impact, further slowing down the pair's movement.

USD/JPY – Slightly bearish

This pair may fall towards 108.40

XAU/USD (Gold) – Slightly bearish

We expect price to rise towards 1605 this week

U30USD (Dow) – Slightly bearish

Index may rise towards 22520 this week

Author

%20V2_XtraSmall.jpg)

Wayne Ko Heng Whye

Fullerton Markets Ltd

As Head of Research & Education in Fullerton Markets, Wayne provides thought-provoking analysis and trading ideas to thousands of clients worldwide.